Sponsored Content

Boosted by Extensive Use in AI Data Centers, Copper Demand is Expected to Soar; Undervalued Mogotes Metals Inc. (OTC: MOGMF | TSXV: MOG) is a Great Way to Profit From Copper’s Unique and Growing Role in the Economy

Summary

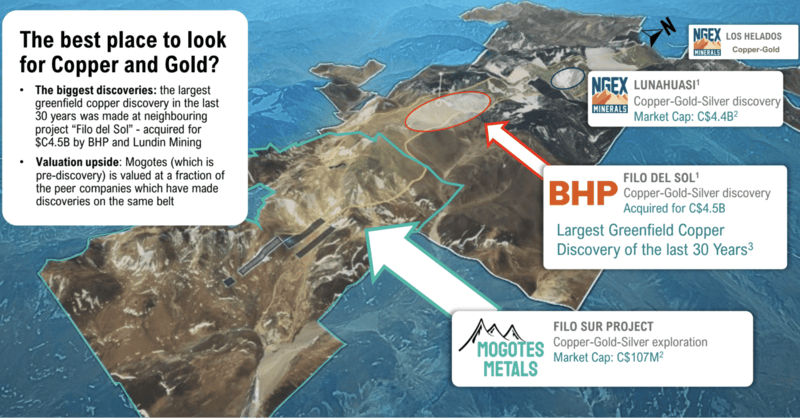

Mogotes Metals Inc has a copper-gold project in a prodigious copper-gold mining district on the border of Chile and Argentina. Mogotes largely undrilled Filo Sur project is adjacent to, on trend with, and shares many of the same geologic characteristics as a BHP/Lundin Mining project that is considered one of the largest copper discoveries over the last 30 years and was recently sold for ~40x the stock market capitalization of Mogotes. Furthermore, the demand for (and likely the price of) copper seems poised to soar over the next few years. At the same time, copper supply based on known projects will be unable to keep up with demand. Given all this, Mogotes is a very attractively priced, speculative resource play.

Expected near exponential growth in the use of AI technologies, and in the industries which will support AI growth such as advanced chip makers and electric power generation facilities, have been the persistent themes of both the overall economy and the stock market for the last few years. Importantly, as AI plays an increasing role in all industries and in our way of life, copper usage is set to soar.

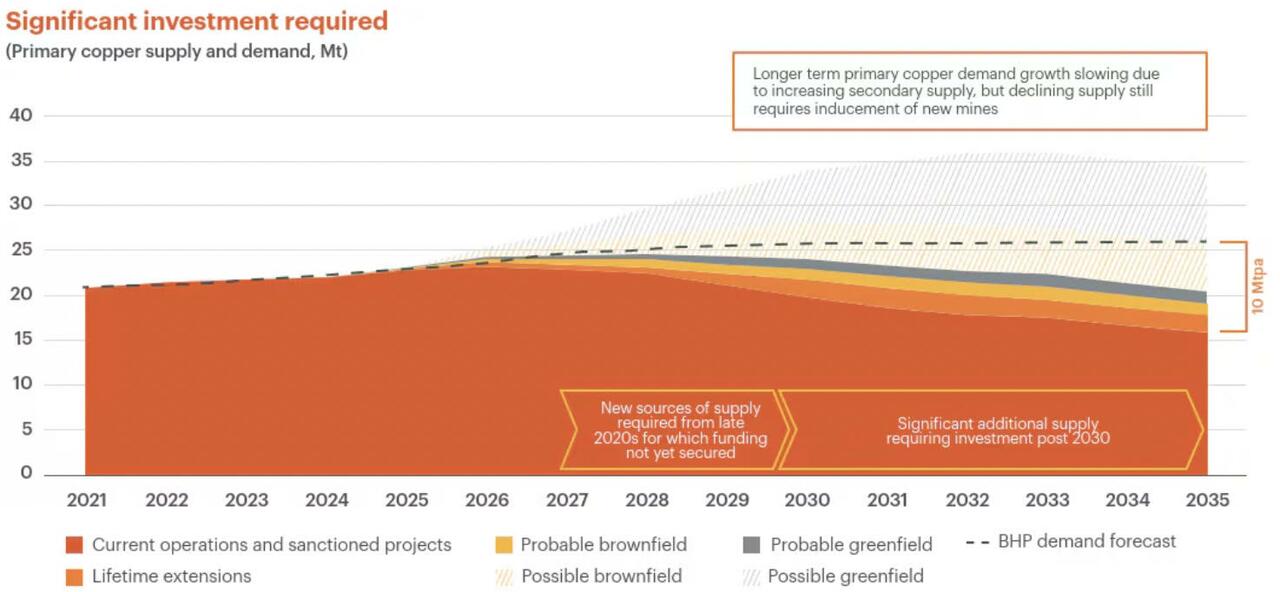

Consider the following reasoning: according to the Copper Development Association, building a conventional data center requires 4,500 to 13,600 tonnes of copper, and a more complex facility which serves the needs of a hyperscaler like Amazon Web Services or Microsoft Azure can contain 45,000 tonnes of this metal. Copper’s malleability and capacity to carry high power loads while minimizing energy loss and dissipating heat caused by dense server equipment, make it an indispensable element in these giant structures. Furthermore, ABI Research, a global technology data intelligence firm, expects about 2,250 data centers to be built on a worldwide basis between 2025 and 2030. If one further assumes a 50/50 mix of conventional and hyperscaler data centers, incremental copper demand over the next six years could amount to 60 million tonnes of copper, or about 10 million tonnes per year. This potential additional annual demand represents a remarkable 40% increase versus the current global copper consumption level of around 26 million tonnes, per Statista.

In addition to data center-related demand growth, copper consumption is increasing in the U.S. and abroad for other reasons. For example, according to the International Energy Agency, electric vehicle (EV) sales exceeded 17 million units in 2024, up from 13.5 EVs in 2023 and 10 million in 2022. An EV uses 3x to 5x more copper than a conventional internal combustion engine (ICE)-powered vehicle (about 200 pounds versus ~40 pounds). Furthermore, the new data centers outlined above, together with population growth, will require the modernization of the U.S. power grid which transmits and distributes power from generating plants to business and residential customers. Concerningly, U.S. Department of Energy estimates that 70% of all transmission lines in this country are over 25 years old. Substantial amounts of copper will be required in these expansion projects.

Furthermore, copper’s remarkable resistance to corrosion makes the mineral central to the development of new aerospace and defense applications. Indeed, beryllium copper alloys enhance the speed and performance of fighter aircraft, and copper’s efficient heat conduction makes the mineral a crucial element in surveillance technologies. Moreover, in late August, the U.S. Department of the Interior proposed adding copper to its list of critical minerals, which would bring the total list to 54 metals. Such a designation highlights the crucial role copper plays in the U.S. economy.

The “supply” aspect of the copper supply-demand equation likewise is favorable: significant supply of the red metal has been recently curtailed as three key copper mines are not producing. Most importantly, a September 2025 mudslide at the world’s second largest copper mine, the Grasberg Block Mine in Indonesia (owned jointly by the Indonesian government and Freeport-McMoran Inc.), will remove around 600,000 tonnes of annualized production probably through sometime in 2027. In addition, a July 2025 mine collapse at the El Teniente mine in Chile, and operational problems at another Chilean mine, Quebrada, have taken substantial copper supply off the market.

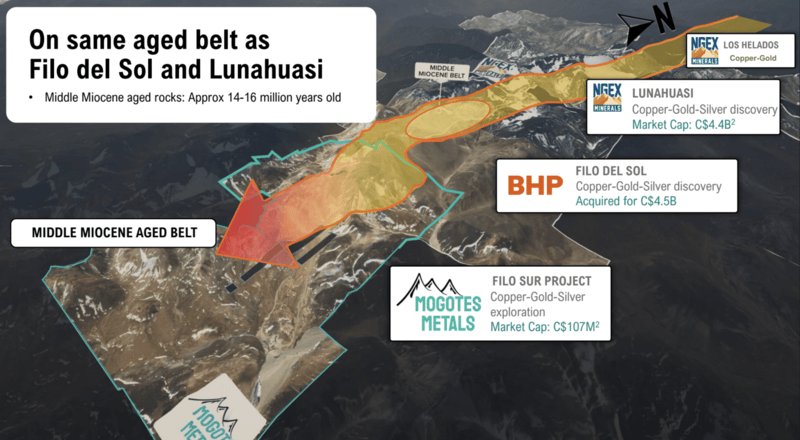

With all this in mind, Mogotes Metals Inc. (OTC: MOGMF | TSXV: MOG) represents an intriguing and potentially extremely undervalued play on copper and gold. Mogotes owns the Filo Sur Project in the Vicuna Copper District of Chile and Argentina. Filo Sur is adjacent to and on trend with BHP/Lundin Mining’s Filo del Sol Project. The BHP/Lundin Mining property, which has been called the largest greenfield copper discovery of the last 30 years, contains 13 million tonnes of copper, 32 million ounces of gold, and 659,000 ounces of silver. (All of these totals include only Measured & Indicated resources.) BHP/Lundin Mining acquired Filo del Solo for C$4.5 billion in January 2025, a time when copper and gold prices were much lower than they are now. Note especially that the Filo del Sol Project’s takeover price is nearly 40x Mogotes current stock market capitalization.

Five Reasons Mogotes Metals Inc. (OTC: MOGMF | TSXV: MOG) Should Be on Your Watchlist

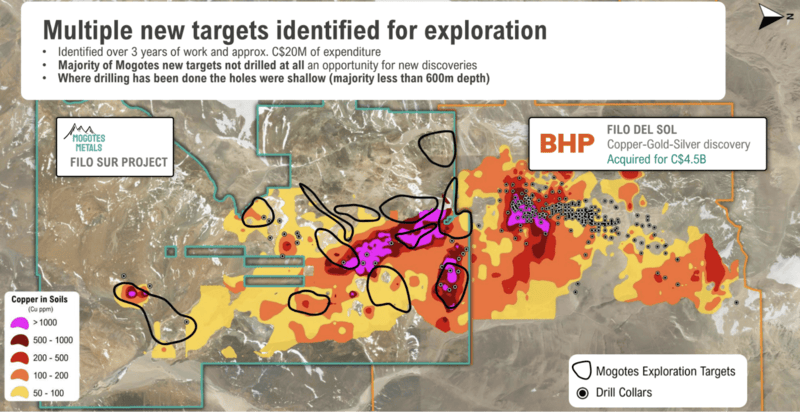

- After three full seasons of field work with an aggregate cost of C$20 million, Mogotes is currently drilling high priority targets at Filo Sur for Porphyry Copper and High Sulfidation Epithermal gold-silver mineralization. Mogotes will operate up to two rigs this drilling season and plans an initial program of 5,000 meters of diamond drilling.The majority of Mogotes Filo Sur Project targets have not been previously drilled, implying new discovery potential. Moreover, for those targets where drilling has been done, the depths drilled have been quite shallow (most less than 600 meters in depth). Most importantly, given Mogotes low current stock market valuation, if the company were to discover substantial mineral resources at Filo Sur, Mogotes share price would likely soar.

- The copper concentration levels in the soils of Mogotes Filo Sur Project compare favorably with the documented copper and gold anomalies in BHP/Lundin Mining’s Filo del Sol Project.

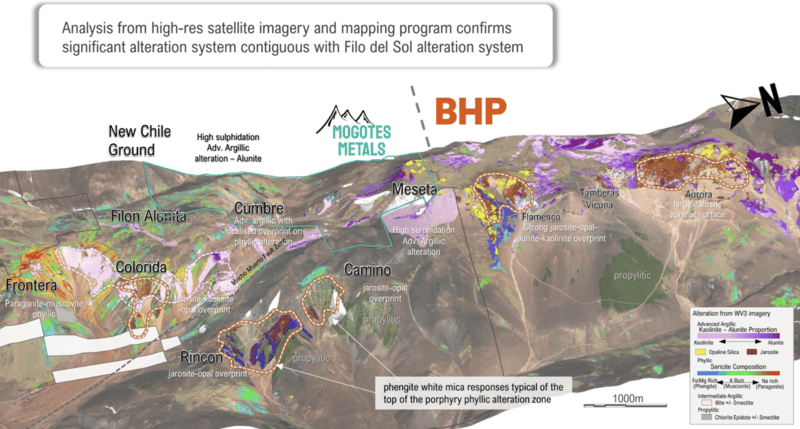

- In geologic terms, an alteration system in a rock group is the process of chemical/mineralogical change due to the interaction with hot hydrothermal fluids or groundwater. An alteration system can create distinct zones of secondary minerals (like copper and gold) around the alteration pathway. Constructively, satellite imagery suggests Mogotes Filo Sur’s alteration system is contiguous with BHP/Lundin Mining’s Filo del Sol Project.

- The geologic profile of Mogotes Filo Sur Project is similar to the profile of adjacent projects which have been determined to be major discoveries. The belt throughout the region is composed of Middle Miocene-aged rocks that were formed 14-16 million years ago. Middle Miocene rocks are characterized by tectonic events that influenced their formation.

- Mogotes is a financially strong and well-managed company. It has C$25.6 million of cash (equivalent to ~20% of its market capitalization) and carries no debt. In addition, Mogotes management team has broad and diverse experience across a range of industries, including mining and finance. Its CEO and President, Allen Sabet, participated in several resource company turnarounds and transformations in his previous role at McKinsey & Company.