Sponsored Content

Central Banks Can’t Stop Buying Gold: Should You?

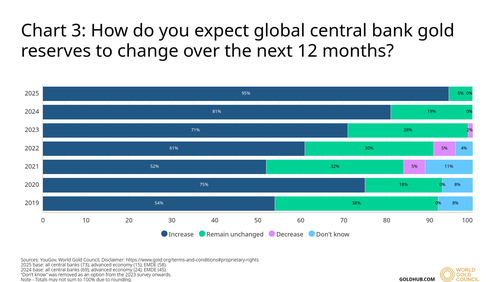

Another 95% of central banks say they’re not done accumulating gold. Nearly half plan to buy more. What do they know that you don’t?

The World Gold Council’s latest central bank survey just dropped, and it confirms what many gold investors have suspected all along:

Gold is becoming the world’s most important reserve asset.

According to the report:

- 95% of central banks expect global gold holdings to increase or remain stable over the next 12 months.

- 43% of central banks plan to grow their own gold reserves — up from 21% just one year ago.

The top reasons? Inflation risk, geopolitical instability, and weakening confidence in the U.S. dollar. The monetary backbone of the global financial system is quietly rebalancing away from fiat and into metal.

Why Are Central Banks Going All-In on Gold?

Because they see what’s coming.

- Inflation isn’t going away. Even if the Fed talks tough on interest rates, price pressures remain sticky. Tariffs are coming back into play, and this could drive inflation higher.

- The dollar isn’t untouchable anymore. With the U.S. running a ballooning deficit, escalating debt, and politically driven fiscal policy, foreign governments are questioning the greenback’s long-term reliability.

- War and fragmentation are here to stay. From Russia and Ukraine to rising tensions in the Pacific, central banks are seeking protection from geopolitical fallout, and gold is their insurance policy.

What Does That Mean for Everyday Investors?

If central banks, with all their insider access and macroeconomic insight, are snapping up gold like it’s going out of style… why wouldn’t you?

You don’t have to buy bars by the ton to protect your savings. But you should be paying attention to the same warning signs that the monetary elite are responding to.

And you should act before the next wave of accumulation drives prices even higher.

Get Started with Gold — The Smart Way

The Gold Starter Pack, available exclusively at JM Bullion, ZeroHedge’s preferred bullion dealer, gives investors a rare chance to buy 1 ounce of .9999 pure gold at spot price. Real gold, carefully sourced from trusted mints and sealed in protective plastic for long-term security. It’s a simple, secure way to build wealth that stands outside the system.

Don't wait for the next crisis to do what central banks are already doing.