Sponsored Content

The Big Bill, The Bigger Deficit: How Washington’s Spending Spree Could Break the Dollar

It’s official: The U.S. deficit is ballooning.

With the “Big Beautiful Bill” recently passing, the Treasury is on track to add another $3.3 trillion to the national debt. That’s on top of already record-breaking spending and an annual deficit set to top $2 trillion in 2025.

In a rational market, this would be cause for alarm. But in Washington, it’s business as usual: borrow, spend, repeat.

The Real Cost of Deficit Spending

The consequences of these fiscal fireworks are already visible:

- Interest payments on the national debt are now one of the government’s largest expenses, topping $1 trillion a year, rivaling military spending.

- Treasury auctions are softening. Demand is slipping, especially from foreign buyers. The Fed has stepped back. And that leaves more debt for the market to absorb at higher interest rates.

- Confidence in the dollar is slipping. A 10%+ drop in the DXY in the first half of 2025 was the worst January–June performance in over 50 years.

More Spending, Fewer Options

The U.S. government is backed into a corner. It can’t raise taxes meaningfully without risking economic contraction. It can’t cut spending without political consequences. And it can’t stop issuing debt, not with bills like this flying through the legislature.

That leaves two levers: Print more money or inflate the debt away. And neither ends well for the dollar.

Gold and Silver Don’t Need Bailouts

If the federal government is losing control of its own balance sheet, then individual investors need to take control of theirs.

Physical gold and silver have no counterparty risk. They aren’t tied to policy promises. They don’t get printed, taxed, or inflated into oblivion. And they’ve outlasted every fiat currency in history.

If you believe the current path is unsustainable — and the numbers clearly say it is — now is the time to diversify out of paper and into something real.

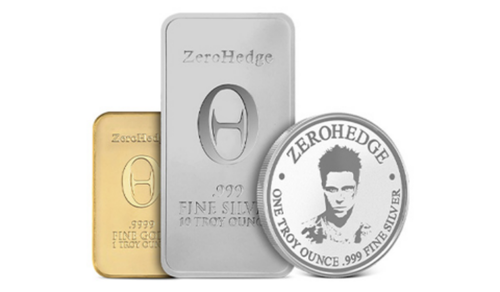

Explore the ZeroHedge Precious Metals Collection

The ZeroHedge Bullion Collection, available only from JM Bullion, ZeroHedge’s preferred bullion dealer, is built for times like these:

1 oz ZeroHedge Gold Bar: .9999 fine gold, sealed in an assay blister pack. A symbol of independence, stamped with the ZeroHedge logo.

10 oz Silver Bar: Solid, stackable, and .999 pure. The foundation of any serious metals portfolio.

1 oz Silver Round: Compact, flexible, and ideal for those who value mobility and real value.

If you believe the current path is unsustainable — and the numbers clearly say it is — now is the time to diversify out of paper and into something real.