Even more bad news for the Biden admin.

...vigilance should be increased for a yuan devaluation. Though not a base case, the tail-risk of one occurring is rising...

"We would be surprised if this is BHP's final offer."

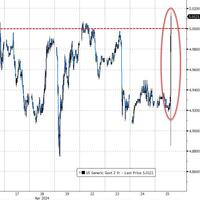

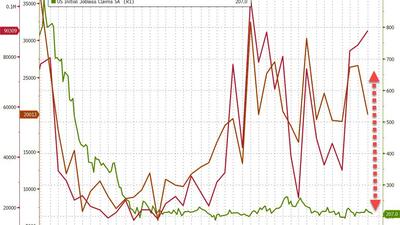

"Just six months out from the presidential election, it looks like the economy is finally slowing down."

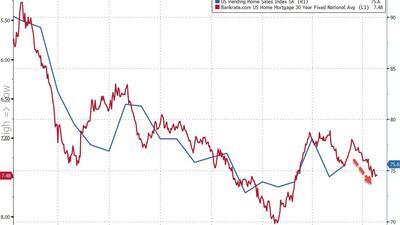

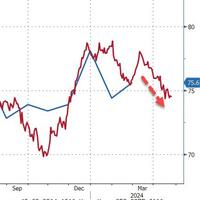

This is the 28th straight month of YoY declines for non-seasonally-adjusted pending home sales.

...besides altering longstanding precedent, the decision could bear heavily on, and delay, the criminal prosecutions President Trump is facing before the election.

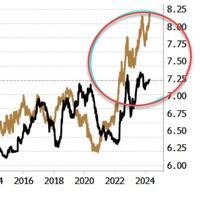

Anyone under the age of 60 probably has no acquaintance with stagflation. The U.S. last experienced this in 1977–1981... It was great for hard assets such as gold, but a nightmare for holders of stocks...

What time is the Biden press conference to confirm there will be rate-cuts this year?

If Trump wins in November, will all this data suddenly be 'allowed' to reflect reality?

Moscow vows to take more territory in Ukraine to counteract the long-range NATO missiles...

"I think we are just hitting a little bit of a reality check. This doesn’t take away the excitement around the potential going forward, but it’s probably valuation coming back to a more realistic pathway.”

"Any nation with a birth rate below replacement will eventually cease to exist."

Silicon Valley might back green energy, but its business benefits from coal...

The decline of the oil and gas industry would be disastrous for the American people.

- European bourses are mostly lower, US equities are mixed, with the NQ underperforming after Meta (-13.1%) results

- Dollar is lower, Antipodeans benefit from higher metals prices, JPY is softer holding above 155.50 against the USD

- Bonds are rangebound awaiting impetus from Tier 1 data later today

- Crude is slightly lower in absence of energy-specific newsflow, XAU benefits from the weaker dollar, base metals are mostly firmer

- Looking ahead, US GDP Advance, PCE Advance, Initi

The control that comes with CBDCs is immense and allows for complete micromanagement of the population...

Johnson reached across the aisle, stiffed the Republican majority that elected him speaker, and pushed through a massive gift to the warfare corporate welfare state...

"Wait until they stop housing & feeding them. That's when the chaos will begin."