Democrats have a list of 10 'non-negotiable' reforms...

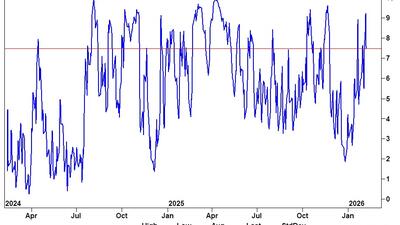

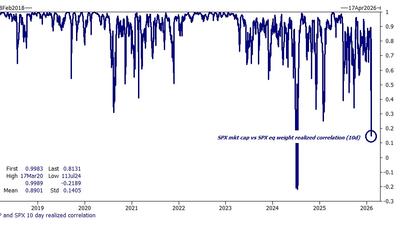

...and it argues for running a bit smaller until technicals rebuild – better liquidity, less crowded shorts, more balanced positioning.

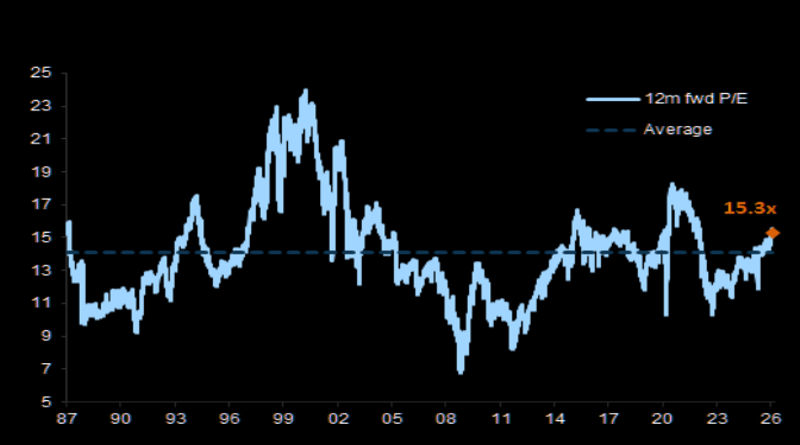

...top Goldman trader suggests this feels like a classic “what would Warren Buffett buy” market.

"The NFL having a Super Bowl Halftime Show where their performer sings ENTIRELY in Spanish & waves other nation's flags..."

Estimate your earnings

oz

Calculate earnings

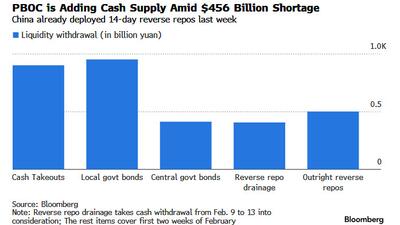

The People’s Bank of China is boosting the supply of money available to banks to ensure they can meet the surge in demand for cash during the Lunar New Year holidays.

"That gives us confidence that we can lean into that group in a more meaningful way, whether ..."

Taking advantage of cheaper energy and less restrictive regulations, Chinese producers are aggressively entering the European market, from fertilizers to plastics...

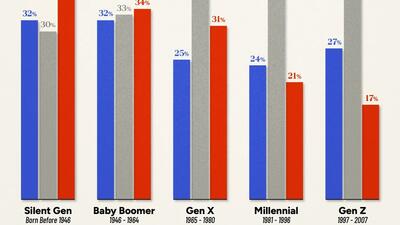

More than half of Gen Z and Millennials identify as politically independent...

It is obvious to everyone that the objective is to silence independent media...

"Our engineers made one final push to test the limits of full-body control and mobility..."

In Groß-Gerau, Hesse, a billion-euro project has been blocked by citizen opposition and the local council’s majority. The town now seems the epitome of Germany’s decline: backward-looking, stubborn, and hopelessly lost in an era that leaves no room for passive solipsism.

"We find ourselves in a world that, to a large extent, is morally, cognitively, and spiritually already collapsing..."

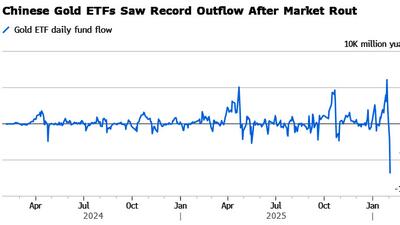

China’s four largest gold-backed exchange-traded funds posted record outflows — about 6.8 billion yuan ($980 million) on Tuesday — just days after they notched record inflows.