"We are victims of a totalitarian con, and our own government (along with many of their allies) is about to hit us with an apocalyptic fascist world coup..."

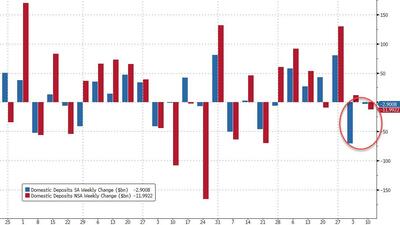

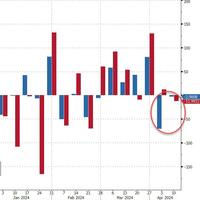

“So far in 2024, that progress on inflation has stalled... Right now, it makes sense to wait and get more clarity before moving,”

"Katherine Maher isn’t qualified to teach an introductory journalism class, much less capable of responsibly spending millions of American tax dollars..."

Triggers speculation it was either Americans or Israelis...

Why are global health officials suddenly showing "enormous concern" about a disease that has been circulating all over the planet for several years now...

Peace was closer in opening months of the war "than has been previously understood."

Green energy planners have missed the point that our physics-based economy favors low-cost producers...

New amendment: "Any Member of Congress who votes in favor of this Act shall be required to conscript in the Ukrainian military."

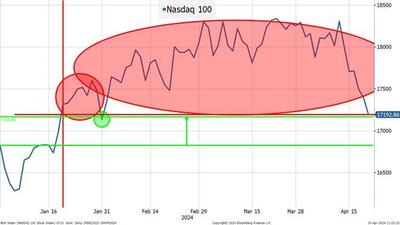

It's nice to anticipate sunny weather, but it's a good idea to carry an umbrella just in case the forecasts prove overly optimistic...

...this halving event will occur as Bitcoin reaches block 840,000, marking the point at which its relative supply issuance will drop below that of gold for the first time...

...it won’t be long before Big Brother’s Thought Police are locking us up to “protect us” from ourselves.

Cypherpunks write code. Clever people ignore politics. You should get out of the house, stop worrying too much about the lunatics running the asylum, and instead admire nature...

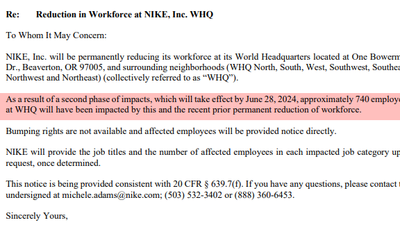

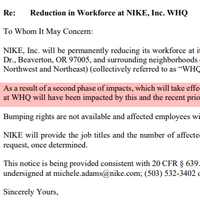

What a nice surprise for employees heading into the weekend.

"It's crazy how resilient those numbers were."

Think about how many people got “FOMO’d” into buying markets at levels they weren’t comfortable with?

Conservatives wary of two major avenues of establishment surprise-attack