Peace was closer in opening months of the war "than has been previously understood."

“So far in 2024, that progress on inflation has stalled... Right now, it makes sense to wait and get more clarity before moving,”

"We are victims of a totalitarian con, and our own government (along with many of their allies) is about to hit us with an apocalyptic fascist world coup..."

"I didn’t make a statement directed towards anyone; I asked a question..."

"The PRC has made it clear that its... plan is to land low blows against civilian infrastructure to try to induce panic and break America’s will to resist.”

Democrats shudder, but new Michigan polls suggest Kennedy could be a net plus for Biden

Joe Biden’s Secretary of Education, Miguel Cardona, threatened during a congressional hearing to weaponize the Department of Education...

Transportation Secretary Pete Buttigieg is caught in one of the worst aviation crises in American history....

For the first time ever, India - which depends on imports for around 87% of its oil consumption - imported roughly equal volumes of OPEC and non-OPEC crude...

"Katherine Maher isn’t qualified to teach an introductory journalism class, much less capable of responsibly spending millions of American tax dollars..."

Why are global health officials suddenly showing "enormous concern" about a disease that has been circulating all over the planet for several years now...

Green energy planners have missed the point that our physics-based economy favors low-cost producers...

New amendment: "Any Member of Congress who votes in favor of this Act shall be required to conscript in the Ukrainian military."

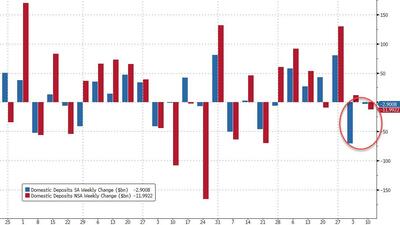

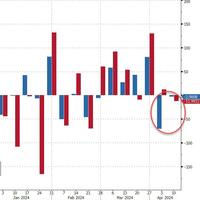

It's nice to anticipate sunny weather, but it's a good idea to carry an umbrella just in case the forecasts prove overly optimistic...

...this halving event will occur as Bitcoin reaches block 840,000, marking the point at which its relative supply issuance will drop below that of gold for the first time...

...it won’t be long before Big Brother’s Thought Police are locking us up to “protect us” from ourselves.