Dow record high, gold green on the week, tech wrecked but S&P unch, crypto dump-and-pump...

Unchecked immigration policies have opened the floodgates for criminal networks to bleed taxpayers dry...

"We note that these pushbacks mostly originated from local communities with little exposure to data centers. In such cases, we expect proposed data centers to relocate..."

Minority Shia communities repeatedly targeted in sectarian violence...

"Bitcoin is crashing so I have to say bye to the love of my life..."

Estimate your earnings

oz

Calculate earnings

The latest announcement from the People's Bank of China follows months of flip-flopping on privately issued yuan-pegged stablecoins.

"We created a dollar shortage in the country. It came to a swift conclusion."

The governor aims to spend his political capital to see guardrails put on the pervasive and rapidly expanding tech before leaving office in a year.

Tlaib's campaign and leadership PAC funneled nearly $600,000 to Unbought Power...

Fresh off federal arrest for storming a Minnesota church, ex-CNN host unleashes on VP...

The same person connected to an illegal biolab shut down in Reedley, California, in 2023.

....without "interference in our internal affairs."

Just a little PSA for the folks who are clearly confused...

“Humans are not just labor units..."

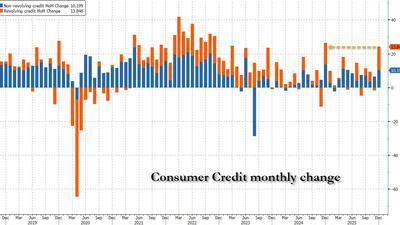

Meanwhhile, the average credit card APR has gone up in the past 2.5 years despite 1.75% in rate cuts by the Fed.

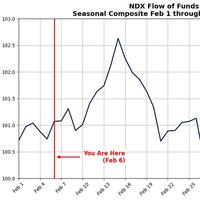

"This week’s tape can only be categorized as adult swim... and then some..."

Jackson's actions raise genuine concerns about impartiality...