Thousands of miles from the border, red states are taking matters into their own hands as the border crisis persists...

They are trained to "rise up, to revolution."

In the alternative, he's in New York City today, although probably doesn't know it, and so am I

2020s era of big government intervention: Main Street says "why save?" Wall Street says "why short?"

Internal US govt assessment determined that 3 IDF battalions committed "gross human rights violations"...

Unlike the J-6-21 “paraders,” locked up in the putrid DC jail for years pending trial, the Hamas frolickers are at near-zilch risk of any serious consequences...

It's that time of year again and US bank deposits sure showed it...

Some aviation experts argue the FAA’s focus on 'diversity' instead of 'merit' in hiring pilots and controllers is leading to serious safety concerns...

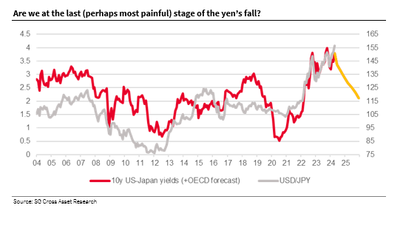

We are at the last - and most painful - stage of the yen's fall.

"Let me repeat, there will never be encampments on the streets of New York City while we’re in power," Chief of Patrol John Chell said...

...rate-cut expectations tumble, but earnings lead stocks higher...

It's time for the Quarterly Refunding Announcement shocker again.

“There is no case here. This is just a political witch hunt,”

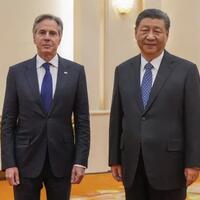

"Russia would struggle to sustain its assault on Ukraine without China’s support," Blinken claimed.

...the ever-increasing optics of the merger “alignment” of the Fed with the Treasury make next week's QRA so crucial.

... 'party of science' has decided to abandon its plan to save millions of lives (of mostly African American youth)

"While this is a significant achievement, we have a long way to go..."