...this appeal could delay lower court proceedings in President Trump’s Washington trial as well as his cases in Georgia and Florida.

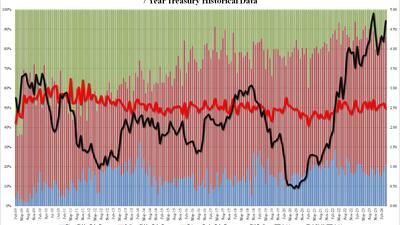

...rate-cut expectations plunged to cycle lows (and June is off the table for the first cut)...

Biden refuses to do anything lest he upset the Progressives who want open borders, guaranteed living wages, clean energy, a right to shelter, a right to free health care, and net zero carbon.

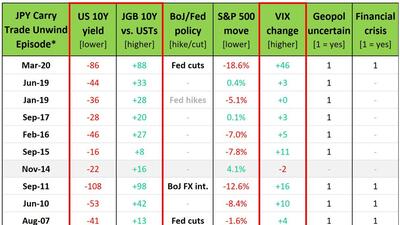

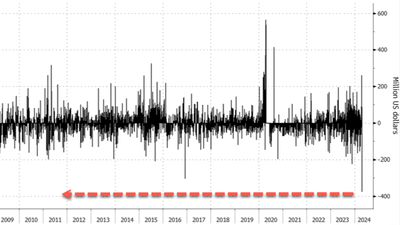

"We’re at a stage where MoF/BoJ have no choice but to intervene. The best way would be for BoJ to hike 25bps this week. It’s not about the macro anymore (BoJ should’ve normalized policy faster last year)."

...during the previous hearing, Dr. Fauci said he "did not recall" specific COVID-19 information and conversations relevant to the Select Subcommittee’s investigations over 100 times.

US Army to begin construction just as Rafah operation looms...

"If the order is issued, it will be one week before the first test."

"The timing of this activity coincides with a general easing of immediate tension..."

The ZiG marks a sixth attempt by the Zimbabwean government and central bank to introduce a currency unit that sets its monetary house in order...

Where did the $1 million come from, Nina?

But it was good enough not to rock the bond market.

The Australian government has gone full authoritarian after passing ‘eSafety’ bill...

One source said the offer did not address the complexities of demerging the Anglo American Platinum and Kumba Iron...

"Reporting has indicated that, even before leaving port, alarms showing an inconsistent power..."

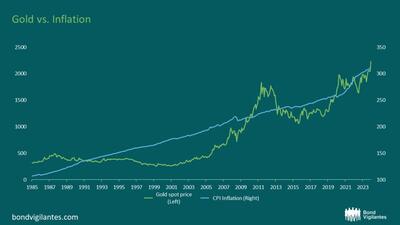

...it doesn’t seem as though gold is currently being bought for its safe-haven appeal at this stage. Where would the gold price be if the Fed starts cutting and the geopolitics worsen?

To be exact, the bid was 16 bitcoin...

Even more bad news for the Biden admin.

We built a neoliberal global system that repressed volatility as QE Spice flowed. But while Great Houses thrived, and some got very rich selling shadow-bank Spice derivatives, that system only increased our fundamental vulnerabilities to key threats...

"The core truth, there's a deal on the table."