Sponsored Content

At $4,080 gold, buy, sell… or something better?

Gold has surged past $4,080 per ounce—once again approaching its recent all-time high.

And if forecasts from Goldman Sachs, JP Morgan, and Morgan Stanley prove accurate, new records are likely ahead.

But the rally has revived a familiar dilemma: buy more gold at these levels, take profits, or wait for a pullback?

Breaking the buy/sell paradox

Prices have been rising, and investors want exposure. But adding here feels risky and selling here risks missing further gains.

Fortunately, there’s a third option to consider.

A new way to own gold

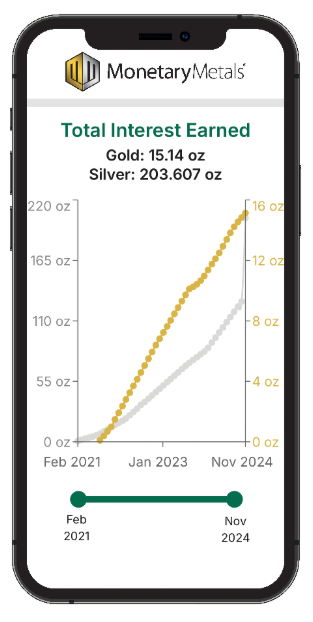

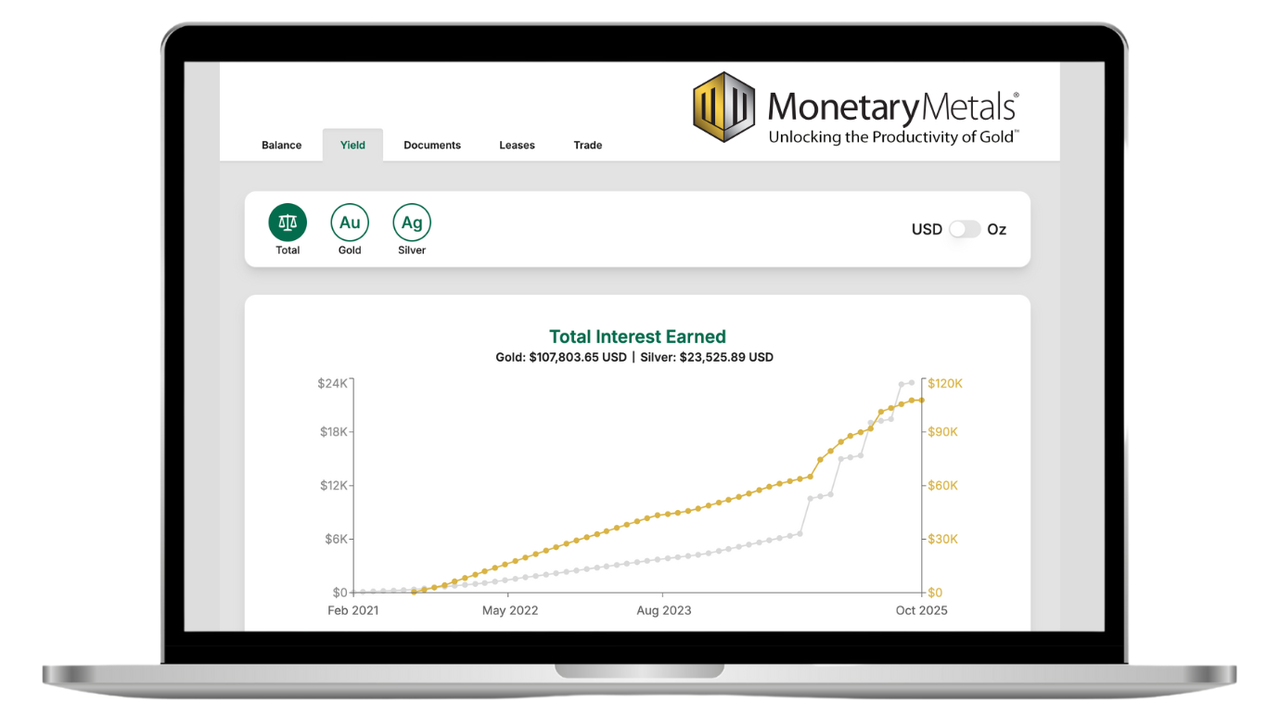

Monetary Metals enables investors to earn up to a 4% annual yield on their gold—paid in physical gold—by leasing metal to qualified businesses such as refiners, mints, and jewelers.

- You earn a return on gold, paid in gold, without selling

- You keep full title and ownership

- Your ounces increase over time

- You keep exposure to the spot price

And unlike traditional vaults that raise fees as gold rises, Monetary Metals provides free storage and insurance, with the option to lease your metal to earn a yield.

It resolves the buy/sell dilemma cleanly:

- Keep your gold

- Earn a yield on it

- Compound your ounces

- Avoid dependence on the dollar price

Why gold with yield matters now

Dollar rates may decline once again as the Fed starts to cut. Meanwhile, inflation continues to erode nominal returns. Markets remain volatile.

Whether gold climbs toward $5,000 or pauses temporarily, one fact remains: idle gold may merely preserve your wealth, but earning gold on gold builds it.

The real question is no longer whether to buy or sell.

It’s whether your gold is working or not.

Learn more about how to earn up to 4% on your gold, paid in gold, today.