NS

NSAPAC stocks traded with a mild positive bias after the tech-led rebound stateside; Flash PMIs ahead – Newsquawk Europe Market Open

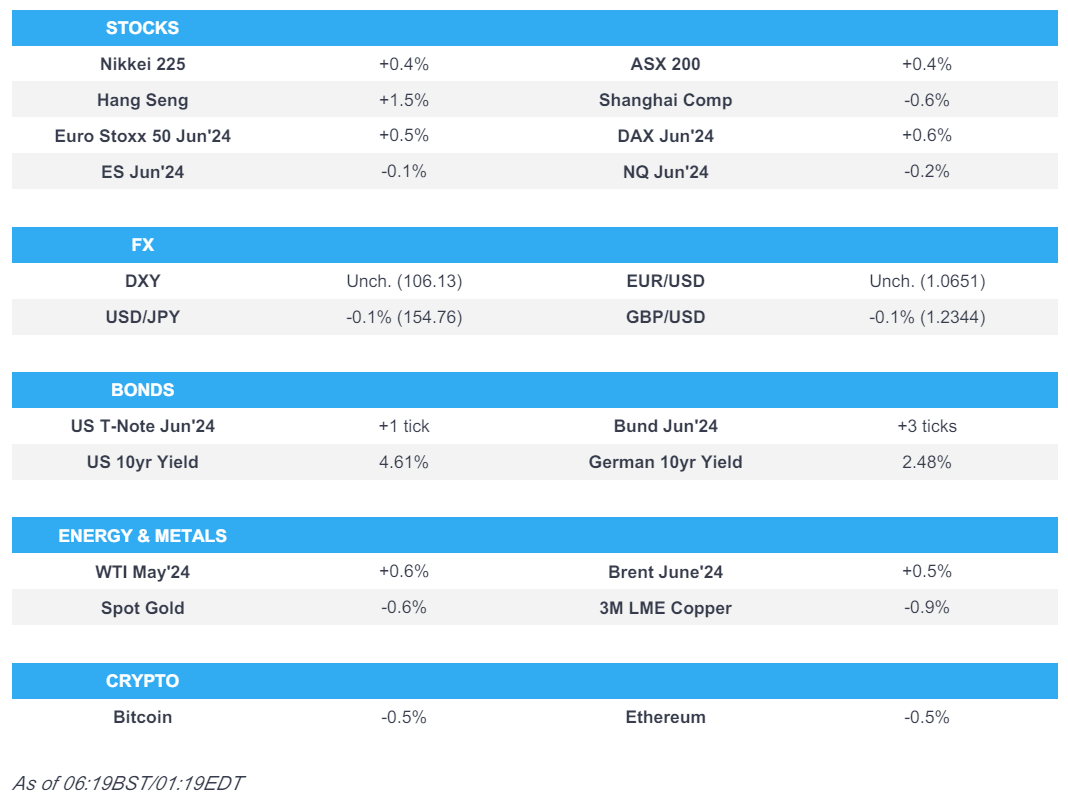

- APAC stocks traded with a mild positive bias after the tech-led rebound stateside.

- European equity futures indicate a higher open with the Euro Stoxx 50 future +0.5% after the cash market closed up 0.4% on Friday.

- DXY is holding above the 106 mark, EUR/USD lingers around 1.0650 and USD/JPY sits near its multi-year high.

- Crude futures edged modest gains in quiet trade, Bund futures took a breather after recently rebounding to above the 131.00 level.

- Looking ahead, highlights include French, EZ, UK, US PMIs, US Richmond Fed Index, Comments from BoE’s Pill & ECB’s Nagel, Supply from Germany, Italy & US

- Earnings from ASM, Kering, Associated British Foods, Novartis, Spotify, General Motors, Philip Morris, PepsiCo, RTX, Fiserv, UPS, Visa, Lockheed Martin & Tesla.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks clawed back some of the prior week's losses with a rebound in Nvidia (NVDA) shares and with semiconductors supportive of the move which resulted in the outperformance of the tech sector. Elsewhere, gold and oil prices were lower following a lack of geopolitical escalation over the weekend which also initially weighed on Treasuries, although T-notes gradually pared the earlier losses and tracked Bunds higher ahead of a plethora of key risk events.

- SPX +0.87% at 5,010, NDX +1.02% at 17,211, DJI +0.67% at 38,240, RUT +1.02% at 1,967

- Click here for a detailed summary.

APAC TRADE

EQUITIES

- APAC stocks traded with a mild positive bias after the tech-led rebound stateside.

- ASX 200 was led by strength in real estate and tech, while the latest flash PMIs from Australia were varied.

- Nikkei 225 traded indecisively and on both sides of 37,500 after briefly wiping out all of its opening gains.

- Hang Seng and Shanghai Comp. were mixed with outperformance in Hong Kong due to tech strength, while the mainland lagged amid the PBoC's continued tepid liquidity operations and with the US drafting sanctions that threaten to cut some Chinese banks off from the global financial system for aiding the Russian war effort.

- US equity futures proceeded sideways with participants awaiting the big tech earnings later this week.

- European equity futures indicate a higher open with the Euro Stoxx 50 future +0.5% after the cash market closed up 0.4% on Friday.

FX

- DXY lacked direction in the absence of any fresh macro drivers and ahead of upcoming key data releases.

- EUR/USD kept afloat but with price action rangebound after yesterday's choppy performance.

- GBP/USD was little changed but off the prior day's lows after finding support at the 1.2300 level.

- USD/JPY retained a firm footing at the 154.00 handle with only brief headwinds from renewed jawboning.

- Antipodeans were varied with slight outperformance in Aussie after AUD/NZD extended above 1.0900.

- PBoC set USD/CNY mid-point at 7.1059 vs exp. 7.2437 (prev. 7.1043).

FIXED INCOME

- 10-year UST futures were rangebound amid the lack of catalysts and ahead of US and German 2-year supply.

- Bund futures took a breather after recently rebounding to above the 131.00 level following dovish ECB rhetoric.

- 10-year JGB futures conformed to the dull mood seen in counterparts with price action also not helped by mixed results at the latest 2-year JGB auction.

COMMODITIES

- Crude futures edged modest gains in quiet trade amid the absence of any energy-specific newsflow.

- Spot gold resumed its recent retreat and briefly breached the USD 2300/oz level to the downside.

- Copper futures were pressured alongside the broad selling across the metals complex.

CRYPTO

- Bitcoin was lacklustre and trickled towards the USD 66,500 level to the downside

NOTABLE ASIA-PAC HEADLINES

- US is reportedly drafting sanctions that threaten to cut some Chinese banks off from the global financial system as it hopes to stop Beijing's commercial support of Russia's military production, according to WSJ.

- BoJ Governor Ueda reiterated that monetary policy will be data dependent and will depend on the economy and inflation, while he said they don't have any pre-set idea on the timing and pace of future rate hikes and if trend inflation accelerates in line with their forecast, they will adjust the degree of monetary support through an interest rate hike. Ueda also stated if their price forecast changes, that will also be a reason to change policy but noted it is hard to say beforehand how long the BoJ should wait in gathering enough data to change policy and would like to leave some scope for adjustment by not pre-committing to a certain policy too much.

- Japanese Finance Minister Suzuki said the government is ready to respond appropriately to excessive FX moves and is closely watching FX moves with a high sense of urgency, while they won't rule out any option and will deal appropriately with excessive FX moves. Suzuki also said he closely communicated with the US and South Korea on forex in Washington and won't deny that last week's discussions in Washington have laid the groundwork for Japan to take appropriate FX action.

DATA RECAP

- Japanese Manufacturing PMI Flash (Apr) 49.9 (Prev. 48.2)

- Japanese Services PMI Flash (Apr) 54.6 (Prev. 54.1)

- Japanese Composite Flash (Apr) 52.6 (Prev. 51.7)

- Australian Manufacturing PMI Flash (Apr) 49.9 (Prev. 47.3)

- Australian Services PMI Flash (Apr) 54.2 (Prev. 54.4)

- Australian Composite PMI Flash (Apr) 53.6 (Prev. 53.3)

GEOPOLITICS

MIDDLE EAST

- Israeli occupation forces reportedly stormed the city of Jericho in the eastern West Bank, while it was also reported that Israeli gunboats targeted the seashores in the city of Khan Younis in the southern Gaza Strip. In relevant news, sirens sounded in the town of Metulla and the Kiryat Shmona area in northern Israel on suspicion of rocket fire, according to Al Jazeera.

- Hezbollah fired dozens of rockets into northern Israel on Monday which drew retaliatory strikes, while it said its attack was in response to recent Israeli strikes on towns and villages in southern Lebanon, according to Associated Press.

- Israeli raids were reported on the town of Yaroun in southern Lebanon, according to Al Jazeera.

- European Commissioner said they are ready to increase support to the Lebanese Armed Forces in order to promote stability, according to Al Arabiya.

- Hamas said it condemns the statements of US Secretary of State Blinken and his attempt to hold the group responsible for obstructing reaching an agreement, according to Sky News Arabia. Hamas said Blinken's statements contradict the fact that the movement has provided flexibility more than once to facilitate an agreement, while it added that the movement's demands are a permanent ceasefire, the withdrawal of the occupation and the return of the displaced to their homes in all areas of the Gaza Strip.

- US defence official said the Al-Asad airbase in Iraq came under attack from an Iranian proxy group today which is the second attack on a US base in two days, according to Fox.

OTHER

- US President Biden told Ukrainian President Zelensky that US aid will come as the Senate passes the supplemental spending bill and he signs it into law.

- UK PM Sunak is to unveil an extra GBP 500mln of military funding to Ukraine and announce the largest supply of munitions to Kyiv on Tuesday as he travels to Poland and Germany, according to FT.

- North Korean state media reported that leader Kim guided the first nuclear counterstrike drills, while it stated that the drills are a clear warning sign to enemies.

EU/UK

NOTABLE HEADLINES

- Italy's Economy Minister expects a gradual easing in monetary policy, likely to take place in the second part of this year.