The Makings of a Huge Speculative Frenzy, Bigger Than The Dotcom Bubble

In our last article on ZeroHedge, “The Fed Is the Instigator of Speculative Bubbles,” we explained how the Fed’s current loose monetary policy is opposite of what they say publicly and is the primary driver of the recent market rally.

In late 2023, we got some signals that the Fed was not serious about inflation fighting. Money supply (M2) actually started rising at that time instead of declining. If the Fed was truly trying to bring down inflation, money supply would be contracting.

That was the green light for us that the big, smart money was ready to load up on stocks. We turned bullish and predicted a big rally going at least into year-end of 2023, that would continue in 2024 if the Fed continued to create liquidity.

In our work, our Dohmen Theory of Liquidity & Credit, which we introduced in the late 1970’s, is more important for the market than valuations based on sales or earnings. Our Dohmen Theory says that the trend of “liquidity & credit” sets the trend for the stock market. It is much more important than earnings reports because fundamentals lag.

Currently we see that money lending is plentiful again. Liquidity has soared as well, with corporations having large cash holdings announcing buybacks again and even acquisitions. We should even see a rush of new IPOs.

Plenty of availability of credit is the fuel for speculation. Proof of this can be seen in the cryptocurrency market with some of those coins soaring even more than Bitcoin. Money and credit are the “mother’s milk” of speculation.

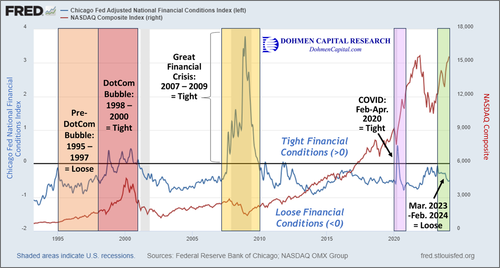

Historically, “loose” financial conditions have helped propel markets, as we can see on the chart below that comparing the Chicago Fed’s Adjusted National Financial Conditions Index (blue line, left axis) to the performance of the NASDAQ Composite (red line, right axis).

We’ve clearly pointed out the important periods when financial conditions were considered “tight” (above zero/black horizontal line) or “loose” (below zero/black horizontal line).

- The pre-dotcom bubble period from 1995-1997 (orange bar) was considered to have “loose” financial conditions, which helped spur the ensuing bubble as the NASDAQ started to ramp higher.

- The dotcom bubble from 1998-2000 (red bar) saw tightening, yet during that time the NASDAQ was able to surge higher during the bubble. However, at the end of that tightening cycle the bubble finally burst, causing the NASDAQ to plummet nearly 80% from 2000-2002.

- The Great Financial Crisis between 2007-2009 (gold bar) produced tight conditions, resulting in a stock market crash as the NASDAQ plunged nearly 60%.

- The brief COVID crisis from February-April 2020 (purple bar) resulted in tight conditions in response to the pandemic, which sent the NASDAQ lower by 33%. Yet, once the Fed flooded the economy with record amounts of stimulus and easing, this ignited the next stock market surge into November 2021.

- The final period starting after the banking crisis (March 2023) until now (green bar) shows financial conditions have become more and more “loose,” which has propelled the NASDAQ higher by 44%.

Combine the current “loose” financial conditions with what will be the most revolutionary technological advancement (Artificial Intelligence) in our generation, and we have what could be the making of a huge speculative bubble.

If you understand and agree with our analysis above, you are ahead of perhaps 80% of all economists.

One thing is important during such bubbles: active investors must know when to exit.

We will of course do our best to keep our members informed of when that might be, just as we did on March 10, 2000, one day before the dotcom bubble burst.

CONCLUSION: We consider financial conditions right now as “loose” by our definition. It has nothing to do with the levels of interest rates, but with credit availability.

We believe speculation will only get wilder unless the Fed actually tightens money by restricting bank lending instead of just hiking interest rates.

If the current AI Frenzy gets too wild, eventually the Fed would become uncomfortable because of the implications it will have on inflation and politics. That may cause an unexpected shift in Fed policy, which would cause a rollercoaster ride in the stock market this year, where some sectors may do well while others do poorly.

This is yet another important factor we at Dohmen Capital Research will keep on our radar for our valued members. Our advanced technical analysis has given us good warnings over the past 48 years.

If you are interested in reading more about how the Fed is fueling the big AI rally, and want to learn about how you can profit in this rare market environment, check out our latest research report, “The Artificial Intelligence Rally: How You Can Thrive In The Greatest Wealth Opportunity In Decades.”

In this 21-page report, we reveal why the current AI frenzy will exceed the dotcom bubble from the year 2000, which will offer incredible opportunities for those who know how to invest during speculative times.

We also provide our short-, medium-, and longer-term market forecasts in this pivotal and important election year, allowing investors to position their portfolios now for the great profit potential throughout 2024.

Get your copy FREE for a limited time only. Simply go to DohmenCapital.com or click this link: Get My Free AI Rally Report Now