They are trained to "rise up, to revolution."

It's time for the Quarterly Refunding Announcement shocker again.

... 'party of science' has decided to abandon its plan to save millions of lives (of mostly African American youth)

"While this is a significant achievement, we have a long way to go..."

The 3rd senior level State Dept official to step down in protest...

Egyptian delegation pitches "new vision" for prolonged ceasefire...

Alvin Bragg is the reason Presidents must have some immunity...

Hospitalized after car flipped on busy road...

Thousands of miles from the border, red states are taking matters into their own hands as the border crisis persists...

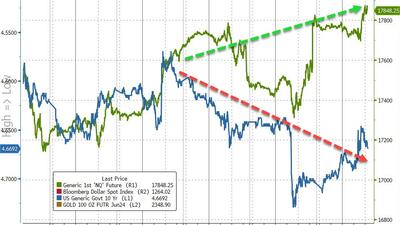

"...my instinct is equity people should be tapping the brakes, while macro people should be pressing the gas..."

Regulators have refused to disclose key details about the tested samples...

In case you needed proof the market is stupid, we present Exhibit A.

Nightmare repeats for USC class of '24 -- whose high school graduations were nixed over Covid

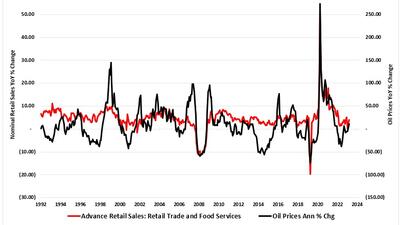

...remain cautious about economic exuberance. Those forecasts are often disappointing...

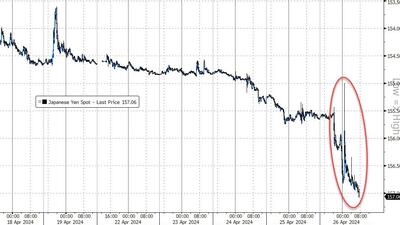

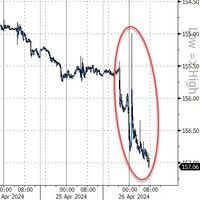

...finally marks the day where the market realizes that Japan is following a policy of benign neglect for the yen.

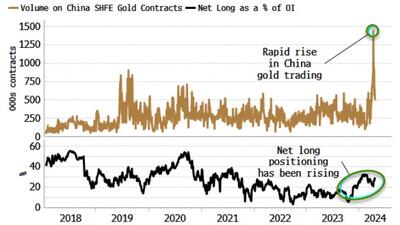

...activity in commodities has prompted conjecture that China is about to orchestrate a significant one-off yuan devaluation.

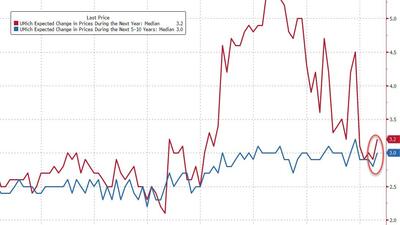

About 38% of consumers reported that high prices were weighing down their living standards, up from 33% who said so last month...

There seems to be an enormous disconnect between what is actually happening in the real economy and the economic narrative that they are constantly pushing.

"The BHP proposal is opportunistic and fails to value Anglo American's prospects..."

The LGBT Equality Index ranks Palestine as 192nd worst out of 197 countries...