25 years...

"Election Integrity Is Under Assult."

... a case that could fundamentally change many cases of January 6th defendants,

Key phrases to listen for include: "patience", "confidence", and/or "we must get Biden re-elected."

Out of the voters surveyed, the majority—54 percent—were independent.

This is insane!

STR >> BTFD!

“The most talked-about investing strategy these days isn’t stuffing money in a mattress, it’s the reflation trade - the bet that the world economy will rebound, driving up interest rates and commodities prices.”

As the US leads on physical defence, it remains paralyzed on any offense despite the two being linked in any successful geostrategy.

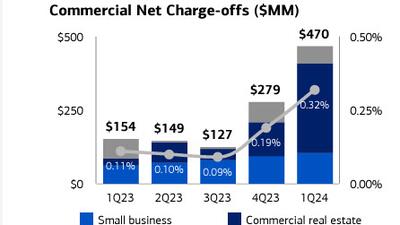

Banks are starting to finally pass massive CRE/office losses through the Income statement. How ugly is it about to get...

IDF warns that Iran will not get off "scot-free"...

A presidential cabinet member could go on trial in the upper chamber this week for only the second time in American history.

PM Fico: "In the aftermath of conflict, there’s a keen interest in re-establishing normalcy in relations with Moscow."

No, he definitely was stabbed...

"He’s definitely not going to be speaker next Congress if we’re lucky enough to have the majority..."

“Markets are looking for an excuse to take a breather and the combination of rising geopolitical risk alongside inflation fear and Fed anxiety is providing some decent ground for that”

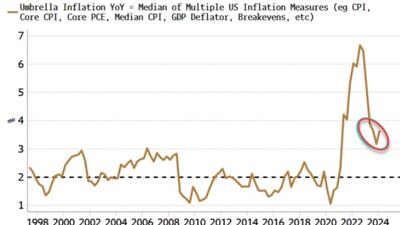

Markets are unprepared for price growth that is becoming entrenched...

...led by a collapse in rental property construction