...watch the fwd P/E multiple of the NDX relatively closely.

...alarming running tally since mid-January...

In Groß-Gerau, Hesse, a billion-euro project has been blocked by citizen opposition and the local council’s majority. The town now seems the epitome of Germany’s decline: backward-looking, stubborn, and hopelessly lost in an era that leaves no room for passive solipsism.

"We find ourselves in a world that, to a large extent, is morally, cognitively, and spiritually already collapsing..."

Estimate your earnings

oz

Calculate earnings

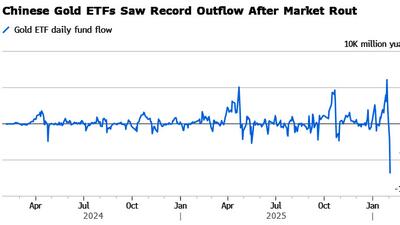

China’s four largest gold-backed exchange-traded funds posted record outflows — about 6.8 billion yuan ($980 million) on Tuesday — just days after they notched record inflows.

Under Trump, the US has taken equity stakes in Lithium Americas, MP Materials, Vulcan Elements, Intel, Westinghouse, US Steel, and entered profit sharing agreements with Nvidia and AMD. It has announced Project Vault, a strategic mineral stockpile and much more.

Years of insufficient enforcement...

...letting the New START lapse...could be exploited by European and East Asian countries to develop their own nukes, thus emboldening some Muslim ones to follow suit.

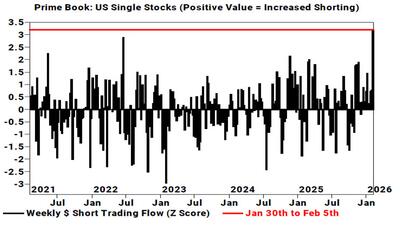

...and it argues for running a bit smaller until technicals rebuild – better liquidity, less crowded shorts, more balanced positioning.

Progressivism is a utopian philosophy of governance that will never find nor create its utopia...

"This week’s notional short selling in US Single Stocks was the largest on our record" - Goldman Prime Brokerage

President Donald Trump says restoring commercial fishing is in the public interest and cites existing federal laws as sufficient protections of the monument.

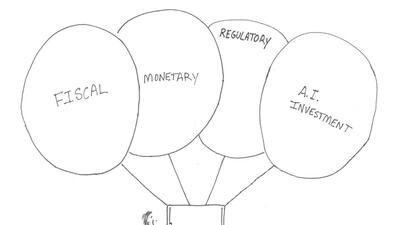

"Trump aggressive intervention to reduce price of energy, healthcare, credit, housing, electricity via Big Oil, Big Pharma, Big Banks, Big Tech means small & mid-cap best play for "boom" on Main St in run-up to US midterms" - Michael Hartnett, BofA

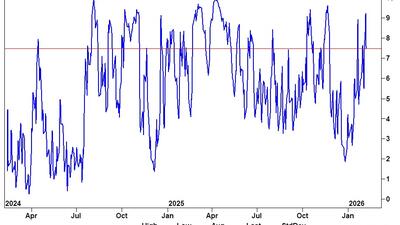

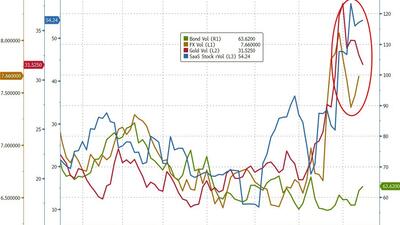

Despite a noisy and volatile start to 2026, with big swings in everything from JGBs to software, it is very much what's happening below the surface.

Health care spending has reached new heights and continues to grow as a share of the U.S. economy, placing an increasing burden on consumers...

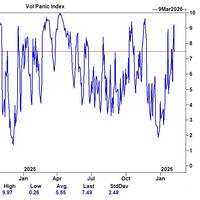

Cross-asset vol has surged... but rate vol has remained relatively contained, largely because the macro outlook hasn’t really changed...

Many were arrested for crimes such as homicides, assaults, sexual predatory offenses, and dangerous drug offenses...

"A big piece of why we think Super Bowl handle will be down is that prediction markets are taking a bite out of that,"