markets

The January Effect saw robust demand across both retail and institutional channels, but Citadel's equity strategy boss has "higher first, then lower vibes for US equities."

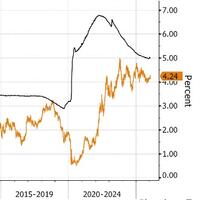

With an almost unprecedented policy mix of easy financial conditions... inflation risks may well move into the foreground... so do not expect further rate cuts... certainly, from the Powell Fed... and perhaps for the entire year.

The goal is to coordinate efforts to secure key minerals needed for modern technologies and reduce reliance on China’s low-cost supplies, which currently give Beijing significant leverage.

Estimate your earnings

oz

Calculate earnings

US homebuilders are working on a plan for a massive program to develop up to a million "Trump Homes" that would address the US affordability crisis while allowing private capital to deploy hundreds of billions in new dollars.

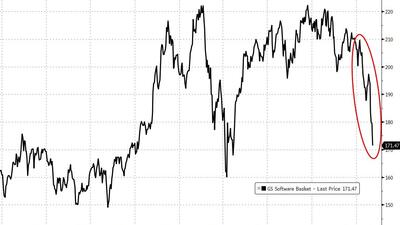

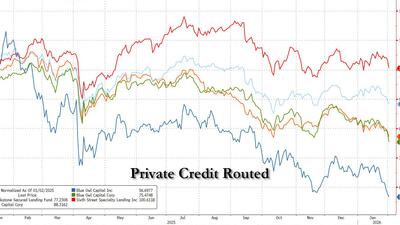

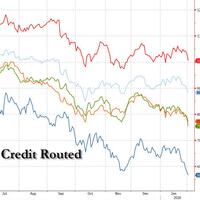

“Software is the largest sector exposure for BDCs, at around 20% of portfolios, making the industry particularly sensitive to the recent decline in software equity and credit valuations,”

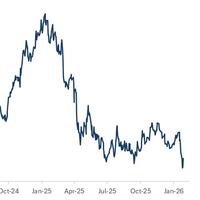

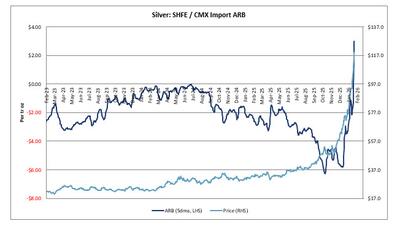

One wonders how long generic ‘markets’ can stay calm in a world in which so many people are so unenamoured of fiat FX; and how metals can cope with “because markets!” HFT speculation that make them trade like an NFT or meme stock.

If Treasury issuance and Fed’s balance sheet path is steady and credibly telegraphed over the long term, accidental tightening of financial conditions can be avoided and any unforced shocks in rates markets would be limited.

Walt Disney, after a more than two-year saga, has landed on its next CEO: Josh D’Amaro, head of the company’s theme parks and consumer products division. D’Amaro, a 28-year-veteran of the company, will succeed Iger effective March 18.

"... the pace of change and execution was not in line with the Board's expectations."

"There is a lot of liquidity out there and it’s remaining committed to financial assets. It’s rotating within the markets, and the macro backdrop is supportive of that continuing."

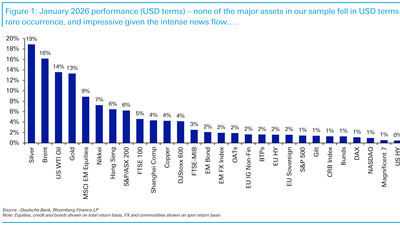

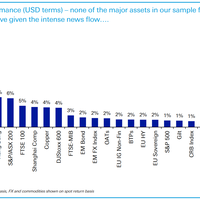

"January managed to both shock and awe in various ways, yet still delivered broad based gains across all global assets in our monthly performance review when measured in USD terms—a genuinely rare occurrence"

"Switch 2 sales figures can be seen as okay, but it would be hard to call them solid."

"Investors we speak to - including long-term institutional and private wealth investors with slow-moving allocation processes - signal strong interest in creating/increasing the gold share in their strategic portfolios..." - Goldman

"Warsh becoming Fed chair won't lead to any major near-term shifts in monetary policy... Most of his comments, and historic disagreements with Fed policy, are on the balance sheet. However, the Fed has already gone down the path that he advocated against"

The deal gives SpaceX a valuation of $1 trillion, and xAI a value of $250 billion,

Overall, the report frames Tesla as a company in the middle of a major transformation...