Israeli media: War cabinet decides to hit Iran back hard...

Houthi anti-ship ballistic missile at one point directly targeted US Navy ships...

“If they restrict and oppress you on the ground, then attack them from the sky,” read the headline of the latest issue of an Islamic State magazine...

...aims to transfer billions of taxpayer dollars to the WHO as well as other industries, in order to vindicate censorship in the name of “public health,” and perhaps most importantly, to transfer sovereignty regarding decision-making for “public health” globally to the Director-General of the WHO

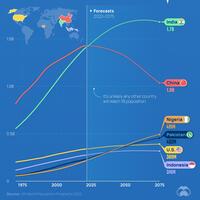

India dominates, China slumping, Nigeria soaring...

While this planet has plenty of water, its distribution does not always coincide with areas where lots of people choose to live...

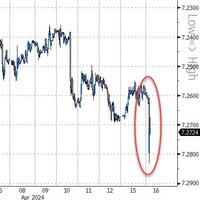

...Chinese spending appetite is slow to return as overseas demand supports manufacturing enough to offset US trade sanctions...

Could it be that simple?

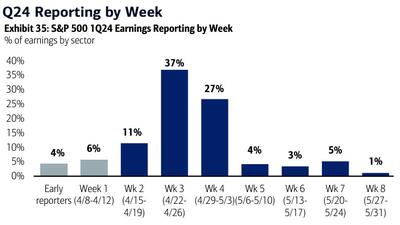

Consensus now expects just 1% EPS growth (vs +8% YoY in 4Q) despite easier comps

Wisconsin voters ban private money, nonprofits from the election process after 2020 ‘Zuckerbucks’ controversy; spotlight now on 22 states that still allow it...

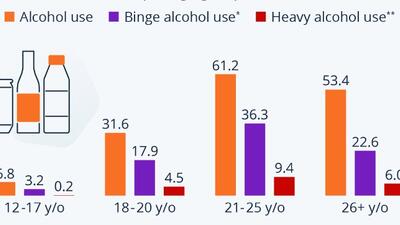

Alcohol abuse is a behavioral risk factor connected to 2.4 million deaths in 2019...

...the system will have to grab enough collateral to fund itself while collateral evaporates in the deflation of the Everything Bubble. This will truly be a case of TINA - there is no alternative.

Of course a Democratic Socialist introduced it...

the men suffered broken bones, electric shocks, sexual abuse, extreme temperatures...

...will develop the next generation of missile interceptor systems...

Of all the antiviral drugs for Covid-19, Pfizer’s Paxlovid has been the most successful... Not for its safety and efficacy, but for its ability to earn the company billions in profits despite being largely ineffective for most people.

A scene reminiscent of the Chuck Norris film Invasion USA...

Note there’s no definitive number given, just “billions”... and even the number of programs, “at least 30,” is fuzzy...