Why gold? Why now?

Intro:

Due to the increased discussion on gold in various contexts — Fed Policy, Geopolitics, US Debt, Recession, BRICS etc— Gold has become a subtopic of various analytic approaches.

Gold Is the Answer to Many Risks

- Fed policy- Easing is bullish

- Geopolitics: Mercantilism, Gold benefits in Geo uncertainty

- US Debt: Bonds suffer, Gold benefits

- Recession: Gold out performs stocks

- BRICS: Replacing the UST/USD as SOV/MOE

- War: flight to safety

The reasons for owning Gold are for the problems ailing the world

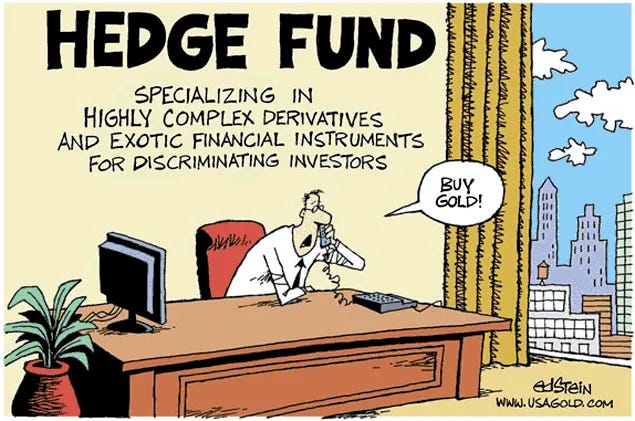

What is Your Bank Telling You?

It has gotten so analysis on any topic listed above, if it does not include an assessment on Gold, is actually doing its investing clients a disservice. Thus, if you want to know who is *not* helping you navigate this new world find the ones not talking about Gold or Silver.1 Anyone not talking about how their particular assessment effects gold, is either not paying attention or accumulating for their own firm’s position.

Orphaned Asset No More

On that note, we have noticed a drop off in Gold coverage lately on its own merits and more sidebar comments on it depending on the topic discussed. This is all further proof no one really knows Gold outside the gold community and many are trying to get a handle on it because it is:

A hot topic,

is going up,

and is actually a hedge for their client risk

To truly understand Gold is to understand the relationships between nations, men, and economies. That is what we try to do here. At the end of it all: Gold is a mirror. it is a reflection back at the viewer of the times he is headed towards.

Greenspan and Dog-Wagging Policy

Alan Greenspan knew that high Gold prices reflect low confidence in the globe’s current path. Since then our government has learned that by cooking market structure and doing deals supportive of USD dominance at the expense of its trade partners, it can keep golds price diminished, thus perpetuating the illusion things are just fine. Now, however, a recent inability to keep prices submerged somewhat are a sign of global consensus changing. The US Government knows this and is acting accordingly.

Much more about gold here Several Gold comments/report excerpts coming today.

Cheers

VBL