NS

NSUS equity futures modestly firmer, JPY bid amid suspected intervention, Bonds benefit from Spanish/German CPIs - Newsquawk US Market Open

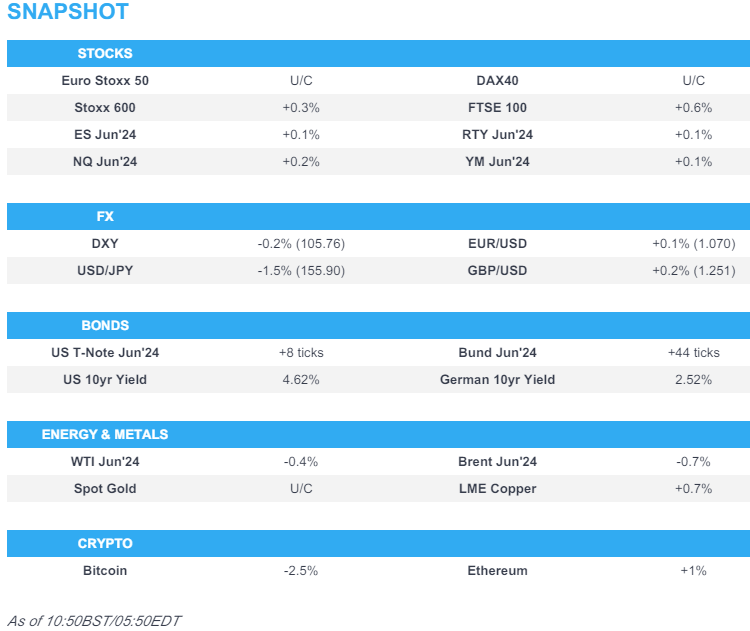

- European bourses were initially firmer, though have since dipped lower; US futures remain modestly in the green

- Dollar is softer amid hefty USD/JPY selling; the pair rose to 160.00 before sharp downticks with intervention suspected

- Bonds are firmer benefiting from dovish Spanish/German inflation metrics

- Crude is softer as Israel-Gaza truce talks continue; XAU flat and base metals mixed

- Looking ahead, German CPI, EZ Sentiment, US Dallas Fed Manufacturing Index, Comments from ECB’s de Guindos, US Quarterly Refunding Estimates, Earnings from NXP Semiconductors, Welltower & Paramount

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx600 (+0.3%) are almost entirely in the green, taking the lead from a positive APAC session overnight. Trade has been rangebound since the open, though has just been coming off best levels in recent trade.

- Basic Resources is found towards the top of the pile, benefiting from modestly firmer base metal prices and after further takeover reports regarding BHP/Anglo American. Retail marginally underperforms.

- US Equity Futures (ES +0.2%, NQ +0.3%, RTY +0.3%) are entirely in the green, posting modest gains in tandem with European peers. In terms of pre-market movers; Apple (+1.5%) gains on reports that it has resumed talks with OpenAI. And Tesla (+6.5%) benefits from news that the Co. has received tentative approval for its self-driving service.

- Click here and here for the sessions European pre-market equity newsflow, including notable earnings/updates from:

- Click here for more details.

FX

- USD is softer vs. peers in the wake of aggressive USD/JPY selling overnight and into the European morning. From a technical perspective, DXY has been as low as 105.46 but is respecting Friday's 105.41 base.

- JPY was volatile overnight and initially surged above 160.00 with no obvious catalysts and with Japanese participants away from the market. The pair later saw a sharper drop and breached 156.00 to the downside in the absence of any obvious drivers; some have speculated potential intervention. Since, USD/JPY has continued to bleed, going as low as 154.54 (currently 155.80).

- EUR is firmer vs. USD (as is the case for all major peers). Focus in the Eurozone today is on the German national CPI at 13:00BST, with regional releases thus far broadly showing increases on a M/M and Y/Y basis, though initial reaction dovish as the core numbers continue to moderate. 1.0733 is the high thus far and yet to approach Friday's best of 1.0753.

- Antipodeans are benefitting from the broadly softer USD. AUD/USD is now up for a 6th consecutive session with focus on a test of 0.66 after printing a session high of 0.6586.

- Japan's Top currency diplomat Kanda said will not comment now, when asked about whether Japan intervened in the currency market.

- PBoC set USD/CNY mid-point at 7.1066 vs exp. 7.2759 (prev. 7.1056).

- Click here for more details.

- Click here for OpEx for today's NY Cut

FIXED INCOME

- USTs are bid with specifics light so far and direction drawn from EGB action after the regions core inflation numbers from Spain & German. Currently at the top-end of a 107-18+ to 107-27+ range with the 10yr yield below 4.65% but in familiar ranges.

- Bunds are firmer with markets focussing on the continued moderation in core Spanish and German state CPI into the 13:00BST nationwide German number. Bunds peaked at 130.87 having pared knee-jerk pressure of around 20 ticks on the German headline numbers; now off best levels.

- Gilts are a touch firmer but yet to move significantly from the unchanged mark in a narrow circa-20 tick range with specifics light and direction for today and this week broadly likely to come from European and US events. Currently at 96.25 shy of Friday's 96.33 best and then 96.67 from Wednesday thereafter.

- Italy sells EUR 6.75bln vs exp. EUR 5.75-6.75bln 3.35% 2029, 3.85% 2034 BTP and EUR 3.5bln vs exp. EUR 3-3.5bln CCTeu.

- EU sells EUR vs exp. EUR 2.5bln 3.125% 2028 and EUR 2.5bln 2.75% 2033 EU Bond.

- Click here for more details.

COMMODITIES

- A subdued day for the crude complex despite the weaker Dollar, but amid the lack of geopolitical escalation over the weekend and amid more sanguine atmosphere surrounding the latest Israel-Gaza ceasefire talks. Brent counterpart slipped from USD 89.25/bbl to USD 88.43/bbl.

- Mixed trade across precious metals with only spot silver benefiting from the slide in the Dollar, whilst spot gold sees its upside capped by the lack of geopolitical escalation and ahead of FOMC later this week. XAU clambered off its USD 2,319.84/oz intraday low but is yet to reach highs seen on Friday at USD 2,352.64/oz.

- Base metals are mixed with some of the market benefiting from the softer Dollar, albeit modestly; 3M LME copper trades on either side of USD 10,000/t.

- TotalEnergies (TTE FP) CEO said the Co. is expected to complete the first phase of the solar power project in Iraq within the next year, while the Co. is to complete the first stage of utilising the by-produced gas from Iraq’s project during 2025 with a production capacity of 50mln cubic feet, according to Reuters.

- Turkey is in talks with ExxonMobil (XOM) over a multi-billion dollar LNG deal, according to FT.

- Click here for more details.

NOTABLE EUROPEAN HEADLINES

- ECB's Wunsch (interview from 20th April) said ECB should be cautious regarding a July cut, should be cautious regarding a larger-than-25bps cut in June. Base case it as least two cuts, "but if we only do two or even three cuts, then we shouldn't communicate that we're going to cut at every meeting". Don't think ECB has sufficient data to have confidence on 100bps of cuts throughout the year. On what could get in the way of a June cut, Wunsch said "really bad news", "two bad readings on the inflation front or other major developments."

- Spanish PM says he has decided to stay on as Prime Minister.

- Scotland's First Minister Humza Yousaf is set to step down after coming to the conclusion that is position is no longer tenable, according to The Sunday Times.

- Fitch affirmed France at AA-; Outlook Stable and affirmed Switzerland at AAA; Outlook Stable, while it affirmed Sweden at AAA; Outlook Stable.

DATA RECAP

- German State CPIs: Uptick from the prior in-fitting with mainland expectations, core NRW continues to cool. Full reaction here.

- Spanish CPI MM Flash NSA (Apr) 0.7% (Prev. 0.80%); CPI YY Flash NSA (Apr) 3.3% (Prev. 3.2%); Core 2.9% (prev. 3.3%); HICP Flash YY (Apr) 3.4% vs. Exp. 3.3% (Prev. 3.3%)

- EU Cons Infl Expec (Apr) 11.6 (Prev. 12.3); EU Business Climate* (Apr) -0.53 (Prev. -0.3, Rev. -0.32); Services Sentiment (Apr) 6.0 vs. Exp. 6.7 (Prev. 6.3, Rev. 6.4); Industrial Sentiment (Apr) -10.5 vs. Exp. -8.6 (Prev. -8.8, Rev. -8.9); Economic Sentiment (Apr) 95.6 vs. Exp. 96.7 (Prev. 96.3, Rev. 96.2); Consumer Confid. Final (Apr) -14.7 vs. Exp. -14.7 (Prev. -14.7); Selling Price Expec (Apr) 5.4 (Prev. 5.6, Rev. 5.5)

- Swedish GDP QQ Prelim. (Q1) -0.1% vs. Exp. 0.2% (Prev. -0.1%); YY Prelim. (Q1) -1.1% (Prev. -0.2%)

- Italian Flash Trd Bal Non-EU (Mar) 5.6B (Prev. 6.74B)

NOTABLE US HEADLINES

- White House said President Biden approved the Kansas disaster declaration and ordered federal assistance to supplement recovery efforts in areas affected by severe winter storm from January 8th-16th.

- Apple (AAPL) intensified talks with OpenAI for iPhone generative AI features in which they are discussing the terms of a possible agreement and how the OpenAI features would be integrated into Apple’s iOS 18, according to Bloomberg. EU says that Apple's (AAPL) iPad operating system has been designated as a gatekeeper under the EU DMA; apple has six months to comply with EU tech rules.

- Tesla (TSLA) CEO Musk made a surprise visit to Beijing with media reports saying he aims to discuss enabling autonomous driving mode on Tesla cars in China. Later, it was reported Tesla is to partner with Baidu (9888 HK) for China self-driving approval, according to Bloomberg. (BBC/Bloomberg) Separately, two US Senators say NHTSA should require Tesla (TSLA) to restrict autopilot use to certain roads.

- Paramount (PARA) is reportedly preparing to fire CEO Bakish, via FT citing sources; additionally, sources add that the Co. is expected to receive a counterbid from Sony and Apollo this week to the offer from Skydance Media. (FT)

GEOPOLITICS

MIDDLE EAST - EUROPEAN MORNING

- "Al-Arabiya sources: An Israeli delegation will head to Cairo tomorrow and the plan is indirect negotiations with Hamas"

- UKMTO said it has receives a report of an incident 54NM Northwest of Yemen's Mokha

MIDDLE EAST

- Egypt offered a new proposal for a truce between Israel and Hamas in which some Israeli hostages would be exchanged for Palestinian prisoners and a three-week ceasefire, while Egyptian officials said Israel helped create the proposal and would enter longer-term discussions once Hamas releases the first group of 20 hostages over the truce period, according to WSJ.

- Hamas said it received Israel’s official response to its position over ceasefire talks and will study the proposal before submitting its response. It was later reported that a Hamas official told AFP that there were no major issues in the group’s remarks on the truce proposal, while it was separately reported that a Hamas delegation is to visit Cairo on Monday for ceasefire talks, according to an official cited by Reuters.

- Israel’s Foreign Minister said Israel will suspend the planned operation in Rafah if Hamas agrees to a hostage deal and stated the release of hostages is their top priority. It was also reported that the Israeli military said the amount of aid going into Gaza will scale up in the coming days.

- Palestinian President Abbas said Israel will go into Rafah in the next few days and the US is the only country that can stop Israel from attacking Rafah, while he is worried that Israel will try to push Palestinians out of the West Bank after it is done with Gaza, according to Reuters.

- Medical official said at least 13 Palestinians were killed in Israeli airstrikes on three houses in Rafah in southern Gaza, according to Reuters.

- US President Biden spoke with Israeli PM Netanyahu on Sunday and reaffirmed his ironclad commitment to Israel’s security, as well as stressed the need for progress in aid deliveries to be sustained and enhanced in full coordination with humanitarian organisations. Furthermore, they discussed Rafah and Biden reiterated his clear position, according to the White House cited by Reuters.

- White House national security spokesperson Kirby said Israel assured the US that they won’t go into Rafah until the US has a chance to share its perspectives and concerns, while he added Israelis have started to meet the aid commitments that US President Biden asked them to meet. It was separately reported that US Secretary of State Blinken will travel to Jordan and Israel following Saudi Arabia, according to Reuters.

- France’s Foreign Minister said to make proposals in Lebanon to stabilise the zone and prevent a war between Hezbollah and Israel, according to Reuters.

- UKMTO said it received reports of an incident 177 nautical miles southeast of the Port of Nashtoon located in eastern Yemen on Saturday night which involved a small boat that approached a ship, although there was no harm or damage and the ship carried on its journey, according to IRNA.

OTHER

- US intelligence found that Russian President Putin did not directly order Navalny’s death in February, according to WSJ. US intelligence report does not dispute Putin’s culpability for the death of Navalny but believes he probably did not order it at that moment, while a Kremlin spokesperson called the intelligence report empty speculation.

- Russian Foreign Ministry said there will be a severe response if Russian assets are touched and it is a pity that some in the West do not understand it, while it was also reported that Russia’s Kremlin said there will be endless legal challenges if Russian assets are seized.

- Russia’s Kremlin said there are no grounds to hold any peace talks with Ukraine given Kyiv’s official refusal to conduct such talks with Russia.

- Kyiv’s top general said fighting on the eastern front worsened and Ukrainian troops had fallen back in three places.

- North Korea’s Foreign Ministry said it will make stern and decisive choices in response to the US using human rights for anti-North Korean behaviour, while it added that the US envoy on North Korean human rights is motivated politically and is considered political provocation, according to KCNA.

CRYPTO

- Softer session for Bitcoin, dipping as low as USD 61.9k, whilst Ethereum holds firmly above USD 3.1k.

APAC TRADE

- APAC stocks began the week on the front foot after the tech-led surge last Friday on Wall St and amid increased optimism regarding a Gaza truce with negotiators set for talks in Cairo on Monday, although Japan was on holiday and ahead of this week's key risk events.

- ASX 200 was led higher by real estate, tech and telecoms owing to softer yields.

- Hang Seng and Shanghai Comp. gained with the former entering into bull market territory after climbing over 20% from its January lows, while participants digested a slew of earnings and the mainland also shrugged off the slowdown in March Industrial Profits.

NOTABLE ASIA-PAC HEADLINES

- China's MOFCOM said export control measures proposed by Japan on semiconductors will seriously affect the normal trade between Chinese and Japanese enterprises, as well as undermine the stability of the global supply chain. Furthermore, it stated that China urges the Japanese side to rectify its 'erroneous practices' in a timely manner and China will take necessary measures to firmly safeguard the legitimate rights and interests of Chinese enterprises, according to Reuters.

- US and Taiwan are to hold in-person negotiation talks on trade beginning on April 29th, according to Reuters.

- Japanese PM Kishida said they will promote union policies for wage increases, according to Reuters.

- PBoC has reportedly expanded a warning on bond investments to regional banks, via Bloomberg citing sources.

- Agricultural Bank of China (1288 HK) Q1 (CNY): Net Income 70.839bln (exp. 73.578bln), NII 144.535bln (exp. 137.021bln).

- PetroChina (857 HK) Q1 (CNY): Revenue 812.184bln (exp. 833.77bln), Net +5% Y/Y, EPS 0.25 (exp. 0.24).

- Japanese Top Currency Diplomat Kanda offers no comments on whether there was FX intervention; will continue to take appropriate action against excessive FX moves; does not have a specific FX level in mind. Speculative, rapid, abnormal FX moves have bad impact on the economy, so unacceptable. Ready to respond 24 hours, 365 days, when asked whether Japan was ready to take action in FX. Will disclose at the end of May if there way intervention.

APAC DATA RECAP

- Chinese Industrial Profits YTD Y/Y (Mar) 4.3% (Prev. 10.2%)