San Fran's CRE Apocalypse: The City's Two Biggest Hotels Have Defaulted

The marxist shit(covered)show that is San Francisco is imploding before our very eyes in ways that are both terrifying, memorable wholly different each and every day.

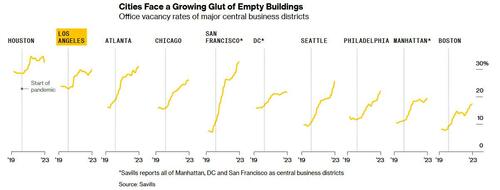

First, it was commercial real estate: at 30%, the city has the highest office vacancy rate in the US...

... and amid an existential crisis for the city's tech-focused tenants, finds that it can't even sell office skyscrapers at a firesale price of 80% off the purchase price, and even in the best case, a 71% discount is as good as it gets (it got worse as we detailed in "There's Poop Everywhere": San Francisco's Office District Not Only A Ghost Town, It's Also Covered In Sh*t).

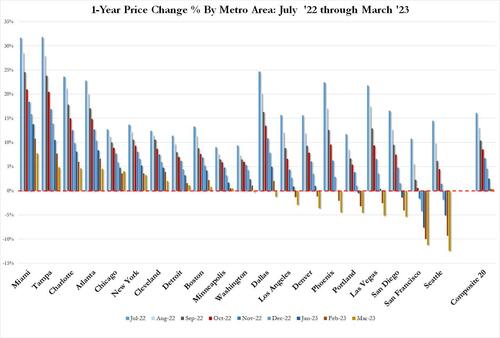

Of course, it's not just commercial real estate: residential is just as bad, with home prices in San Fran now tumbling double digits y/y, and just that other liberal disaster, Seattle, seeing home prices plunge faster.

But while we expect the implosion in residential housing prices to accelerate, it's really CRE where the ticking neutron bomb is to be found, and according to the latest horror story out of San Fran's commercial real estate market, the owner of two of San Francisco’s biggest hotels — Hilton San Francisco Union Square and Parc 55 — has stopped mortgage payments and plans to give up the two properties.

As the SF Chronicle reports, Park Hotels & Resorts said Monday that it stopped making payments on a $725 million loan due in November, handing over the keys to the property to the creditors and expects the “ultimate removal of these hotels” from its portfolio. The company said it would “work in good faith with the loan’s servicers to determine the most effective path forward.”

“After much thought and consideration, we believe it is in the best interest for Park’s stockholders to materially reduce our current exposure to the San Francisco market. Now more than ever, we believe San Francisco’s path to recovery remains clouded and elongated by major challenges — both old and new,” said Thomas Baltimore Jr., CEO of Park Hotels, in a statement which could be applicable to every other liberal-controlled US metropolis.

The 1,921-room Hilton is the city’s largest hotel and the 1,024-room Parc 55 is the fourth-largest, and together they account for around 9% of the city’s hotel stock. The hotels could potentially be taken over by lenders or sold to a new group as part of the foreclosure process, although it is unclear who would want to put even one dollar of equity into property that will more than likely redefault within a few years.

That's because there is no easy solution to San Fran's long list of challenges which not only a record high office vacancy of around 30%, but also concerns over street conditions (and the amount of feces covering them), a lower rate of return to office compared with other cities (because woke snowflakes are naturally entitled to work from home of course) and “a weaker than expected citywide convention calendar through 2027 that will negatively impact business and leisure demand,” Baltimore Jr., said.

Park Hotels said San Francisco’s convention-driven demand is expected to be 40% lower between 2023 and 2027 compared with the pre-pandemic average.

San Francisco Travel, the city’s convention bureau, expects Moscone Center conventions to account for over 670,000 hotel room nights this year, higher than 2018’s 660,868 room nights but far below 2019’s record-high 967,956. And weaker convention attendance is projected for each following year through 2030.

Park Hotels & Resorts expects to save over $200 million in capital expenditures over the next five years after giving up the hotels, and to issue a special dividend to shareholders of $150 million to $175 million. The company’s exposure will shift away from San Francisco toward the higher-growth Hawaii market (good luck with that).

Parc 55 is a block from Westfield San Francisco Centre (the mall where Nordstrom is also departing), and the block where Banko Brown, an alleged shoplifter, was killed in a shooting outside a Walgreens in April. Nearby blocks are also full of empty storefronts, as tourist and local foot traffic hasn’t fully recovered and probably never will.