Sponsored Content

America’s Credit Rating Just Took Another Hit. Time to Rethink ‘Safe’ Assets?

America’s Credit Rating Just Took Another Hit. Time to Rethink ‘Safe’ Assets?

The warnings are getting harder to ignore. Moody’s just joined Fitch in downgrading its outlook on U.S. government debt, citing “rising interest costs, unsustainable deficits, and deepening political dysfunction”.

Translation: Even the world’s most prominent credit agencies are beginning to admit what many ZeroHedge readers have long suspected: The U.S. is losing control of its finances.

Moody’s Sounds the Alarm on U.S. Credit Risk

In a sharp move, Moody’s downgraded its outlook on U.S. sovereign credit from “stable” to “negative.” The agency warned of mounting interest payments, a lack of credible fiscal reform, and worsening political gridlock in Washington.

What’s not mentioned, but just as relevant, is the growing pressure from protectionist policies like tariffs. These measures may sound strong on paper, but in practice they often lead to price spikes, supply disruptions, and retaliatory trade wars. The result is more inflation, weaker growth, and a Fed stuck in a no-win scenario.

Fitch downgraded the U.S. previously. Now Moody’s is preparing to do the same.

Why This Isn’t Just a Wall Street Problem

This isn’t just about credit markets or bureaucratic ratings. It affects everyday Americans in very real ways:

- Higher borrowing costs on mortgages, credit cards, and auto loans

- Rising inflation, compounded by fluctuating tariffs and supply issues

- Loss of confidence in the U.S. dollar as a global standard

- Growing pressure on the Fed to choose between inflation and instability

When the world questions U.S. creditworthiness, markets don’t wait for Washington to catch up.

Gold Doesn’t Have a Credit Rating. And That’s the Point.

Gold doesn’t need a vote in Congress or a promise from the Treasury. It doesn’t get downgraded. It doesn’t default. And it isn’t printed into devaluation.

Throughout history, during every major debt and currency crisis, gold has stood firm as a store of value. It’s one of the few assets that isn’t someone else’s liability.

With America’s fiscal foundation cracking and inflation lingering, hard assets are once again proving their worth.

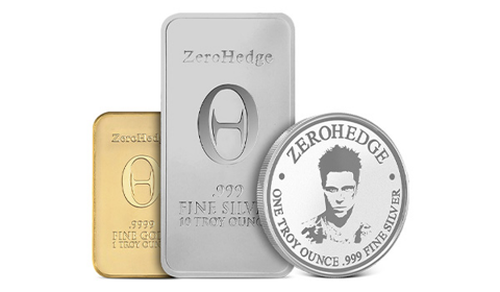

The ZeroHedge Bullion Collection: Real Wealth, Delivered Discreetly

When the warnings start flashing, you don’t want promises. You want something real.

That’s why JM Bullion, ZeroHedge’s preferred bullion dealer, created the ZeroHedge Bullion Collection — a curated line of gold and silver, delivered directly and discreetly to your door.

1 oz ZeroHedge Gold Bar: .9999 fine gold, sealed in an assay blister pack. A symbol of independence, stamped with the ZeroHedge logo.

10 oz Silver Bar: Solid, stackable, and .999 pure. The foundation of any serious metals portfolio.

1 oz Silver Round: Compact, flexible, and ideal for those who value mobility and real value.

If you’ve been waiting for the signal, this is it. Secure your real assets now—before the next shock hits.