NS

NSStateside equity futures flat, Dollar firmer vs G10 peers & Bonds pressured ahead of supply and Fed speak - Newsquawk US Market Open

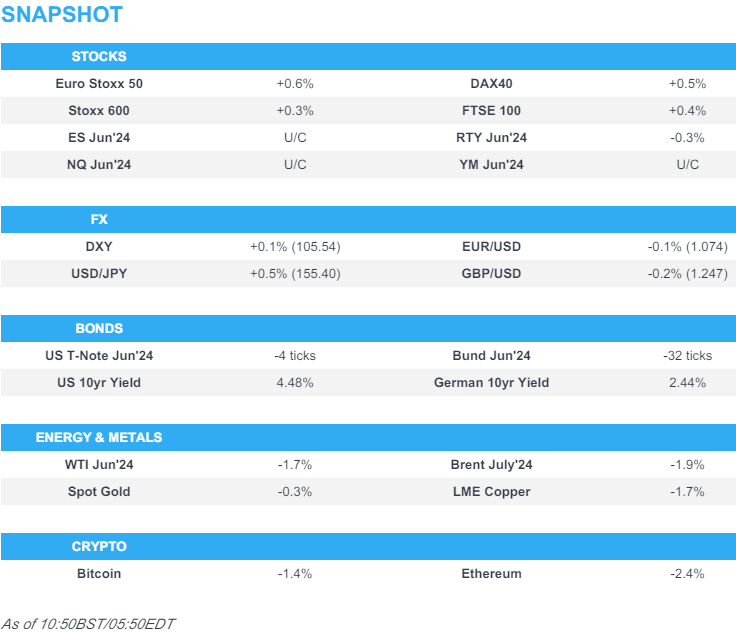

- European equities are entirely in the green, whilst Stateside futures are a little more tentative

- Dollar is incrementally firmer, G10s peers softer to various degrees, AUD & JPY underperform

- Bonds pressured, taking a breather from this week’s advances

- Crude slips with geopolitical updates light, XAU and base metals are pressure from the Dollar and downbeat Chinese price action overnight

- Looking ahead, US Wholesale Sales, BoC FSR, comments from ECB’s Wunsch & de Cos, Fed’s Cook, Jefferson & Collins, Supply from the US, Earnings from Emerson Electric, Airbnb & Uber

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx600 (+0.3%) are almost entirely in the green, with indices initially opening tentatively around the unchanged mark before picking up gradually to session highs throughout the morning.

- European sectors are mixed, with Food Beverage and Tobacco at the top of the pile, lifted by post-earning strength in AB InBev (+4.4%). Basic Resources is the clear underperformer, given the weakness in underlying metals prices; Autos are also hampered by poor BMW (-4.5%) results.

- US Equity Futures (ES U/C, NQ U/C, RTY -0.3%) are mixed and trading with little direction, continuing the tentative price action seen in the prior session. Apple (+0.6% pre-market) gains amid reports that its China iPhone shipments rose 12% in March.

- Click here and here for the sessions European pre-market equity newsflow. Including earnings from BMW, Siemens Energy and more.

- Click here for more details.

FX

- USD is firmer vs. all peers but to varying degrees. Support for the DXY has in large part been provided by further upside in USD/JPY. Fresh US fundamentals are lacking in what could well be a quiet week ahead of next week's inflation metrics, though a handful of speakers and supply populate today's docket. As such, DXY has continued to consolidate around the mid-point of the 105 handle.

- EUR is softer vs. the USD but less so than peers with some support via the EUR/GBP and EUR/SEK crosses. Fresh fundamental drivers for the Eurozone are lacking and expectations of a June ECB cut remain firmly anchored. Currently trading around 1.074.

- GBP is softer vs. the broadly firmer USD with UK specifics light ahead of tomorrow's BoE which some are framing as a potential dovish hold. Cable has slipped to the 1.24 handle, going as low as 1.2468.

- JPY is losing further ground to the USD with jawboning efforts from Japanese officials futile. 155.41 is the high watermark thus far with the next target a test of 156. CPI next week likely to be the next inflection point for the pair. Commentary from BoJ Governor Ueda sparked some volatility, though was ultimately unreactive to the commentary.

- Antipodeans are both softer vs. the USD with AUD lagging alongside downside in metals prices. AUD/USD has extended on yesterday's downside which has seen the pair dragged from Friday's post-NFP peak at 0.6647 to a current low of 0.6565.

- SEK is losing ground vs. peers as the Riksbank pulls the trigger on a rate reduction and leaves the door open to another two cuts in the second half of the year. Accordingly, EUR/SEK has jumped from 11.691 to a high of 11.7564 but has failed to test the YTD peak at 11.7708.

- PBoC set USD/CNY mid-point at 7.1016 vs exp. 7.2202 (prev. 7.1002).

- Brazil is to examine changes to pension benefit calculations in spending review, according to Reuters

- Click here for more details.

FIXED INCOME

- USTs are a touch softer, in-fitting with the narrative outlined for Bunds above but with USTs yet to meaningfully or lastingly deviate from the unchanged mark in narrow 108-28+ to 109-03 bounds. 10yr supply and Fed speak from Cook, Collins and Jefferson scheduled.

- Bunds are under modest pressure as the fixed income complex takes a very slight breather from the bullish action that has been in place since the Payrolls report on Friday. After printing an earlier 131.45 base Bunds have since stabilised around 20 ticks above this.

- Gilts are essentially unchanged, and under some very modest pressure at the open which was softer by 15 ticks given bearish leads elsewhere. UK-specific developments light. Overnight, the Times Shadow MPC said the BoE on Thursday should leave rates unchanged. Currently holding around 97.95 towards Tuesday's close and by extension at the top-end of that session's 97.48-98.08 bounds.

- UK sells GBP 2.5bln 1.50% 2053 Green Gilt: b/c 3.26x (prev. 3.05x), average yield 4.545% (prev. 4.565%), tail 0.6bps (prev. 0.3bps).

- Click here for more details.

COMMODITIES

- A downbeat morning for the crude complex with newsflow rather light and Israel's Rafah operation seemingly not likely to spark a wider conflict as things stand, though the situation remains very fluid. Brent July slipped from USD 83.05/bbl to 81.96/bbl, with some flagging the 200 DMA around USD 81.95/bbl.

- Another soft session for precious metals, likely as Israel's "limited" Rafah operation has failed to spark a regional war, with international efforts also underway to cushion the impact of the incursion. XAU trades towards the bottom of a 2,303.75-2,321.53/oz range.

- Lower across the board for base metals amid a firmer Dollar and following the downbeat mood in Chinese markets overnight.

- US Private Energy Inventory Data (bbls): Crude +0.5mln (exp. -1.1mln), Cushing +1.3mln, Gasoline +1.5mln (exp. -1.3mln), Distillate +1.7mln (exp. -1.1mln).

- Russian Deputy PM Novak said there are no discussions about an oil output increase at OPEC+.

- EU Ambassadors will today be discussing a new package of sanctions against Russia, where the focus will be on restricting LNG profits, via Politico.

- Indonesia's President said copper concentrate export permits for Freeport and Amman will be extended with the details of the extension still being calculated, according to Reuters.

- Morgan Stanley has removed its USD 4/bbl risk premium from Brent forecasts, reverts forecast back to forecast of USD 90/bbl by Q3; expects OPEC to extend current production agreement at June 1st meeting, eventually to year-end, including voluntary cuts.

- China Industry Ministry says the draft rules would guide Lithium battery firms to reduce manufacturing projects that "purely" expand production capacity

- Click here for more details.

NOTABLE EUROPEAN HEADLINES

- The BoE should leave rates unchanged at its meeting on Thursday but consider lowering them in June, according to the Times' shadow MPC.

- UK Home Office announced on Tuesday night that it was aware of a technical issue affecting E-gates across the country, while it was working closely with the Border Force and affected airports to resolve the issue. However, Heathrow Airport later stated that all Border Force systems were now running as usual and it did not expect any issues this morning when the operation starts up.

- ECB's Scicluna is to face charges of “fraud and misappropriation,” relating to his time as the Finance Minister of Malta, via Politico citing documents.

- Riksbank cuts its Rate by 25bps to 3.75% (as expected by a majority of respondents); Policy rate is expected to be cut two more times during H2 if inflation outlook cuts (bringing total 2024 cuts to 3 vs prev. guided just over 2). Click here for details.

- Barclays European Equity Strategy; raises Utilities to Market Weight from Underweight; cuts Energy to Market Weight from Overweight

DATA RECAP

- German Industrial Output MM (Mar) -0.4% vs. Exp. -0.6% (Prev. 2.1%, Rev. 1.7%)

- Spanish Ind Output Cal Adj. YY (Mar) -1.2% (Prev. 1.5%, Rev. 1.3%)

- Italian Retail Sales SA MM* (Mar) 0.0% (Prev. 0.1%); Retail Sales NSA YY (Mar) 2.0% (Prev. 2.4%)

EARNINGS

- BMW (BMW GY) Q1 (EUR): Revenue 36.61bln (exp. 36.82bln). EBIT 4.05bln (exp. 3.96bln). Automotive revenue 30.94bln (exp. 31.01bln). Automotive EBIT Margin 8.8% (exp. 9.05%). EBT Margin 11.4% (exp. 10.6%). BEV sales +28% Y/Y. 2024 outlook confirmed. Shares -4.5% in European trade

- Siemens Energy (ENR GY) Q2 (EUR): FCF 483mln (prev. -294mln Y/Y), Profit before special items 170mln (prev. 41mln Y/Y), Net Profit 108mln (exp. -11mln). Outlook: Expects sales growth 10-12% (exp. +6%), Profit margin of -1% to +1% (prev. guided -2% to +1%). Now expects FCF pretax of up to 1bln (prev. guided negative at up to 1bln). Shares +12.5% in European trade

NOTABLE US HEADLINES

- Apple (AAPL) China iPhone shipments at 3.75mln, +12% in March, via official data.

GEOPOLITICS

MIDDLE EAST

- "IDF: We are conducting a precision operation in limited areas east of Rafah in the southern Gaza Strip", according to Asharq News. Additionally, "IDF says it continues operations east of Rafah", via Al Arabiya, "IDF: Hamas military infrastructure destroyed in the Rafah crossing area".

- Israeli artillery shelling was reported east of Rafah in the southern Gaza strip, according to Al Jazeera.

- Hamas said Cairo talks are the 'last chance' for Israel to recover hostage talks, according to Al Arabiya. Furthermore, a Hamas official said the group set red lines in the ceasefire negotiations that cannot be conceded, according to Sky News Arabia.

- White House thinks the Israeli operation to capture the Rafah crossing doesn't cross President Biden's "red line" that could lead to a shift in US policy towards the Gaza war although the US warned that if it broadens or gets out of control and Israeli forces go into the city of Rafah itself, it will be a breaking point, according to US officials cited by Axios.

- CIA Director Burns plans to travel to Israel on Wednesday for talks with Israeli PM Netanyahu and Israeli officials, according to a source cited by Reuters.

OTHER

- Ukrainians hit a fuel depot in the Russian-controlled city of Luhansk, according to sources via X.

- Russia launched an air attack on Kyiv, according to Ukraine's military. It was later reported that Russia targeted energy facilities in Kyiv, Poltava, Lviv and other regions, according to Ukraine's Energy Minister. Furthermore, Ukraine's largest private electricity company said the Russian attack caused serious damage at three thermal power plants.

- Taiwan's leader is open to dialogue with Beijing on an equal footing, according to Taipei's de facto envoy to the US under President-elect Lai cited by SCMP.

CRYPTO

- A slightly softer session for Bitcoin and now holding just above USD 62k, whilst Ethereum slips below USD 3k.

APAC TRADE

- APAC stocks were mostly lower after the choppy US performance and in the absence of fresh catalysts.

- ASX 200 lacked firm direction with gains in industrials and energy offset by weakness in miners and financials.

- Nikkei 225 underperformed as participants digested earnings including disappointing guidance by Nintendo.

- Hang Seng & Shanghai Comp were ultimately lower amid trade and tech-related frictions after the US revoked export licences that allowed Intel (INTC) and Qualcomm (QCOM) to supply Huawei with semiconductors.

NOTABLE ASIA-PAC HEADLINES

- BoJ Governor Ueda said the BoJ will scrutinise the impact of yen moves on the economy in guiding monetary policy and FX moves could have a big impact on the economy and prices, so could warrant a monetary policy response, while he added the BoJ may need to respond via monetary policy if such impact from yen moves affect trend inflation. Ueda said they expect trend inflation to gradually head towards 2% and will adjust monetary policy as appropriate if trend inflation heads toward 2% as projected or if they see a risk of inflation overshooting their forecast. Furthermore, Ueda said they don't see yen moves as having a big impact on trend inflation so far but there is a risk the impact could become more significant in the future and they won't necessarily wait until inflation achieves their forecasts in 1.5 to 2 years to raise rates with the central bank to adjust the degree of monetary support accordingly if trend inflation moves as projected.

- Japanese Finance Minister Suzuki said he is watching FX movements with a sense of urgency and won't comment on forex levels, while he added it is important for currencies to move in a stable manner reflecting fundamentals. Furthermore, he said they will take a thorough response for forex and don't believe that resources for intervention are limited.

- Chinese April Prelim Retail Car Sales -2% Y/Y (vs +6% in March).

- BoJ Governor Ueda says Japan's economy is recovering moderately albeit with some weakness; will guide policy appropriately from perspective of stably and sustainably achieving the price target. Rapid/abrupt and one-sided Yen falls are negative for Japan's economy are undesirable. Click here for more commentary.