Sponsored Content

The Copper-to-Gold Ratio: The Market’s Most Overlooked Warning Signal?

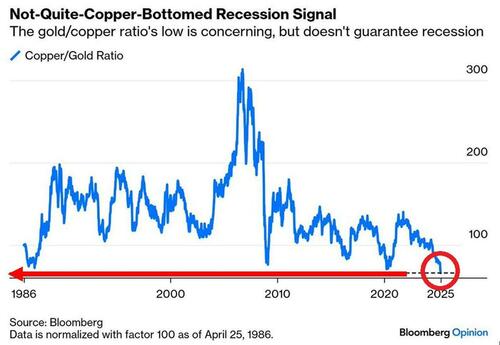

Gold’s been stealing the spotlight, but another signal is flashing behind the scenes: the copper-to-gold ratio.

Historically, this ratio has been a powerful gauge of where the economy is heading—and where metals might go next.

Right now, that warning light is flashing red.

What the Copper-to-Gold Ratio Means

When copper outperforms gold, it usually signals economic optimism. Copper is tied to growth—construction, manufacturing, and technology. When it’s strong, it suggests expansion.

But when gold outperforms copper, markets are bracing for trouble. Investors start seeking safety instead of betting on growth. It’s an early warning sign that something bigger might be brewing.

Right now, gold is dominating copper. As of April 22, 2025, the copper-to-gold ratio has plummeted to its lowest level in nearly 40 years, signaling recessionary conditions not seen since major downturns in the mid-1980s.

Even with copper’s recent price action, it hasn’t been able to keep pace with gold’s surge.

Why This Matters for Metals Investors

If history holds, a falling copper-to-gold ratio doesn’t just warn about the economy—it often marks the start of powerful moves in precious metals.

During previous periods of weakness in the ratio, gold and silver exploded higher, as investors scrambled for hard assets when paper promises looked shaky.

Today’s setup is eerily similar. We have tariffs fueling inflation, slowing global trade, a wobbling dollar, and bond markets flashing stress signals. It's no surprise that gold has broken out, and silver could be close behind.

Now’s the Time to Get Real

Markets are full of noise. But the copper-to-gold ratio cuts through it. It's signaling caution. It's telling investors that growth bets are getting riskier, and real assets like gold are becoming more essential.

Owning physical gold is about positioning yourself before the storm hits full force.

JM Bullion’s Gold Starter Pack gives you direct ownership of .9999 pure gold—a hedge against government missteps and fiat failures.

The Gold Starter Pack, available exclusively at JM Bullion, ZeroHedge’s preferred bullion dealer, offers investors an accessible entry into the gold market.

Each Starter Pack allows you to acquire 1 ounce of gold at spot price, carefully sourced from trusted mints and sealed in protective plastic. It’s a simple, secure way to build wealth that stands outside the system.

Don’t wait for the signal to become a headline.

Secure your Gold Starter Pack today.