This past week's selloff exposed how much of the market's recent support was transient...

Democrats have a list of 10 'non-negotiable' reforms...

In an age of rage, it is often difficult to stand out in the mob as so many pander to the perpetually irate...

...there is no respite to the sensory overload...

Estimate your earnings

oz

Calculate earnings

"KD was a disaster, with a miss-and-cut report, several mgmt. changes, and a delayed 10Q filing."

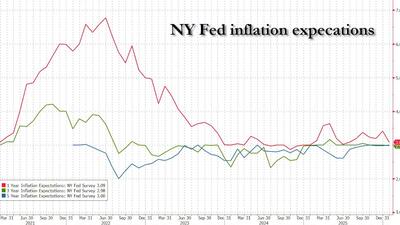

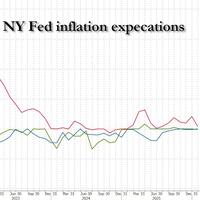

...uncertainty expressed regarding future inflation outcomes - decreased

The question is whether the Clintons are again gaming the system after avoiding a bipartisan vote to hold them in contempt...

...our macro models suggest that equity valuations are higher than the macro backdrop would normally justify.

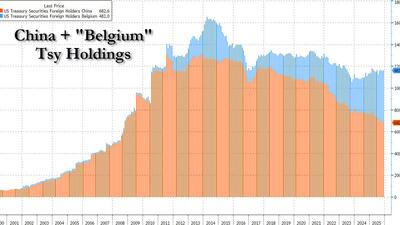

“what is left for the banks is small, and China doesn’t exactly set the Treasury market on fire at the monthly auctions.”

The pattern of freer trade for friends and restricted trade elsewhere is a template that is now being repeated globally as the world coalesces into interest blocs with geopolitical hedgerows erected in between...

"It's like watching a fatal car crash in slow motion..."

...market turmoil sparks rumors.

...and it argues for running a bit smaller until technicals rebuild – better liquidity, less crowded shorts, more balanced positioning.

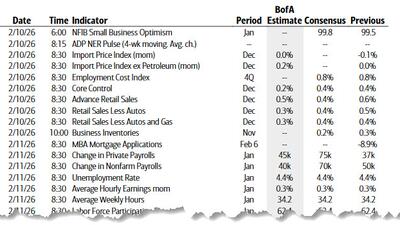

The next five days will feature an unusual pairing of major US data releases: the January employment report on Wednesday and the January CPI report on Friday, two reports which usually never appear in the same week

Navy issues photo set of A-10 Thunderbolt doing strafing runs...

"Once again, Big Pharma is weaponizing the US..."

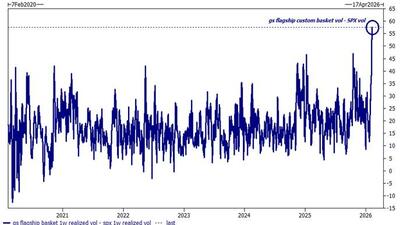

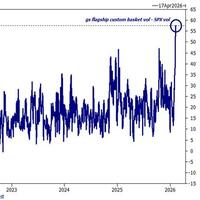

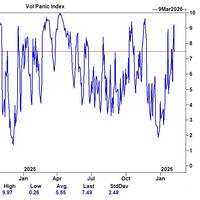

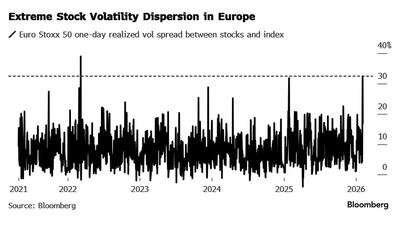

European equities experienced one of the highest dispersion sessions in years last week: The gap between the weighted average realized volatility of Euro Stoxx 50 Index constituents and the gauge itself spiked above 30 points, the second-largest gap since 2009.