Sponsored Content

Could the Penny Disappear?

The penny: a relic of American tradition and a glaring symbol of financial waste. In 2023 alone, the U.S. Mint lost $179 million producing over 4.5 billion pennies, each costing more than 3 cents to make. Now, with the Department of Government Efficiency (DOGE) and President Trump reportedly considering eliminating the coin, the debate over its future has taken center stage.

But this conversation is about more than just the penny—it’s about a system that seems designed to bleed taxpayers dry. What happens when the smallest unit of currency becomes a liability? More importantly, what does this reveal about the broader economy, the declining value of the dollar, and how you can protect your wealth?

The Penny Problem: A Warning Sign

The government’s struggle to manage the penny is just one example of systemic inefficiencies. For nearly two decades, the cost of producing the coin has exceeded its value, a loss that’s compounded by inflation, rising material costs, and bloated government spending.

Even if the penny is scrapped, the underlying issues remain:

The Dollar Is Losing Value: The penny isn’t worth the metal it’s made from, and the dollar isn’t far behind. Inflation, national debt, and monetary policy have eroded its purchasing power.

Reliance on Fragile Systems: The U.S. economy depends on increasingly unsustainable practices, from high-cost coin production to unchecked government spending.

Global Trends Demand Change: Other nations, like Canada, scrapped their lowest-denomination coins years ago. The U.S., by clinging to outdated practices, risks falling behind.

Precious Metals: The Answer to a Broken System

The penny’s inefficiency is a microcosm of a much larger problem: fiat currencies and financial systems are losing their reliability. But there is a solution, and it’s been trusted for centuries—gold and silver.

Enduring Value: Precious metals don’t lose their worth to inflation or economic mismanagement. Their value isn’t dictated by a central bank or fragile government policies.

A Hedge Against Uncertainty: When fiat currencies fail, metals like gold and silver shine. They’re immune to the inefficiencies that plague coins like the penny and the systems they represent.

Universal Confidence: Around the world, gold and silver are recognized as true stores of value. In a volatile economy, they’re the ultimate insurance policy.

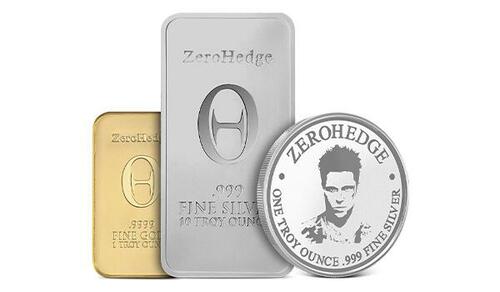

Take Action with the ZeroHedge Bullion Collection

If you’re tired of watching wealth bleed out of the system, it’s time to take control. The ZeroHedge Bullion Collection, available exclusively at JM Bullion, ZeroHedge’s preferred bullion dealer, offers a secure, tangible way to safeguard your assets.

1 oz ZeroHedge Gold Bar: Crafted from .9999 pure gold, this bar is not just a valuable asset but a statement of self-reliance. Stamped with the iconic ZeroHedge logo, it embodies independence from a failing system. Encased in an assay blister pack, it guarantees authenticity and purity.

10 oz Silver Bar: A heavyweight anchor for your portfolio, made from .999 fine silver, offering stability and long-term value.

1 oz Silver Round: Perfect for flexibility and stacking, this round provides real value in a compact form while maintaining the iconic ZeroHedge branding.

Each piece in the collection is a defiant response to the inefficiencies of fiat currencies and central banks. Together, they empower you to build a portfolio that’s resilient, private, and independent.

With the government losing billions on pennies, now is the time to hold something that won’t lose its worth—or its relevance. Precious metals are your shield against inefficiency, inflation, and instability.