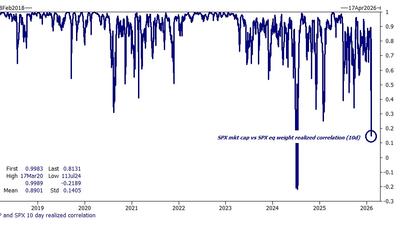

This past week's selloff exposed how much of the market's recent support was transient...

Democrats have a list of 10 'non-negotiable' reforms...

The pattern of freer trade for friends and restricted trade elsewhere is a template that is now being repeated globally as the world coalesces into interest blocs with geopolitical hedgerows erected in between...

"It's like watching a fatal car crash in slow motion..."

Estimate your earnings

oz

Calculate earnings

...market turmoil sparks rumors.

...and it argues for running a bit smaller until technicals rebuild – better liquidity, less crowded shorts, more balanced positioning.

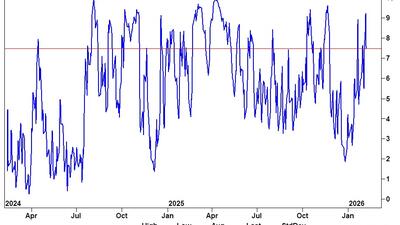

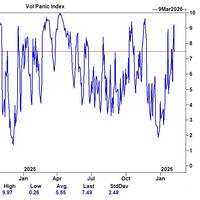

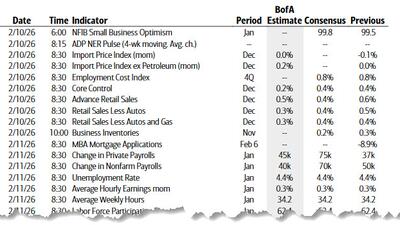

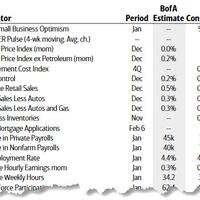

The next five days will feature an unusual pairing of major US data releases: the January employment report on Wednesday and the January CPI report on Friday, two reports which usually never appear in the same week

Navy issues photo set of A-10 Thunderbolt doing strafing runs...

"Once again, Big Pharma is weaponizing the US..."

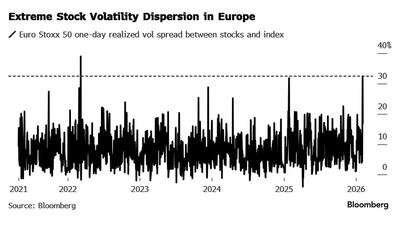

European equities experienced one of the highest dispersion sessions in years last week: The gap between the weighted average realized volatility of Euro Stoxx 50 Index constituents and the gauge itself spiked above 30 points, the second-largest gap since 2009.

“These moves also make people say, ‘Let me be a little bit more cautious than I had been” and wait for a better opportunity"

Radical leftist ramps up obstruction efforts amid Trump’s deportation push...

...top Goldman trader suggests this feels like a classic “what would Warren Buffett buy” market.

Automotive giant Stellantis is reporting multi-billion-euro write-downs for the second half of 2025. At the same time, management announces a strategic return to traditional internal combustion engines and a stronger focus on hybrid powertrains.

"The NFL having a Super Bowl Halftime Show where their performer sings ENTIRELY in Spanish & waves other nation's flags..."