Democrats have a list of 10 'non-negotiable' reforms...

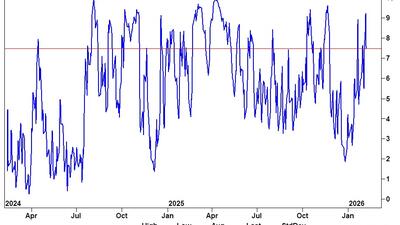

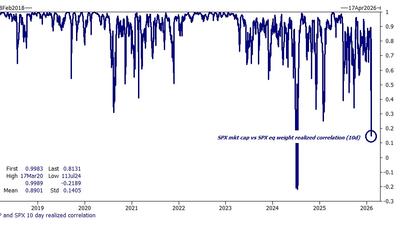

...and it argues for running a bit smaller until technicals rebuild – better liquidity, less crowded shorts, more balanced positioning.

"Once again, Big Pharma is weaponizing the US..."

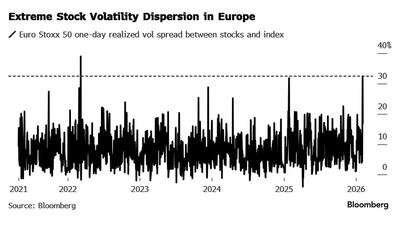

European equities experienced one of the highest dispersion sessions in years last week: The gap between the weighted average realized volatility of Euro Stoxx 50 Index constituents and the gauge itself spiked above 30 points, the second-largest gap since 2009.

Estimate your earnings

oz

Calculate earnings

“These moves also make people say, ‘Let me be a little bit more cautious than I had been” and wait for a better opportunity"

Radical leftist ramps up obstruction efforts amid Trump’s deportation push...

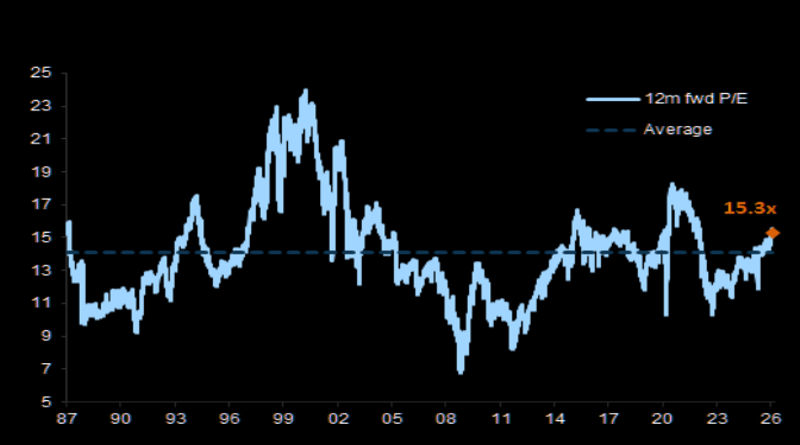

...top Goldman trader suggests this feels like a classic “what would Warren Buffett buy” market.

Automotive giant Stellantis is reporting multi-billion-euro write-downs for the second half of 2025. At the same time, management announces a strategic return to traditional internal combustion engines and a stronger focus on hybrid powertrains.

"The NFL having a Super Bowl Halftime Show where their performer sings ENTIRELY in Spanish & waves other nation's flags..."

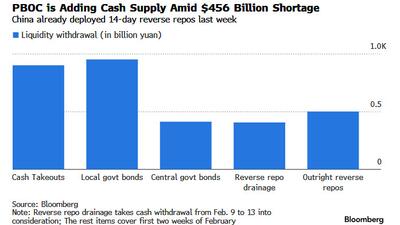

The People’s Bank of China is boosting the supply of money available to banks to ensure they can meet the surge in demand for cash during the Lunar New Year holidays.

"That gives us confidence that we can lean into that group in a more meaningful way, whether ..."

Taking advantage of cheaper energy and less restrictive regulations, Chinese producers are aggressively entering the European market, from fertilizers to plastics...