...there is no respite to the sensory overload...

"The NFL having a Super Bowl Halftime Show where their performer sings ENTIRELY in Spanish & waves other nation's flags..."

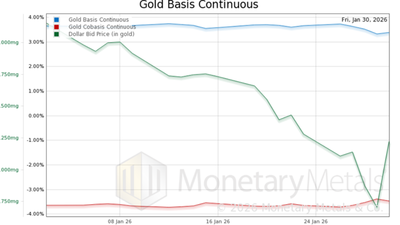

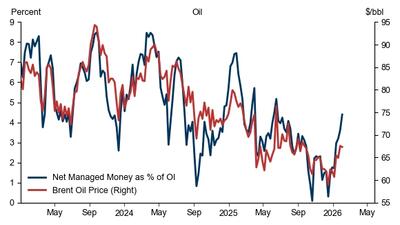

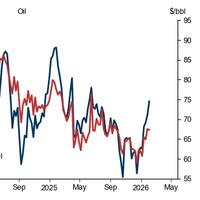

What really drove gold’s violent January reversal

Sponsored Content By Monetary Metals

Sponsored Content By Monetary Metals

"Democratic Socialists of America has been engaging in a dynamic called "narrative convergence," advancing narratives that stoke domestic unrest..."

Different dynamics are aligning now, forces better structured to the survival of our nation...

Estimate your earnings

oz

Calculate earnings

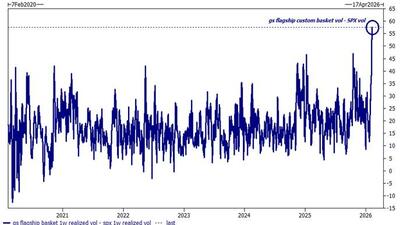

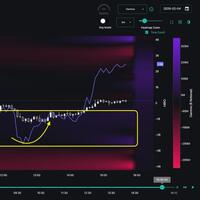

Really, it all just felt like an extension of Friday's squeeze (rather than a new dawn)...

Cuba tells airlines jet fuel supplies are suspended for a month...

The agency is funding research that officials say will determine autism causes...

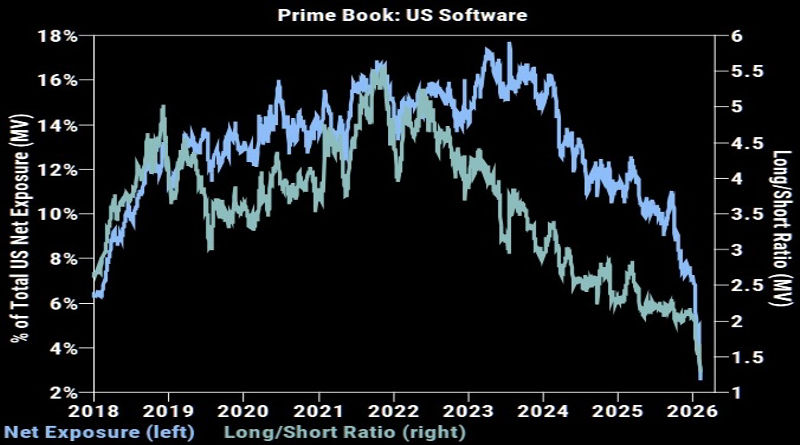

...the investor rotation in hard assets can keep several metals prices high for longer, including above what physical fundamentals justify...

“These [alleged] ties could pose a national security threat, potentially jeopardizing key military, intelligence, and civilian infrastructure,”

"In practice, the opposite is happening..."

These speculative narratives are classic hallmarks of a mania: the story, not the data, becomes the primary driver of price...

"Criminals will continue to ignore the law, as they always have..."

This past week's selloff exposed how much of the market's recent support was transient...

"You will run out of fuel long before you will outrun us."

The end-game of debt-debasement is already visible. The only thing that's still up in the air is our response...