Bull Do Brasil — Druckenmiller Is Already In. Are You?

Bull do Brazil

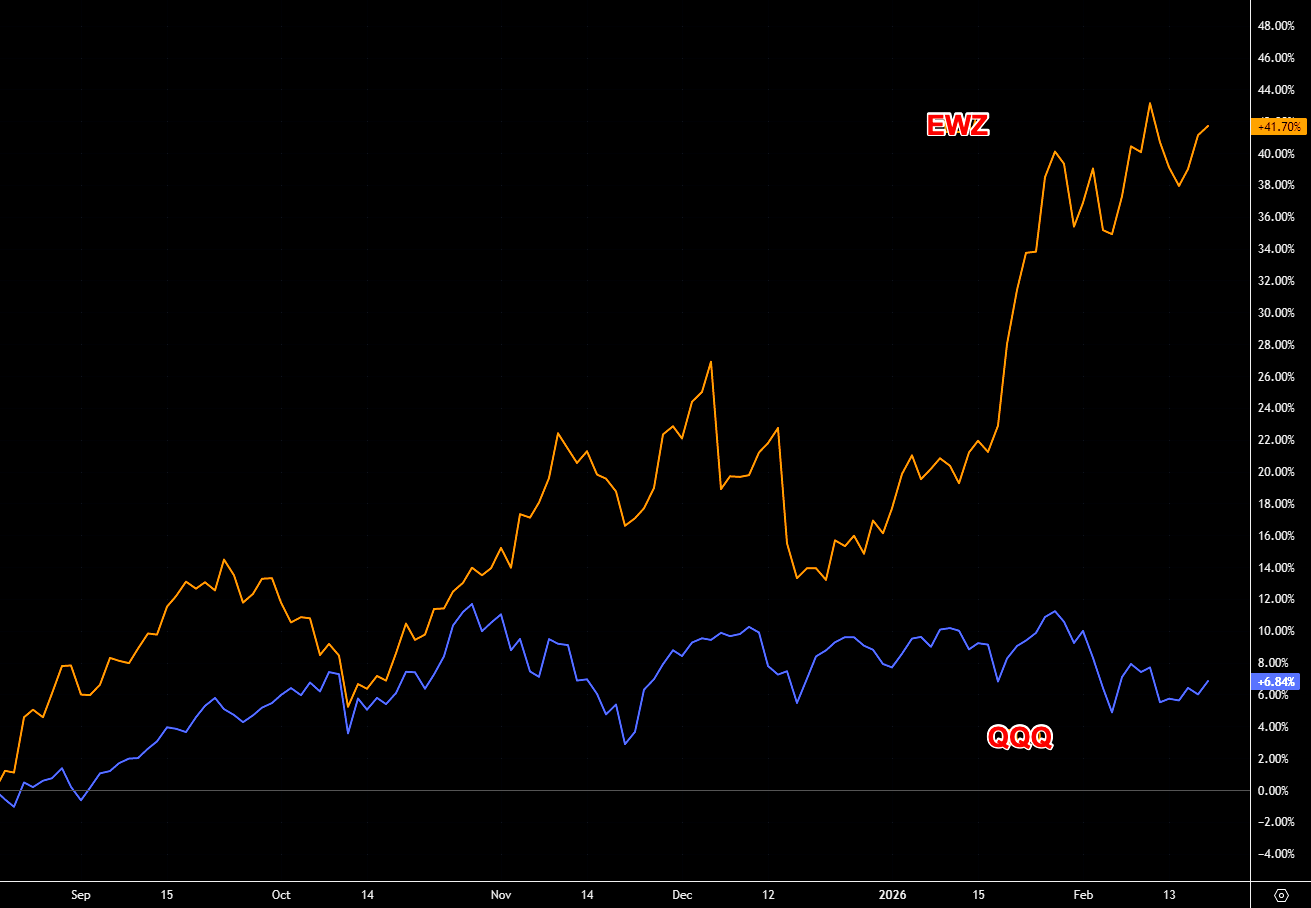

A little over a year ago, we flagged Brazil as one of the most bombed-out assets to watch. Since then, EWZ has surged, effectively going vertical, highlighted by the aggressive gap higher in mid-January. The fundamental story remains intact, but EWZ is now approaching a significant resistance zone just overhead. More recently, we’ve also learned that legendary investor Stanley Druckenmiller has been building a position in EWZ over the past several months. How do you play it from here?

Source: LSEG Workspace

Massive

$40 is the key level to watch. The longer-term weekly chart adds perspective, and the recent bullish 50/200-week moving average cross is hard to ignore.

Source: LSEG Workspace

Have fun staying boring

Performance over the past 6 months: EWZ +42%, QQQ +7%.

Source: LSEG Workspace

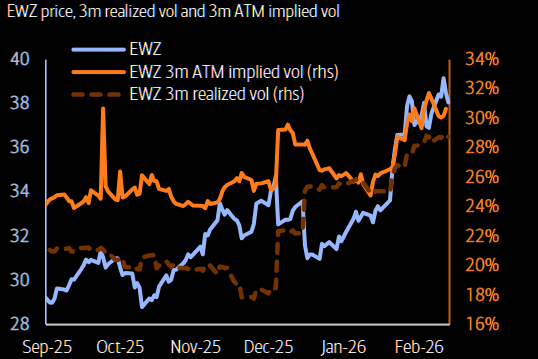

Wanna see spot up, vol up?

Underexposed investors have been forced to chase Brazil longs via calls, leading to a surge in both price and volatility.

Source: LSEG Workspace

Brazilian bubble

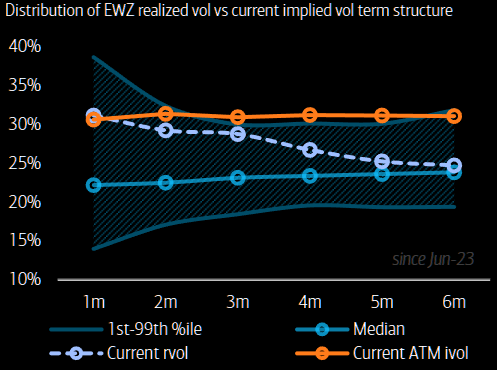

EWZ has surged nearly 30% since September, but the rally has shown classic spot-up, vol-up instability, pushing its Bubble Risk Indicator close to extreme levels (~0.8) according to BofA's derivatives teeam. For those looking to participate without overpaying for volatility, a calendar call spread — long Mar-26 calls vs. short Jul-26 further OTM calls — looks attractive, especially given the unusually flat volatility term structure at elevated levels.

Source: BofA

Source: BofA

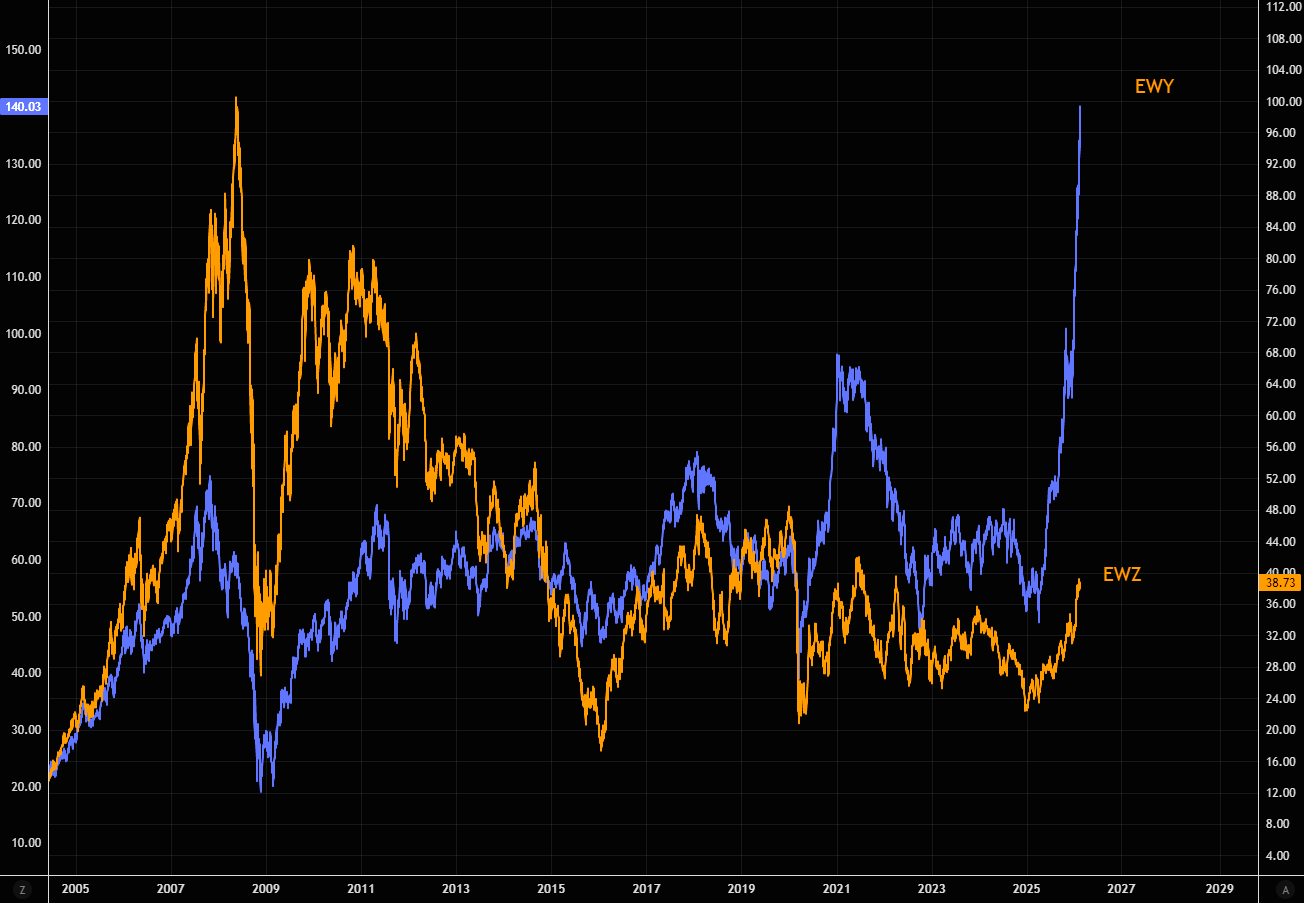

Nothing is impossible

There is little fundamentally in common between EWZ and EWY (Korea), yet the two have moved closely together over the years. The broader point: when emerging market trades go extreme, they tend to extend much further, and longer, than most expect. Ask yourself: how many investors do you know who are actually long EWY?