Law enforcement has uncovered these previously inaccessible new images showing an armed individual...

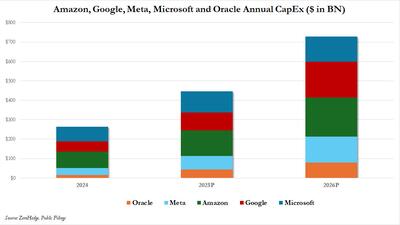

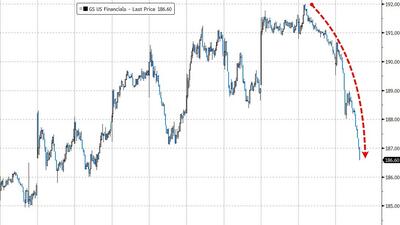

"This is a major transition, and a critical one when thinking about potential risk and return for corporate bonds in the US..."

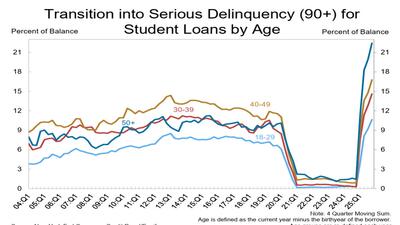

US Consumer Debt Delinquencies Soar To Highest Since 2017 While Office Delinquencies Hit Record High

“Delinquency rates for mortgages are near historically normal levels, but the deterioration is concentrated in lower-income areas and in areas with declining home prices.”

Instead of raw acceleration, AI development should focus on systems that “foster human freedom and empowerment” and ensure “the world does not blow up"...

“I represent a working-class district in Orange County, and constant utility rate increases mean incessant pressure for constituents to make ends meet..."

Estimate your earnings

oz

Calculate earnings

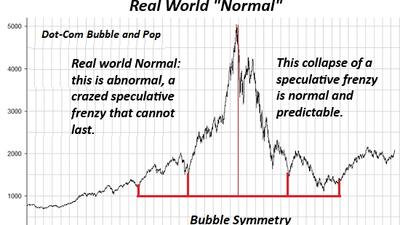

This isn't "Capitalism", it's Model Collapse ushering in the inevitable conflagration...

"We see the strongest momentum for ROST and TJX into F4Q results."

Fetterman rejected comparisons of the SAVE America Act to resurrecting Jim Crow laws...

"...anxiety around AI-headline risk seems to be at a maximum (Inbounds are high)."

Neville Roy Singham nonprofit network...

“We believe such worries are overdone, and that the rally in gold will resume...”

A curious dynamic is emerging under the surface.

"In Anchorage, we accepted the United States' proposal..."

...one of the more aggressive episodes of retail dip-buying in tech, and especially software, that we've observed...

'Woefully inadequate...'

The key signal for those who called Warsh a ‘hawk’ is that the Fed is going to run the economy hot...

Most names in the space slumped following reports from Reinsurance News and others that OpenAI approved the first AI insurance app on ChatGPT, built by Spanish digital insurer Tuio.

Once again, the pattern is familiar: raise taxes in California, and watch the private jets head east.

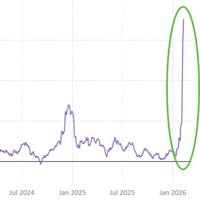

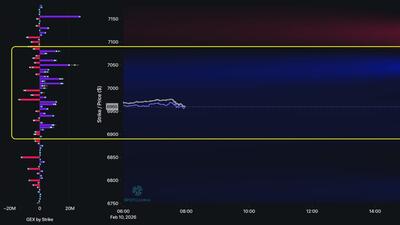

...6,950 is the risk pivot for the S&P