Given the timing...

Ethereum co-founder Joseph Lubin says the SEC is engaging in strategic enforcement action instead of meaningful discourse with the cryptocurrency industry.

"How do we even know who they are?"

"This virus, like all viruses, is mutating. We need to continue to prepare for the possibility that it might jump to humans..."

"TAMARACK data was notable for its meaningfully deteriorated safety profile..."

Some Republicans have deemed all of the protests 'antisemitic & pro-Hamas'...

"Officials are particularly focused on electric vehicles, and they are expected..."

Still, "it's likely that inflated cocoa prices will stick around..."

The problem is we have an insurance system that is a massive bureaucracy...

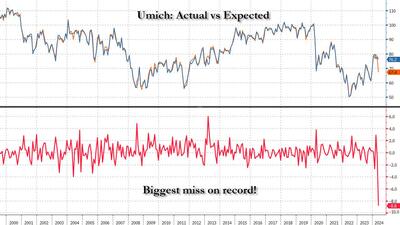

The economic collapse meant to greenlight rate cuts is coming right on schedule.

Despite a growing firestorm of criticism, the author went ahead with her tour, sitting down on Sunday with Margaret Brennan of CBS News.

‘A vote for Trump is a vote for yourself,’ the iconic boxing promoter has said.

“A rally of the laggards is our key allocation call, and so far, we’re witnessing signs that it’s happening. The market needs to maintain a delicate balance — a sweet spot where the job market remains mildly soft and earnings growth continues.”

United Airlines Boeing 737 Makes Emergency Return To Japanese Airport After Wing Flap "Irregularity"

Another day, another issue with Boeing planes.

“People are using gold as an ATM they never had...”

...the idea of investing in or owning bitcoin can evoke reactions from skepticism to disbelief. If you look beyond the popular narratives, however, you might find there is more to the story than first impressions suggest.

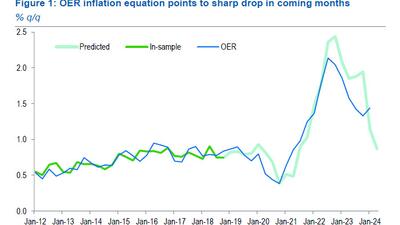

"when we looked closely at shelter costs, particularly at the owner equivalent rent (OER) component, we found reason for optimism that shelter inflation could fall soon and bring down core inflation."