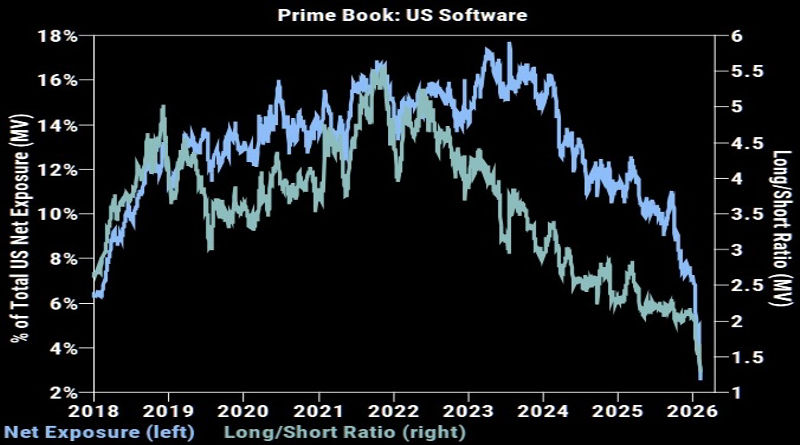

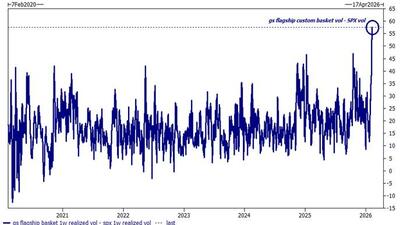

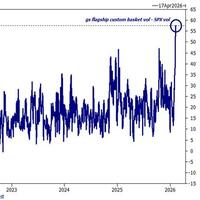

This past week's selloff exposed how much of the market's recent support was transient...

Democrats have a list of 10 'non-negotiable' reforms...

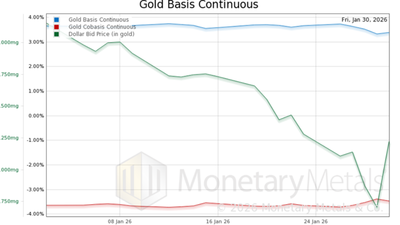

What really drove gold’s violent January reversal

Sponsored Content By Monetary Metals

Sponsored Content By Monetary Metals

“These [alleged] ties could pose a national security threat, potentially jeopardizing key military, intelligence, and civilian infrastructure,”

"In practice, the opposite is happening..."

Estimate your earnings

oz

Calculate earnings

These speculative narratives are classic hallmarks of a mania: the story, not the data, becomes the primary driver of price...

"Criminals will continue to ignore the law, as they always have..."

"You will run out of fuel long before you will outrun us."

The end-game of debt-debasement is already visible. The only thing that's still up in the air is our response...

In an age of rage, it is often difficult to stand out in the mob as so many pander to the perpetually irate...

...there is no respite to the sensory overload...

"KD was a disaster, with a miss-and-cut report, several mgmt. changes, and a delayed 10Q filing."

The question is whether the Clintons are again gaming the system after avoiding a bipartisan vote to hold them in contempt...

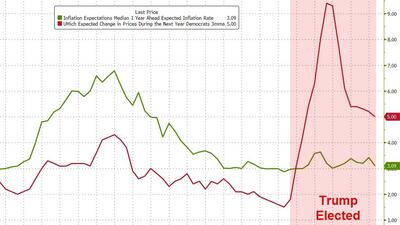

...our macro models suggest that equity valuations are higher than the macro backdrop would normally justify.

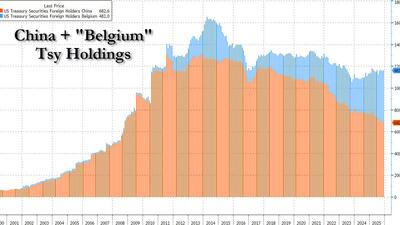

“what is left for the banks is small, and China doesn’t exactly set the Treasury market on fire at the monthly auctions.”

The pattern of freer trade for friends and restricted trade elsewhere is a template that is now being repeated globally as the world coalesces into interest blocs with geopolitical hedgerows erected in between...