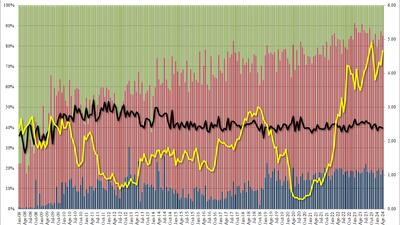

The late stage of a global system has a ‘false dawn’ as the economy shifts from producing things,...to producing financial assets, which make money while destabilising society and the global system itself

"Wait until they stop housing & feeding them. That's when the chaos will begin."

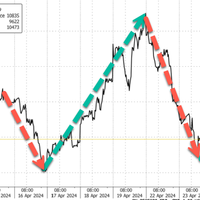

...BoJ bluff-calling and bitcoin bloodbath from the usual 'perps'...

"ABC reporter says not all the terrorist sympathizers are students..."

"you may see markets overshoot to the upside but feels like the buy-the-dip has kicked in with aspects of both Tech and Value poised to lead and the resumption of the AI trade."

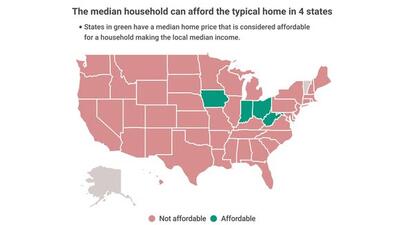

The median U.S. income-earner ($74,755) with 10% down could only afford a home that costs $207,529 - 38% less than the current median-priced home...

12 Washington officers with the Electronic Surveillance Unit were undercover...

"...there have been a number of documented shortcomings,..."

Johnson reached across the aisle, stiffed the Republican majority that elected him speaker, and pushed through a massive gift to the warfare corporate welfare state...

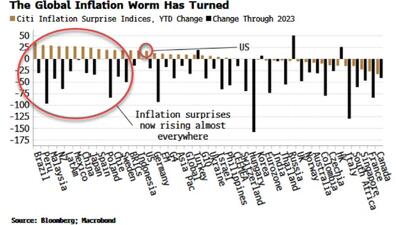

There continues to be scant evidence of inflation hedging in markets despite clear signs price-growth risks are rising...

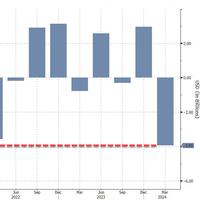

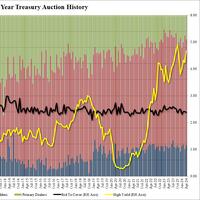

If yesterday's 2Y auction was stellar, today's 5Y was the opposite.

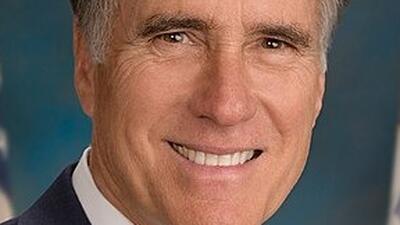

“I think everybody has made their own assessment of President Trump’s character, and so far as I know you don’t pay someone $130,000 not to have sex with you...”

"There could be just some easing of the frenetic moves we've seen."

This is why those who understand these dynamics are getting out, even though the city was their home...

"...demand in the US market has fallen sharply beyond expectations, making Apple take a conservative view of demand in non-US markets."

Jack Boroudjian and I discuss monetary policy, fiscal policy, the move in gold, politics and why the bond market may take the spending keys away from the Biden administration.