markets

"Dissent is essential to democracy. But dissent must never lead to disorder or denying the rights of others... no place for hate speech in America."

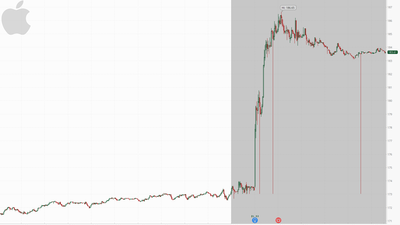

Because when others won't buy your stock you kinda have to step in.

"All eyes on AAPL tonight."

"Consumers continue to be even more discriminating..."

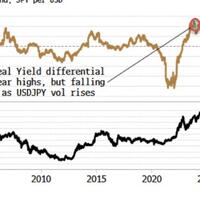

It’s getting precarious for yen carry traders...

"The Ministry of Finance is in trouble."

The yen is beyond saving, and gold will outperform it even if the BoJ manages to narrow the gap in the shorter term...

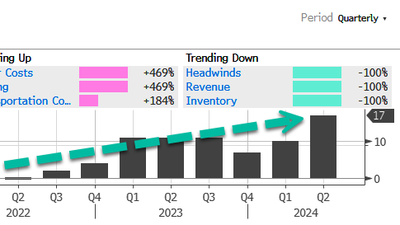

This is the 17th monthly downward revision in the last 22 months... come on!!!

"We have strong growth and a FED/Treasury willing to use its tools to support the economy which is bullish risk assets IMO."

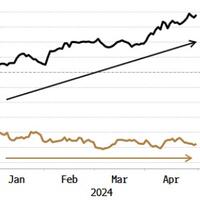

It looks like mainly US-based traders took Powell’s pivot in December more seriously than those predominately based abroad...

Maybe Jay Powell can see the "stag" and the "flation" now?

“All in all, it’s a bull message for markets. We’ve got the confirmation that Powell doesn’t want to raise rates.”

- European equities are mixed while US equity futures are entirely in the green

- Dollar is flat, CHF bid after hotter inflation metrics, USD/JPY higher and at 155.20

- USTs softer but relatively contained in the fall-out of the FOMC; Bunds are higher and playing catch up

- Crude is incrementally firmer, XAU is softer and base metals are mixed

- Looking ahead, US Challenger Layoffs, International Trade, IJC, CNB Policy Announcement, ECB’s Lane, BoC's Macklem & Rogers.

Both VW and Mercedes have seen a downturn in demand...