Why Stocks Might Not Be Number One For Trump 2.0

Another Reason Stocks Might Not Be Number One For Trump 2.0

Last week, ZeroHedge shared a post about why bonds might be a bigger focus than stocks for President Trump this time around ("The Trump 2.0 Put: Got Bonds?"):

The Trump 2.0 Put has a similar meaning to the 1.0 Put, except it pertains to the bond market. Per Bloomberg:

Trump has famously obsessed with the stock market as a real-time referendum on his presidency.

But now, with Musk and Treasury Secretary Scott Bessent in his ear at the start of his second term, much of the attention has shifted to another benchmark — the 10-year Treasury bond yield.

Trump made a fortune in real estate. As such, he is keenly aware that interest rates and leverage greatly impact economic growth.

Now Chamath Palihapitiya has suggested another reason why Trump 2.0 may be less interested in stocks. Before we get to his post, let's share the post that probably inspired it. Mark Mitchell from the pollsters Rasmussen Reports, teased the results of a new poll showing that Trump's highest approval rating is in the youngest age range, 18-to-39.

👀 Trump Approval might be a boring 50% right now, but the age Demos are WILD!

— Mark Mitchell, Rasmussen Reports (@honestpollster) March 3, 2025

65+ - 45%

40-64 - 46%

18-39 - 60% <==🤯

Maybe America has a future again.

With that almost certainly in mind, Chamath Palihapitiya suggested on X today, that since that age group doesn't own as much stock as older demographics, Trump may not mind falling stocks this time around:

1. Trump is more popular with young people than old people. Most young people don’t own stocks or homes (aka they are asset-light).

2. Trump is also more popular amongst working and middle class folks. Most of these folks are also asset-light.

It stands to reason that a fall in asset prices (stocks down or home prices down) have very little impact on his core constituents. To that end, I won’t be surprised if Trump has little reaction, then, to an equity or home price market correction.

Separately, the upside of shrinking these asset prices is that it gives the folks mentioned above a legitimate chance to buy into those markets at lower levels, making equity ownership and/or home ownership more possible.

Tangentially, if Trump figures out how to get rents lower, he will unite young people and asset-light working people into a reliable voting block for the foreseeable future. He will have given them the trifecta: cheaper stocks, cheaper homes, lower rent.

Said differently, don’t presume that the stock market going up is a useful barometer anymore. In fact, it going down may be a better signal for his popularity.

Time will tell.

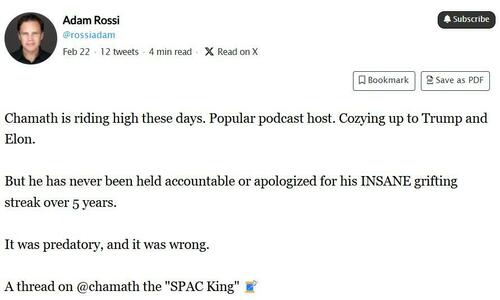

Incidentally, Chamath has some personal familiarity with falling stocks, as Adam Rossi noted in this thread last week:

Chamath's Prediction May be More True Of Real Estate Than Stocks

Falling real estate prices would almost certainly be seen as a boon by most young Trump supporters, many of whom have been priced out of the housing market. Given the popularity of trading apps like Robinhood, it's not as clear they would be happy about falling stocks. But if he is right that President Trump doesn't mind seeing stocks drop this time, than investors need to consider how to approach a market without a plunge protection team.

Investing Without A Plunge Protection Team

If neither the Fed nor the White House have your back this time around, investors should consider adjusting their approach in a few ways.

- Look for opportunities on the short side as well as the long side. Readers may recall we had another successful exit betting against Nvidia (NVDA) last week. We need to look for more opportunities like that.

- Take advantage of volatility. When the market drops, look for mean reversion opportunities. Four of our five successful exits last week were variations of this. If you'd like a heads up when we place our next trade of that type, you can subscribe to our trading Substack/occasional email list below.

- Consider hedging. Market rallies may be a good time to add downside protection. You can download the Portfolio Armor optimal hedging app by aiming your iPhone camera at the QR code below (or by tapping here, if you're reading this on your phone).

If you'd like to stay in touch

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we're using that for our occasional emails now).