"Wait until they stop housing & feeding them. That's when the chaos will begin."

Johnson reached across the aisle, stiffed the Republican majority that elected him speaker, and pushed through a massive gift to the warfare corporate welfare state...

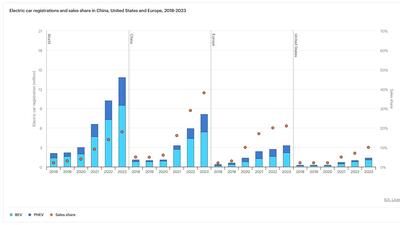

...confirms smaller and cheaper is the path to prosperity in the EV market.

"I think that will be another growth wave in that space, which I will make sure to capture."

"Don't want to lift the finger. For the money."

Like everything else it seems, the funding has been politicized, and it’s at risk in the upcoming farm bill...

His angry lyrics resonate with young Iranians tired of the clerical establishment...

Many countries in the West, with the notable exception of Germany, have also recognized that nuclear power generation would help them achieve net-zero emission goals...

Says military equipment will start being transferred "in the next few hours" from the US stockpile.

Of course Chutkan is involved...

...be afraid America, very afraid!

The dreadful grip of the UniParty on national security policy has finally produced sheer madness in a single package...

Hardly the start the "Fabulous Four" wanted...

The late stage of a global system has a ‘false dawn’ as the economy shifts from producing things,...to producing financial assets, which make money while destabilising society and the global system itself

...BoJ bluff-calling and bitcoin bloodbath from the usual 'perps'...

"ABC reporter says not all the terrorist sympathizers are students..."