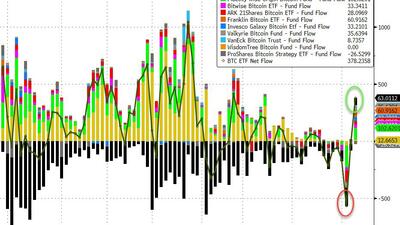

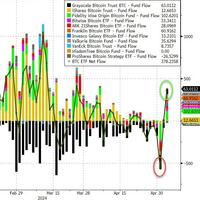

"Bitcoin peaked on the day when market flipped from pricing in more cuts to less cuts than the Fed... the good news is that “tail risks” of Fed hike & JPY collapse now lower after Fed “eased” (less QT) & Japan spent $55bn to support FX."

"The loss of specific document locations is a destruction of exculpatory evidence..."

Former MI6 spy writes that "Positioning scarce air defense ‘to save Israel’ therefore, exposes Ukraine (and slows the US pivot to China, too)."

"This is not going to stop. It’s going to keep on going..."

Or else, is the Kremlin establishing a legal ground for arresting him in some future scenario?

Six health care workers reported suffering negative adverse effects after previously taking COVID-19 shots in the report...

“Live in your Libertarian cave! That’s not the world we live in...”

Supporters say the bill addresses historical injustices and is no more discriminatory than giving preferences to veterans...

"That's what you get for buying meat at Walmart."

"A single data center typically had a demand of 30 megawatts or greater. However, we're now receiving individual requests for demand of 60 to 90 megawatts or greater, and it hasn't stopped there."

Israel gives Hamas leadership one week to accept hostage deal...

"It's never declining. The chart's not ever decreasing. It only goes one way. Bitcoin is a capital ratchet. It's a one-way ratchet..."

Inflation is not a coincidence or a fatality; it is a policy...

A key task involves military divers working underneath the pier to ensure all the parts are secured & stable.

Nancy Pelosi, John Kerry, Al Gore, Michael Bloomberg, and Rep. Jim Clyburn...

"OR does this mean the hotel is used to house illegal aliens invading our border?"

But wrangling over details could blow up the deal at finish line...

"Many people thought we… wouldn’t need to prepare such lines. They didn’t expect a new Russian offensive."