Sponsored Content

CNBC: The wealthy are now leasing their gold instead of selling it

Gold near record highs has created an unexpected trend: investors are no longer buying gold simply to hold it. They’re putting it to work.

A recent CNBC article highlighted the surge in gold leasing, a financing mechanism long used by refiners, jewelers, and fabricators—now increasingly adopted by wealthy individuals looking to earn income on metal they already own.

At the center of this shift is Monetary Metals, the company making gold leasing accessible to individual investors around the world.

CNBC quoted Keith Weiner, Founder & CEO of Monetary Metals:

“People are no longer just buying gold and waiting for it to go up to $5,000. They want to hold it regardless of price — and then the mind immediately turns to: how do I put it to work?”

Why gold leasing is becoming so popular

With gold at historic highs, businesses across the supply chain need metal to fund production and inventory—but without taking on price exposure. Leasing provides that solution.

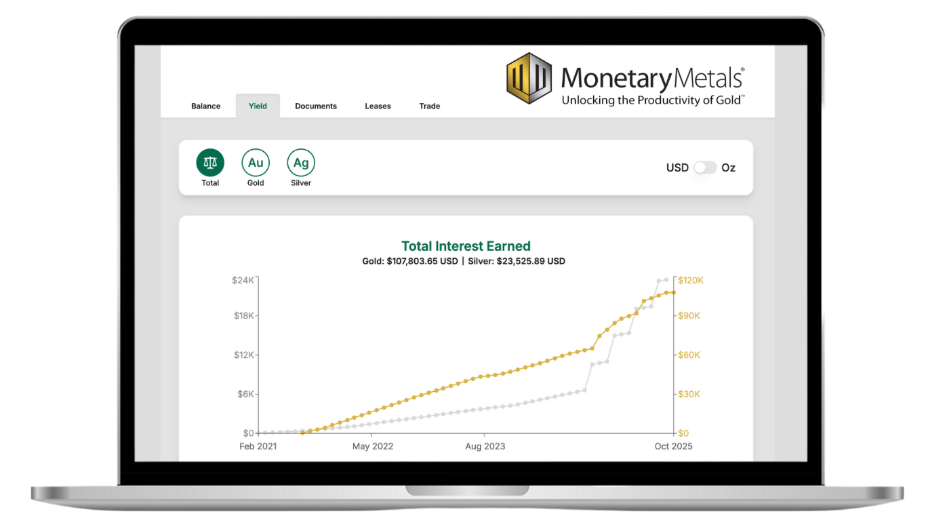

Investors who supply the gold earn a monthly yield in gold, while businesses obtain the metal they need for operations.

These “gold-on-gold” returns are what CNBC identified as the main driver as to why investors who already hold gold are increasingly choosing to put their metal to work in leases.

A real investor example

CNBC interviewed a long-time Monetary Metals client who recently doubled the amount of gold he leases through the platform.

He explained his reasoning:

“The only certain bet I know is that currencies will depreciate. Central banks have been accumulating gold at an extraordinary rate. We live in a world where global debt is unprecedented. Accumulating gold is the easiest, stress-free decision one can make.”

CNBC reported that he currently earns approximately 3.8% per year, paid in physical gold.

Risk management and track record

Risk controls are a critical component in the leasing market. Monetary Metals prioritizes their investor’s by implementing:

- Third-party audits

- Insurance

- Advanced RFID metal tracking

The bigger trend

CNBC’s coverage reflects a broader shift already underway: gold owners who plan to hold long term increasingly want income—not just price exposure.

Leasing lets them:

- Keep full ownership

- Maintain spot exposure

- Earn a yield in physical metal

- Compound ounces over time

As more investors learn about leasing, this is becoming the new baseline for productive gold.

Learn more

The CNBC article can be read here. (Free account may be required.)