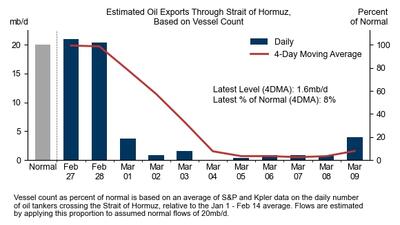

...because of risks of a delay to our assumption of a gradual 28-day normalization in Strait of Hormuz (SoH) flows from this week onwards.

Hegseth vows in fresh briefing to "permanently deny Iran nuclear weapons forever."

"This is in the heart of Toronto."

The wiring issue is yet another manufacturing setback...

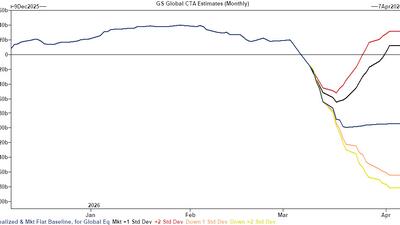

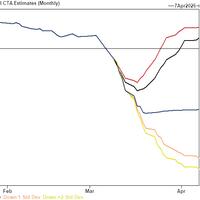

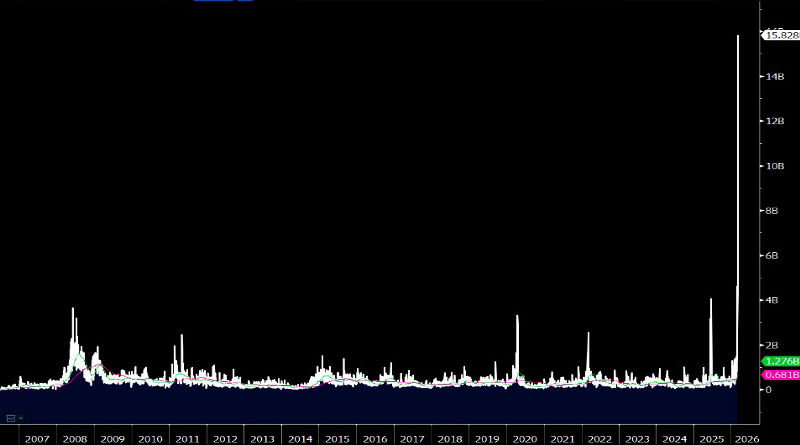

Some of the world’s biggest multi-strat hedge funds like Millennium, Poin72 and Balyasny suffered hundreds of millions of dollars in losses last week after the war against Iran sent oil prices surging and triggered wild market moves.

Archer and Joby take their legal battle to another level...

"...to assess the current security of supply and market conditions to inform a subsequent decision on whether to make emergency stocks of IEA countries available to the market." - IEA

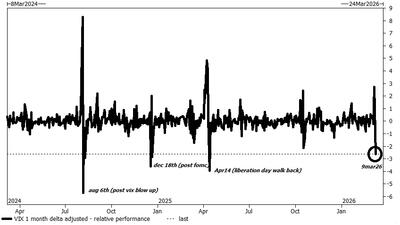

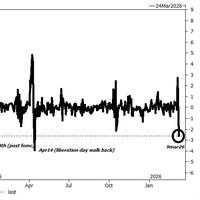

...gamma is quite negative across the entire spectrum of SPX prices, which backs the idea that high volatility should continue.

...agents seized $1.3 million in cash, a 2021 Rolls Royce Cullinan, a 2021 Chevrolet Corvette, and a 2020 Chevrolet Silverado.

“Housing affordability is improving, and consumers are responding,”

The suspects arrested allegedly believed they were communicating with underage victims...

"Sell estimates over the next week are some of the largest we have seen" - Goldman

"The Texas Redomiciliation may reduce the risk of future frivolous litigation against the Texas Corporation and its directors and officers."

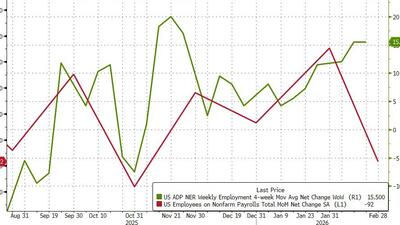

...according to ADP, private employers added the most jobs last week since Thanksgiving.

“The war in Iran is not over and can intensify again at any moment. Any gains will remain limited until there are clear signs of an end to hostilities in the Gulf and shipping through the Strait of Hormuz improves again.”

Markets create outcomes, not the other way around...

Activists’ ‘solidarity’ stunt backfires...

Trade flows show China is becoming less reliant on the US market... builds 120-day oil 'shock shield'