Gold With The Flow Or Seize The Tow…

Outside the business cycle and the war cycle, both of which cannot be beaten and for which investors can only prepare by analysing market data untainted by political propaganda, those who have dedicated enough time to studying how to adapt to and navigate the business cycle understand that the best way to benefit from it is not only by tracking the evolution of the three key ratios driving it (the stock market-to-oil ratio, the gold-to-bond ratio, and the stock market-to-gold ratio) but also by following the money, i.e., capital flows.

https://www.investopedia.com/terms/c/capital-flows.asp

Capital flows have long shaped economies and power dynamics, from ancient trade routes to modern financial markets. Cicero observed how events in Asia rattled Rome, while Aristotle’s critique of money-making foreshadowed Marx’s ideas. The colonial era saw wealth extraction, industrialization shifted capital to the West, and Bretton Woods formalized financial flows. In recent decades, globalization and digital finance accelerated cross-border investments, until the current decade, marked by the rise of a multipolar world.

The South Sea Bubble (1720) and the Mississippi Bubble (1719–1720) were early examples of speculative mania driven by international capital flows. Investors across Europe fuelled the South Sea Company’s surge, lured by exaggerated trade prospects in the Americas, while John Law’s Mississippi Company in France drew speculative capital with promises of Louisiana wealth. Both collapsed when profits failed to materialize, wiping out fortunes and exposing the risks of cross-border speculation, setting a precedent for the volatile, interconnected financial systems that define modern capital flows. A century and a half later, the Panic of 1896, triggered by a silver price collapse and over-speculation in railroads and real estate, led to U.S. bank failures and rising unemployment. Struggling to stabilize its gold-based system, the U.S. saw British investors inject capital to protect interests and seize distressed assets, highlighting the growing interdependence of global markets. This crisis foreshadowed modern international capital flows, demonstrating how financial distress in one nation could drive cross-border investment and reshape economic power dynamics.

https://www.britannica.com/video/William-Jennings-Bryan-speech-Cross-of-Gold-July-8-1896/-9087

Economists, preoccupied with theories of absolute control, failed to grasp the significance of net capital movement during the global rise of Marxism. In response, politicians introduced regulatory measures, beginning with the Interstate Commerce Act of 1887 and the Sherman Anti-Trust Act of 1890 to curb business consolidation. These were accompanied by the McKinley Tariff of 1890, crafted by William McKinley and John Sherman. The pivotal Sherman Silver Purchase Act of 1890, designed to appease Free Silver Democrats, mandated increased silver purchases, expanding the money supply but destabilizing U.S. Treasury gold reserves. This unsound policy contributed to the Panic of 1893, prompting President Grover Cleveland to push for its repeal.

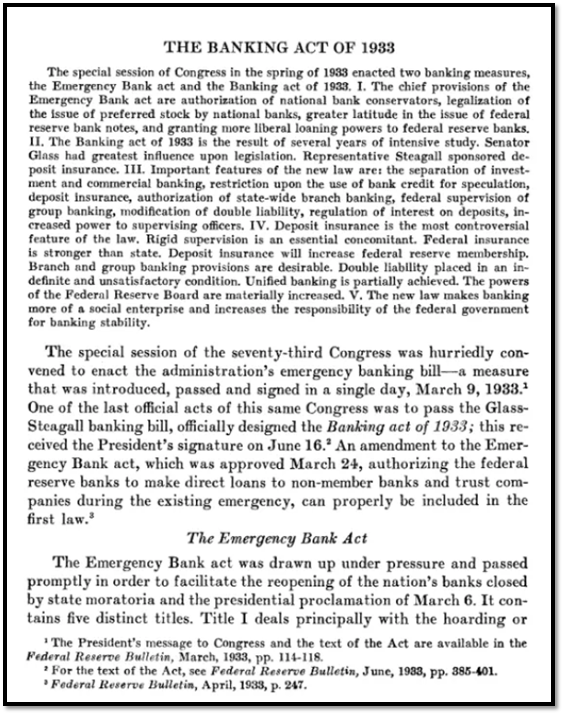

Governments often disrupt free capital movement through capital controls, measures like currency restrictions, investment limits, and transaction approvals, to stabilize economies, prevent capital flight, and manage volatility. Throughout history, capital controls have been employed by various nations to manage economic challenges, often during times of crisis or transition. One early example is the United States during the Great Depression, when the 1933 Banking Act and subsequent measures restricted gold outflows and foreign exchange transactions to stabilize the dollar and curb panic-driven capital flight.

https://corporatefinanceinstitute.com/resources/economics/emergency-banking-act-of-1933/

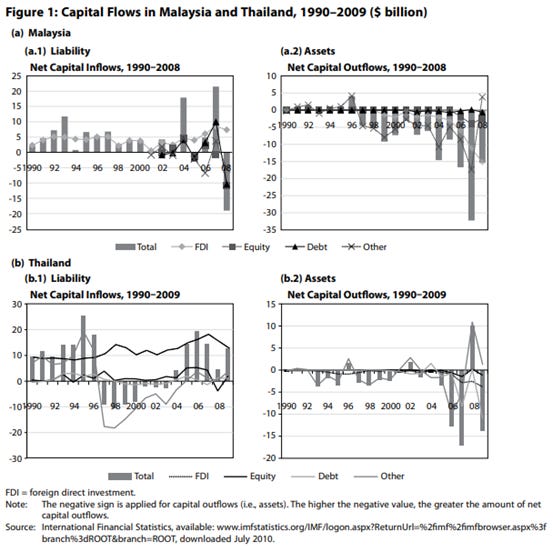

In post-World War II Britain, the government imposed strict controls under the Exchange Control Act of 1947, limiting the amount of sterling that could be converted into foreign currencies to protect dwindling reserves and finance reconstruction. During the 1997 Asian Financial Crisis, Malaysia and Thailand famously implemented capital controls, including fixing the exchange rates of the ringgit and baht and restricting offshore trading, to shield their economies from speculative attacks, measures that, while controversial, were credited with aiding recovery.

https://www.adb.org/sites/default/files/publication/28804/economics-wp251.pdf

More recently, Iceland imposed capital controls following its 2008 banking collapse, restricting foreign currency outflows to stabilize the krona. These measures were gradually lifted by 2017 as the economy recovered.

https://www.bbc.com/news/business-39248677

As of March 7, 2025, several countries maintain capital controls based on historical patterns and economic conditions, though specifics depend on evolving policies. China upholds long-standing restrictions to manage currency stability, while Argentina curbs dollar outflows to combat inflation. Russia enforces controls amid sanctions, requiring exporters to repatriate earnings, while Ukraine restricts transactions due to war-related pressures. India applies targeted measures to protect its economy, and Venezuela maintains tight controls amid its prolonged crises.

Capital flows have once again been at the epicentre of financial media discussions since the start of the year, following a late January Financial Times article highlighting the movement of gold from London and Zurich to Comex vaults in Manhattan, supposedly due to the threat of tariffs on imports from the UK and Europe.

https://www.ft.com/content/86a5fafd-603e-4ee1-9620-39b5f4465f53

Since the U.S. election in November, gold traders and financial institutions have moved around 18 million troy ounces (around 560 tons) into Comex vaults following the publication of the November 5th, 2024, election results. With around 39.7 million troy ounces now stored in Comex gold storage, this level is the highest in 35 years and above the levels seen in May 2020, when the global pandemic triggered a massive flow of physical gold into New York vaults.

Comex Gold Inventory data & Monthly Change.

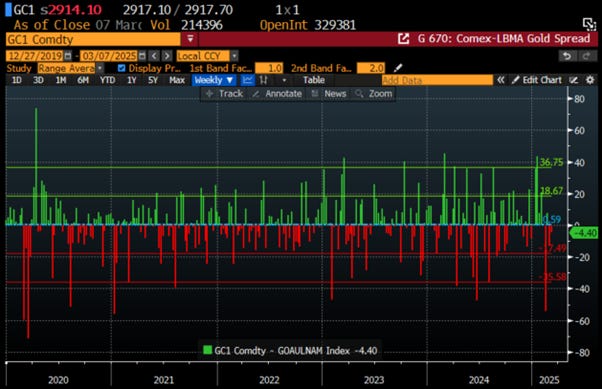

This "transatlantic" movement of physical gold has raised many questions and triggered a spike in the spread between the Comex and LBMA gold prices over the past month, a spike which has just eased recently.

Spread between NY Comex Gold Price & LBMA London Price.

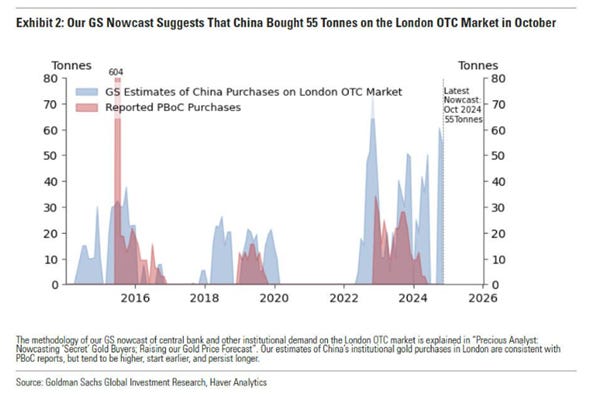

Gold flowing across geographies is nothing new, and it's not only New York's Comex vaults that have seen massive inflows in recent months. In fact, global flows of physical gold out of London are largely directed eastward, with most commercial gold eventually ending up in China via Switzerland. According to customs data, Switzerland imports about 1,000 tonnes of London gold annually, where it is refined in various Swiss mints and redirected to retail markets, primarily in China and, to a lesser extent, India. Indeed, China’s undisclosed purchases in the London OTC market reached an all-time high in late 2024 and continue to this day.

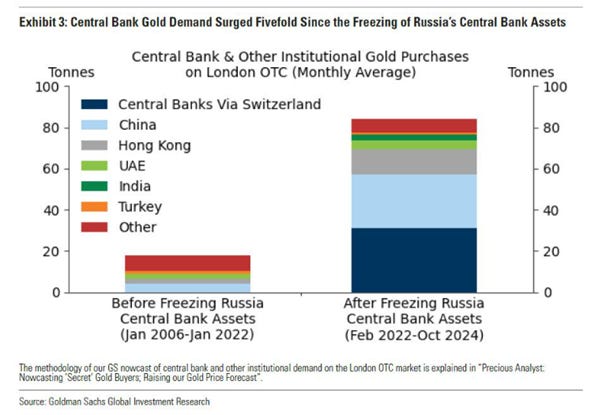

To be sure, it hasn't been just China: ever since the U.S. decided to make gold bugs around the world very rich by weaponizing the U.S. dollar in the aftermath of the Ukraine war, central bank gold demand has surged five-fold, leading to gold hitting a record high of $2,800 earlier today.

What stands out this time is that unlike in 2019 when Comex vaults were nearly empty of "registered" gold, sometimes dropping to zero with most of the vaults filled with "eligible" gold, there is now a notable amount of registered gold in the Comex system. "Eligible gold" refers to gold stored in approved Comex vaults that meets the requirements for delivery against gold futures contracts. This includes 100 oz and kilo bars, but not 400 oz bars. However, eligible gold doesn't necessarily mean it's for immediate trading; some may be stored for futures trading, while other gold could be deposited for reasons unrelated to futures contracts. "Registered gold," on the other hand, is eligible gold for which a warrant has been issued by an approved warehouse. These warrants, which are "documents of title," confirm ownership of a specified quantity of gold stored in the warehouse, meeting the requirements for delivery against a gold futures contract. A warrant details the number of gold bars, their serial numbers, and refiner brands. In terms of physical priority, registered gold ranks above eligible gold. Additionally, there is "pledged gold," which refers to vaulted gold used as collateral for margin obligations.

Comex Registered Gold Inventory (blue histogram); Comex Eligible Gold Inventory (red histogram).

Unlike "paper" gold, where physical delivery is not involved, COMEX gold futures are physically deliverable and can be settled in real gold. However, in 2018, only 1.6 million ounces (51 tonnes) of gold were actually delivered, meaning 99.98% of COMEX gold futures did not result in physical delivery. The majority of gold accumulation is happening in just three vaults: Brink's, HSBC, and JPMorgan, with JPMorgan holding the largest share. These three vaults alone account for 82% of all COMEX gold inventory, reflecting a significant rush to store physical gold, particularly at JPMorgan’s vault.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/gold-with-the-flow-or-seize-the-t…

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.