Sponsored Content

Bitdeer’s Q4 Shows How to Monetize Energy Infrastructure

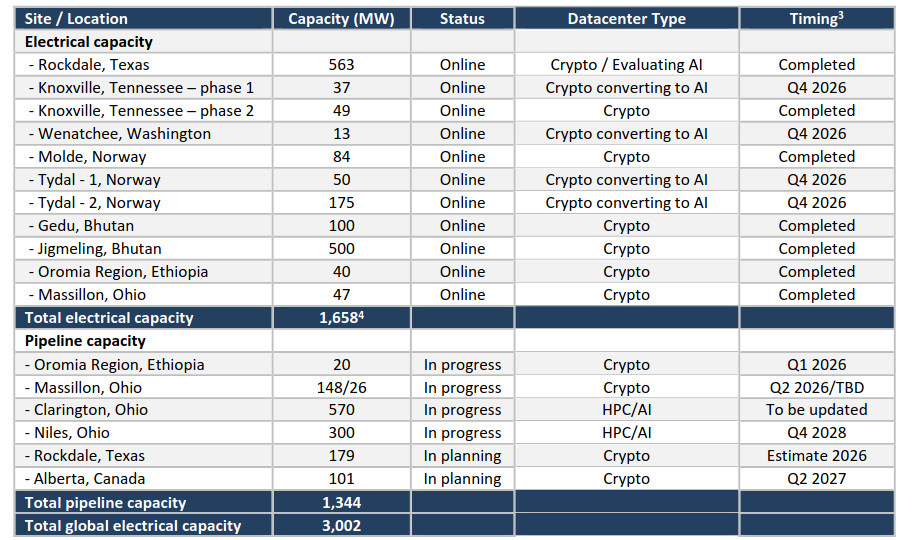

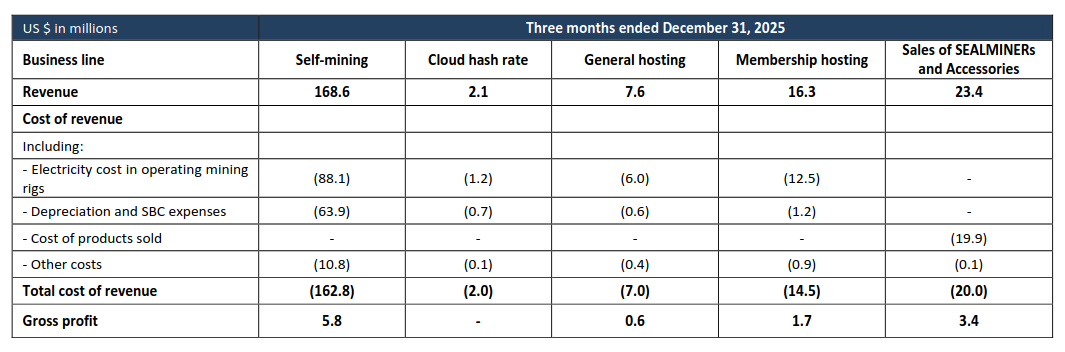

Bitdeer’s Q4 2025 earnings, published last week, reveal material top-line growth and operational expansion, with the company now controlling a total electricity capacity of over 3 GW across four continents. Revenue increased 226% year over year to $225 million, primarily driven by bitcoin self-mining, which generated $168.6 million, up 306% year over year.

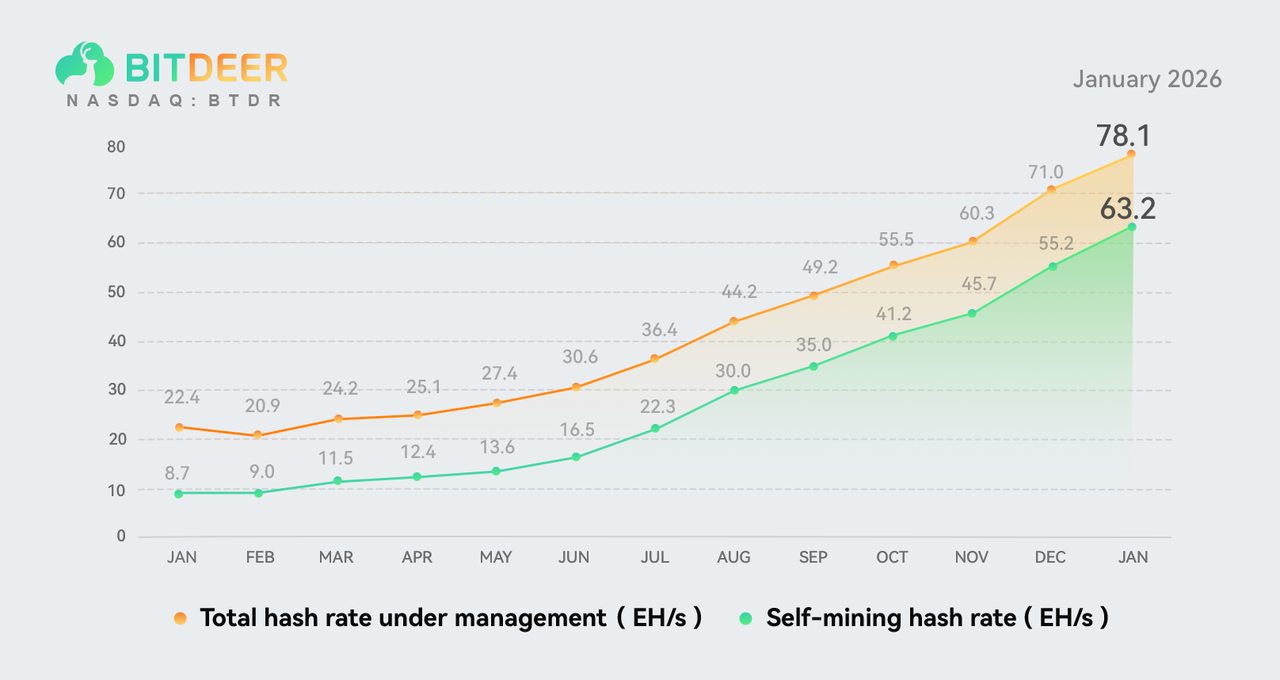

The company reported $70 million in net income, with adjusted EBITDA turning positive to roughly $31 million, reversing a prior-year loss. Operationally, Bitdeer continued its operational expansion and now accounts for approximately 7% of the total computing power of the global Bitcoin network.

By deploying capital into site build-outs that can be immediately monetized through its proprietary hardware fleet, Bitdeer occupies a differentiated position among public miners. The company’s financials show $454M in Q4 financing inflows to support balance sheet liquidity and growth initiatives. Bitdeer reported $97.9 million in net cash from investing activities, including $50.7 million of capital expenditures for datacenter infrastructure, GPU equipment procurement, and mining rigs, partially offset by $150.6 million in proceeds from cryptocurrency disposals.

From its 563-megawatt (MW) site in Texas to its ~1-gigawatt (GW) data center capacity under development in Ohio, the company has been quietly investing in the acquisition of energy infrastructure and anticipating the global surge in demand for facilities where AI/HPC data centers can be quickly deployed.

On the Earnings Call last week, Bitdeer’s Chief Strategy Officer Haris Basit said:

“We believe this represents one of the most attractive and AI-suitable power portfolios in the industry and provides us with a vast opportunity as the demand for such capacity continues to grow.”

Bitdeer is building a power portfolio comparable in scale to the top global hyperscalers and stands out as the only public company th

Its revenue from self-mining activities increased to $168.6M from last year’s $41.5M, in line with the 464.3% increase in computing capacity, measured in hash rate. Compared to the 469 bitcoins produced in Q4 of 2024, Bitdeer mined 1673 coins last quarter.

Independent analysis of Bitdeer’s disclosed data suggests fleet hashcost (how many US dollars are spent per unit of computational power) of roughly $22/PH/s in Q4 2025, down materially following deployment of newer-generation machines. The analysis indicates that Bitdeer's self-mining fleet is well-positioned to remain profitable at the operating level and successfully navigate challenging market conditions.

Jihan Wu, CEO and Chairman of Bitdeer, recently stated:

“Self-deployment will be a very important strategy in 2026, especially in this kind of market. Our market share for Bitcoin mining output will continue to grow into 2026.”

In addition to self-mining, Bitdeer recorded $23.4M in quarterly revenue coming from its hardware sales, which will now include a new chip targeting Dogecoin and Litecoin mining that the company expects to outperform bitcoin miners in fiat-based output. While still a modest contributor to revenue, the company’s HPC and AI cloud segment resulted in a $2.3M revenue stream, which is expected to expand with colocation deals in sites such as Tydal, Norway, and Clarington, Ohio.

The earnings underscore a strategic direction in which revenue scales alongside infrastructure ownership and power capacity expansion. As capital flows into long-lived assets that are increasingly in demand, Bitdeer enjoys the flexibility of monetizing them through bitcoin mining while prioritizing colocation models to achieve better economic performance.

While responding to a question about potential deals, Basit said:

“We feel pretty confident that we’re going to get colocation deals done in the near future. Predicting that timeframe is going to be hard, and the discussions are pretty intense with several counterparties.”