On one side, we have talk show host Dennis Prager and Newsweek opinion editor Batya Ungar-Sargon defending Israel's actions. Taking the opposing position will be Young Turks founder Cenk Uygur and libertarian Dave Smith.

"Daszak lies even when the facts are in full view and the lies are obvious..."

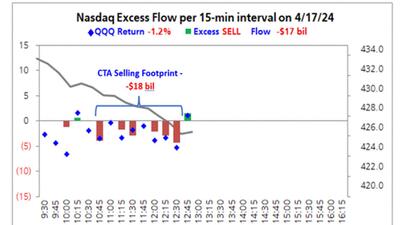

Excess Sell Flow in the Nasdaq was a cool $17 billion today, of which $18 billion (no typo) was between 10:45am and 12:45pm...

By examining the ratio of costs to salary, a new study ranked the top 10 most expensive nations for higher education.

They still may advocate for teachers, but politicking is now their main focus...

"They are paying close attention to the movements of the big bull in the May contract."

Take a step back (in time), and see that our neoliberal, debt-addled, was-lower-for-longer global system is not just in a Polycrisis but a Polybius Crisis...

"I have been in law enforcement for over 20 years and this is the first time I encountered something like this, someone using a translator app to try and rob a bank. First time our officers have dealt with it too."

Simply put: Bidenomics means you get less for more.

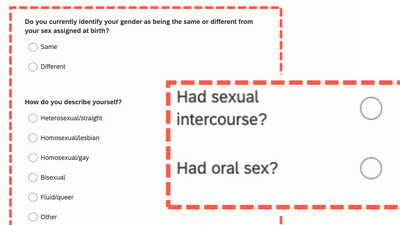

One very concerned parent asked why their kids are being data mined by the school...

"For the third time in three consecutive cycles, secretive federal agencies are trying to rig our presidential election..."

The lesson here is that progressives are not willing to negotiate their open border agenda in the slightest, even to prevent child victimization...

The juror, Kara McGee, spoke to the media after she was excused...

Follows weekend Iranian seizure of Israeli linked Portuguese-flagged container ship...

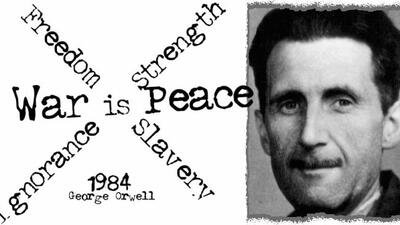

...the year when many people became aware that they were living in a Corruptocracy.

"If the trough has passed, the recent disinflationary force from falling commodity prices may be done."

"We have brought the public sector together and now we must prevail on the humanity and generosity of the private sector," Karen Bass said.

We’re well into what I’ve long called The Greater Depression...

...keep the ruling class in power while the lower classes remain powerless.