Analysis: TiPs Do Not Hedge Inflation as Advertised

TiPs Do Not Hedge Inflation as Advertised

TL/DR

"In some cases TIPS are a certifiably bad inflation hedge."

-ZeroHedge

TiPS performance will continue to be dictated more by Treasury market dynamics than inflation itself. For holders of TiPS to replicate what banks can do (see attached cartoon) multiple factors must be hedged and re-hedged.TiPS, like most “products” offer imperfect hedging convenience. You’re better off buying Gold and some Stocks to hedge inflation. The math has been done.

Contents (890 words)

- The Limits of TIPS as an Inflation Hedge

- Interest Rate Sensitivity Undermines Inflation Protection

- Inflation-Linked Returns Overwhelmed by Rising Yields

- TIPS ETF Demand Has Moderated

- Breakeven Inflation Rates Offer a Better Hedge

- Challenges for Individual Investors

- Short-Term TIPS Breakevens Resemble Trading Oil

- Conclusion: TIPS Require Contextual Hedging

- Side by Side: TiPS ETF vs Gold

The Limits of TIPS as an Inflation Hedge

Authored by GoldFix, ZH Edit

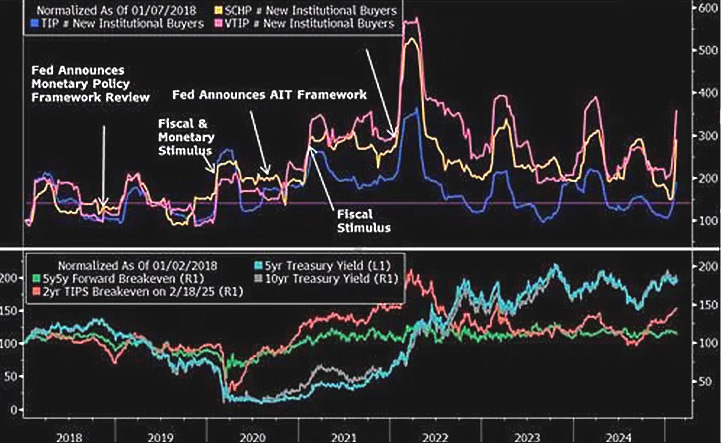

Treasury Inflation-Protected Securities (TIPS) are often seen as a hedge against inflation, but their sensitivity to interest rate movements creates challenges, particularly in the short term. In some cases, as Bloomberg Intelligence’s Ira Jersey has analyzed, TIPS are an outright poor hedge against inflation. Institutional investors, who surged into TIPS ETFs in 2022 as inflation spiked, have since tempered their positions as the rate environment changed.

Inflation-Linked Returns Overwhelmed by Rising Yields

TIPS performance is more dependent on yield fluctuations than inflation itself. A comparison of Bloomberg’s TIPS and Treasury indices against the headline CPI illustrates that TIPS tend to track nominal Treasuries over time. The outlier was 2021, when Treasuries sold off early while TIPS remained well-bid due to inflation concerns.

Gold outperformed TiPs since inception even without Russian-Ukraine War Gold Rush...

TIPS ETF Demand Has Moderated

Institutional demand for large TIPS ETFs, which peaked during the 2022 inflation surge, has since faded. After a brief resurgence in early 2024, driven by tariff-related inflation concerns, inflows again stabilized. As real yields climbed, TIPS fund returns turned negative, prompting institutions to reduce exposure. Those who re-entered earlier in the year may have done so more as a duration play than a direct inflation hedge.

Institutional Investors Ain’t Buying TiPs Protection Anymore…

Without an interest rate hedge, TIPS remain vulnerable to broader Treasury market movements. Since early 2022, 10-year TIPS yields have risen by over 3%, leading to price declines that wiped out the 13.5% gain in the TIPS reference index (CPURNSA). The TII 0.25% 2/50 bond has dropped 54 points in price over that period.

Breakeven Inflation Rates Offer a Better Hedge

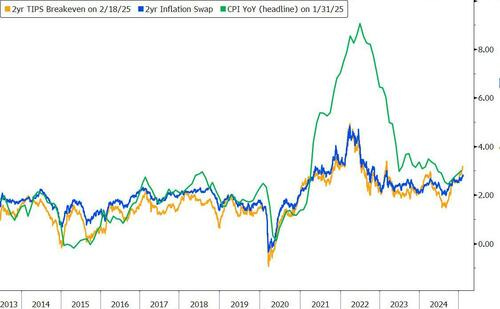

Rather than holding TIPS outright, breakeven inflation rate trades and CPI swaps are often superior inflation hedges. The breakeven rate is the difference between a nominal Treasury yield and a TIPS yield of the same maturity. Investors executing this trade would buy TIPS while shorting a Treasury or selling Treasury futures. However, mismatched maturities between TIPS and futures introduce curve risk, especially when ETFs are used for the long TIPS leg.

Tips (yellow) all too frequently trade below Headline inflation (Blue) swaps…

Inflation swaps, priced based on market expectations for headline CPI, typically trade at a spread to TIPS breakevens due to funding costs and cash market haircuts.

Continues here

Free Posts To Your Mailbox