...this appeal could delay lower court proceedings in President Trump’s Washington trial as well as his cases in Georgia and Florida.

In the United States, you pay property taxes on your home. This reality gives rise to the perennial question: do you really own your home if maintaining that title requires paying huge property taxes on the place annually?

Behind the facade of normalization, even high-income lifestyles have been ghetto-ized...

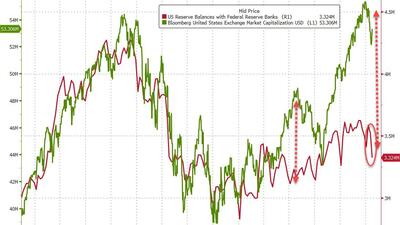

...pain in bank balance sheets is coming back...

...expressing concerns that “foreign adversaries are taking advantage of loopholes to impact American political activity with little-to-no transparency.”

An absolute blowout of a quarter.

“This ban would devastate seven million businesses and silence 170 million Americans,”

"..orchestrating a new era of AI transformation..."

...rate-cut expectations plunged to cycle lows (and June is off the table for the first cut)...

Biden refuses to do anything lest he upset the Progressives who want open borders, guaranteed living wages, clean energy, a right to shelter, a right to free health care, and net zero carbon.

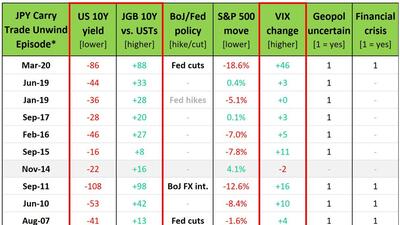

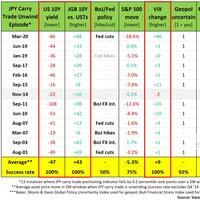

"We’re at a stage where MoF/BoJ have no choice but to intervene. The best way would be for BoJ to hike 25bps this week. It’s not about the macro anymore (BoJ should’ve normalized policy faster last year)."

...during the previous hearing, Dr. Fauci said he "did not recall" specific COVID-19 information and conversations relevant to the Select Subcommittee’s investigations over 100 times.

US Army to begin construction just as Rafah operation looms...

"If the order is issued, it will be one week before the first test."

"The timing of this activity coincides with a general easing of immediate tension..."

The ZiG marks a sixth attempt by the Zimbabwean government and central bank to introduce a currency unit that sets its monetary house in order...

Where did the $1 million come from, Nina?