“I think everybody has made their own assessment of President Trump’s character, and so far as I know you don’t pay someone $130,000 not to have sex with you...”

Who will win the "Double-Hater" vote in November?

"...demand in the US market has fallen sharply beyond expectations, making Apple take a conservative view of demand in non-US markets."

Jack Boroudjian and I discuss monetary policy, fiscal policy, the move in gold, politics and why the bond market may take the spending keys away from the Biden administration.

One might start to think that Democrats want school shootings to continue, but why would that be...?

Hong Kong’s financial regulator has officially approved the first batch of spot Bitcoin and Ether ETFs for trading...

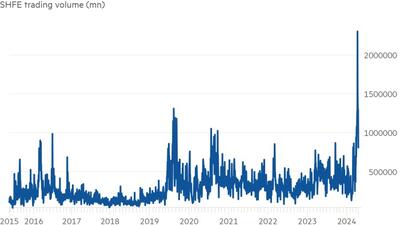

"With exchange controls and capital controls, you can’t just look at other markets to put your money into..."

The Patrick Mahomes of the investment world are few and far between. At times, overconfidence is a good trait, but it can also be a critical flaw...

...the official data showed crude inventories plunging last week by the most since January...

4 suspected of working for China & two for Russia, ironically as Scholz attempts a reset with Beijing...

"Kering's performance worsened considerably..."

Damage control from years of ridiculous DEI policies will not be cheap.

...initially suggested the idea of a collaborative approach to decentralize Bitcoin mining in October 2021.

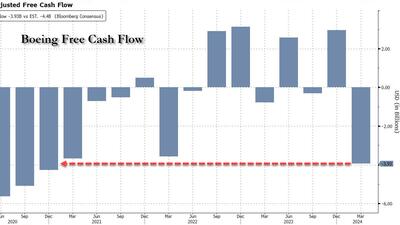

...not helped by the 8th downward revision in the last year...

Musk is under relentless attack from Aussie officials for allowing free speech on X...

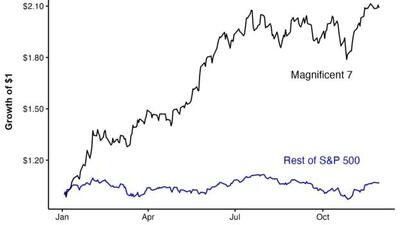

“There are high hopes for big US tech. Inflation and valuation levels don’t seem to be a concern at the moment.”

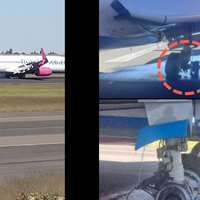

"Looks like an explosion."

"We are taking up their space and consuming their resources... They say this openly. "