Sponsored Content

BREAKING: Blue Gold Limited Launches World’s First Tokenized Gold Platform as 1 Million Pre-Registrations Signal Market Revolution

Blue Gold Limited (NASDAQ: BGL) has officially launched the world’s first fully integrated tokenized gold system, achieving over 1 million pre-registrations worth $129 million in just five days while securing $140 million in institutional funding to revolutionize precious metals investment.

In what industry analysts are calling a watershed moment for both the gold and digital asset markets, $BGL has successfully bridged the $2.4 trillion traditional gold market with cutting-edge blockchain technology through their groundbreaking mine-to-wallet ecosystem. The tokenized gold platform represents the first time in history that investors can own audited physical gold directly from mining operations through blockchain-verified digital tokens.

The market response has been nothing short of extraordinary. $BGL’s Standard Gold Coin (SGC) pre-registration campaign generated over 1 million sign-ups within the first five days of launch, representing approximately $129 million in initial investor interest. Each SGC token represents exactly one gram of physical gold held in secure, audited storage, sourced directly from the company’s own mining operations in Ghana’s prolific Ashanti Gold Belt.

Gold Tokenization Breakthrough Attracts Institutional Backing

The tokenized gold innovation has caught the attention of serious institutional investors, with $BGL securing $140 million in committed funding specifically to restart their flagship Bogoso Prestea mine operations. The funding package includes a $65 million secured loan from a new institutional investor and a previously announced $75 million equity line of credit, demonstrating unprecedented confidence in the company’s revolutionary approach to gold investment.

“This funding, along with the amount that is already committed, clearly evidences our capacity to invest and restart the mine to bring it back into full production,” stated Andrew Cavaghan, Chief Executive Officer of $BGL. The funds are currently held in escrow, conditional on resolving a lease dispute with the Government of Ghana, which management expects to conclude favorably in the near term.

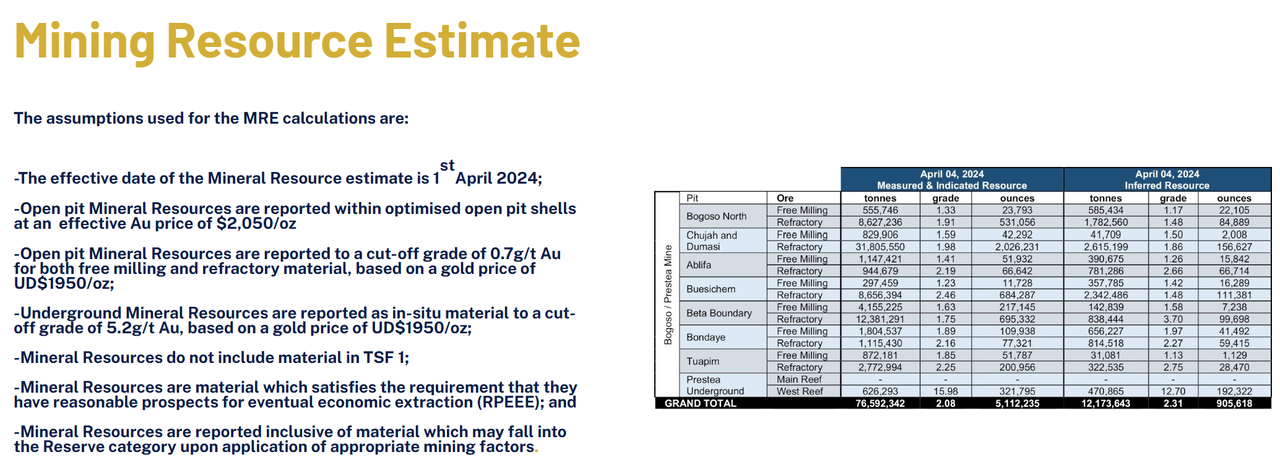

The Bogoso Prestea mine represents a substantial asset, containing 5.1 million ounces of gold resources in the measured and indicated category, plus an additional 0.9 million ounces in inferred resources. Located approximately 200 kilometres from Ghana’s capital, Accra, the mine provides the physical foundation for Blue Gold’s tokenized gold system, ensuring that every digital token is backed by real, extractable gold reserves.

Revolutionary Mine-to-Wallet Technology Eliminates Traditional Barriers

What sets Blue Gold’s tokenized gold crypto platform apart from existing digital gold offerings is their complete vertical integration. While competitors rely on third-party gold suppliers and storage providers, Blue Gold controls the entire value chain from extraction through tokenization. This integration provides cost advantages, supply security, and the ability to scale operations based on market demand.

The company’s dual-division structure maximizes operational efficiency while maintaining regulatory compliance across multiple jurisdictions. The Physical Division, headquartered in the UK and UAE, manages gold mining and trading operations, while the Digital Division, based in the US, oversees the blockchain technology and token ecosystem. This geographic diversification provides regulatory flexibility and operational resilience that competitors cannot match.

The gold tokens operate on the Ethereum blockchain through sophisticated smart contracts that ensure transparency, security, and instant global transferability. Unlike traditional gold investments that require storage, insurance, and complex liquidation processes, Blue Gold’s tokenized gold investment platform enables 24/7 trading, fractional ownership, and immediate redemption for physical gold when desired.

Market Validation Signals Massive Opportunity

The overwhelming response to Blue Gold’s pre-registration campaign validates the growing demand for asset-backed digital currencies that combine the stability of precious metals with the accessibility of blockchain technology. The $129 million in initial interest represents genuine market validation rather than speculative enthusiasm, as evidenced by the institutional funding commitments and strategic partnerships the company has secured.

Industry experts note that the gold tokenization market remains in its early stages, with existing players focusing primarily on tokenizing externally sourced gold rather than controlling the entire value chain. Blue Gold’s integrated approach addresses fundamental limitations of both traditional gold investment and existing cryptocurrencies, creating what analysts believe could become the new standard for precious metals investment.

The timing appears optimal for Blue Gold’s market entry. Gold prices have surged to record levels above $4,000 per ounce, driven by currency debasement concerns and institutional demand for inflation hedges. Simultaneously, digital asset adoption continues accelerating as institutions seek stable alternatives to volatile cryptocurrencies. Blue Gold’s tokenized gold platform sits perfectly at this intersection, offering the stability of physical gold with the convenience of digital assets.

Investment Implications and Market Outlook

For investors, Blue Gold Limited represents a unique opportunity to participate in what could become a fundamental transformation of precious metals investment. The company’s current market capitalization of approximately $160 million appears modest considering its substantial gold resources, secured funding, and first-mover advantage in the tokenized gold space.

The successful pre-registration campaign demonstrates that Blue Gold has solved a real market problem by eliminating the traditional barriers to gold ownership while maintaining the security and intrinsic value that makes gold attractive during periods of economic uncertainty. As currency debasement accelerates and traditional safe havens prove inadequate, the ability to own audited, blockchain-verified gold through a mine-to-wallet system may prove prescient.

Blue Gold’s achievement in launching the world’s first fully integrated tokenized gold system while securing substantial institutional backing and generating massive pre-registration interest positions the company at the forefront of a market revolution. The convergence of record gold prices, institutional digital asset adoption, and growing demand for stable cryptocurrencies has created ideal conditions for Blue Gold’s innovative platform to capture significant market share in the emerging digital gold economy.

As the lease dispute resolution approaches and mine operations prepare to restart, $BGL appears positioned to benefit from multiple catalysts that could drive substantial value creation for early investors who recognize the significance of this tokenized gold breakthrough.