"Wait until they stop housing & feeding them. That's when the chaos will begin."

Johnson reached across the aisle, stiffed the Republican majority that elected him speaker, and pushed through a massive gift to the warfare corporate welfare state...

The decline of the oil and gas industry would be disastrous for the American people.

- European bourses are mostly lower, US equities are mixed, with the NQ underperforming after Meta (-13.1%) results

- Dollar is lower, Antipodeans benefit from higher metals prices, JPY is softer holding above 155.50 against the USD

- Bonds are rangebound awaiting impetus from Tier 1 data later today

- Crude is slightly lower in absence of energy-specific newsflow, XAU benefits from the weaker dollar, base metals are mostly firmer

- Looking ahead, US GDP Advance, PCE Advance, Initi

The control that comes with CBDCs is immense and allows for complete micromanagement of the population...

Any positive decision would be driven by purely political motives since there’s no military necessity for adding Poland to the nuclear-sharing program...

"Putin doesn’t have the slightest right to quote Kant..."

Radical ‘charity’ is pushing propaganda inside more than half of Scottish schools...

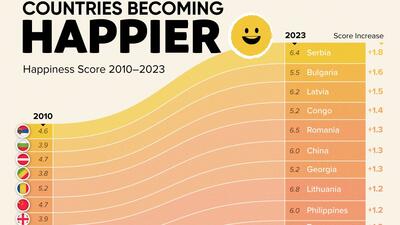

Serbia leads a list of 12 Eastern European nations whose average happiness score has improved more than 20% in the last decade...

... spring is just the dress rehearsal for what will happen in winter.

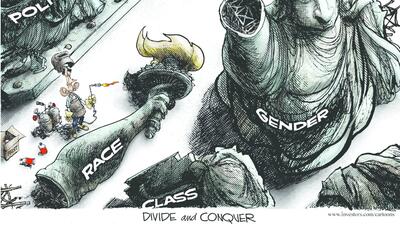

"Stir them up. Set one against the other. Divide and conquer. That’s the way to soften up a democracy...”

Market remains in a tricky environment with technicals + macro challenges being met with a mixed start to earnings (‘solid’ prints being faded: ASML, TSM, NFLX and now META tonight).

There’s little doubt that it would change everything, but what’s the truth?

"A15 is actually a reprise of efforts from Antifa and the far-left revolutionary class we saw in 2020..."

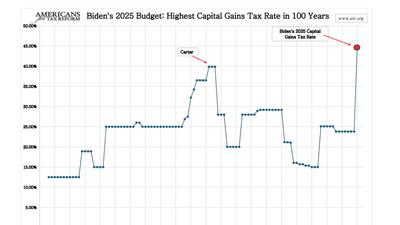

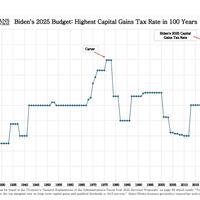

Add the state capital gains tax and the Biden combined federal-state rate would exceed 50% in many states

Thomas-Greenfield: "Today's veto begs the question: why? What could you possibly be hiding."

Agency says results show why it recommends kids get an updated shot...

White House admits Russia likely to make more gains in coming weeks...

Flipping a gun for a price higher than one paid now may turn anyone into a dealer, making any such sale unlawful if it does not involve all the licensing and paperwork that govern gun dealers...