Really, it all just felt like an extension of Friday's squeeze (rather than a new dawn)...

"The NFL having a Super Bowl Halftime Show where their performer sings ENTIRELY in Spanish & waves other nation's flags..."

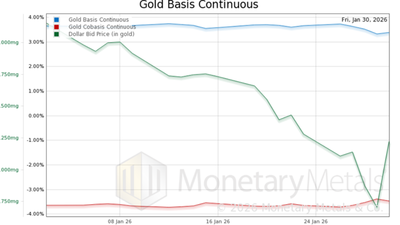

What really drove gold’s violent January reversal

Sponsored Content By Monetary Metals

Sponsored Content By Monetary Metals

The spot, which ran right after Bad Bunny’s halftime performance... dared to portray ICE agents as friends, neighbors, fathers, veterans...

A recent City Hall report suggests most of the money supports short-term services that manage homelessness rather than resolve it.

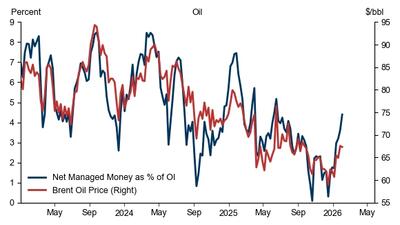

Wall Street–style liquidity is reportedly moving into prediction markets, signaling a shift toward deeper markets, higher volumes and greater institutional participation...

Estimate your earnings

oz

Calculate earnings

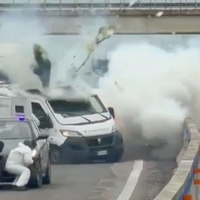

" ... where an armed commando attacked an armoured cash-in-transit van."

...with many more expected in the days to come...

"Democratic Socialists of America has been engaging in a dynamic called "narrative convergence," advancing narratives that stoke domestic unrest..."

Different dynamics are aligning now, forces better structured to the survival of our nation...

Cuba tells airlines jet fuel supplies are suspended for a month...

The agency is funding research that officials say will determine autism causes...

...the investor rotation in hard assets can keep several metals prices high for longer, including above what physical fundamentals justify...

“These [alleged] ties could pose a national security threat, potentially jeopardizing key military, intelligence, and civilian infrastructure,”

"In practice, the opposite is happening..."

These speculative narratives are classic hallmarks of a mania: the story, not the data, becomes the primary driver of price...