Sponsored Content

A crucial rate the Fed can’t cut

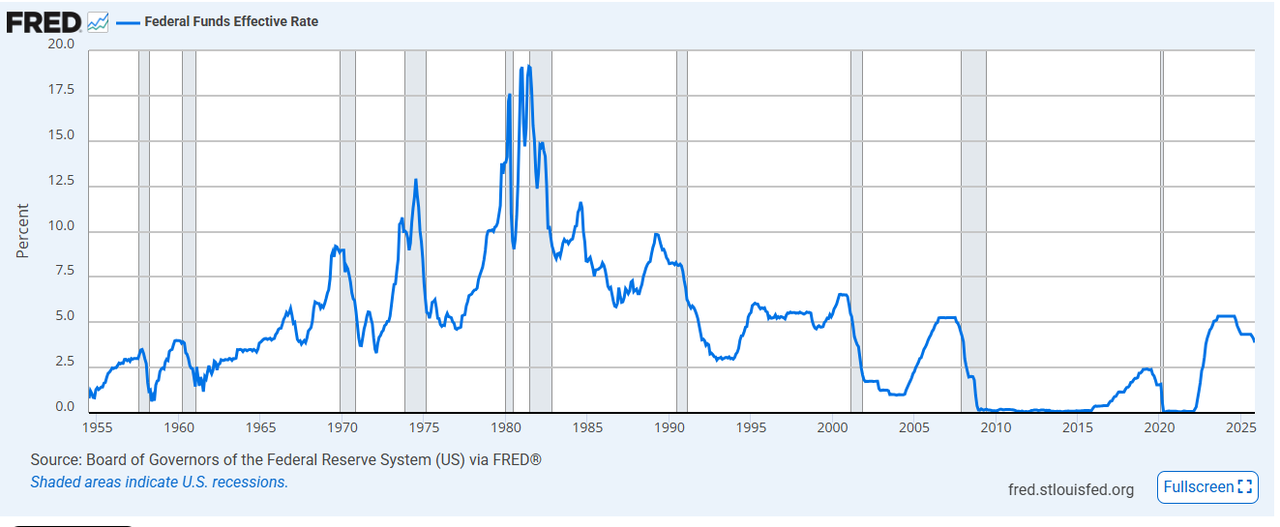

In December, the Federal Reserve cut interest rates again, continuing its pivot away from the most aggressive tightening cycle in decades.

While inflation has cooled from its peaks, economic growth has been rocky—and policymakers increasingly signal that supporting liquidity and financial stability now takes priority over fighting yesterday’s price pressures.

That shift has real consequences for savers.

As the Fed lowers rates, yields on savings accounts, CDs, money market funds, and bonds tend to follow. Income that once felt easy to generate becomes harder to find.

Once again, the return on dollars is being compressed by policy.

This is not unusual. Over long periods of history, real yields on dollars have gravitated toward zero—or below it—especially when governments face large deficits and refinancing needs.

Central banks are not immune to political realities, and changes in leadership and appointments can influence how aggressively rates are cut or held down.

Regardless of who occupies the seats, the direction of pressure is clear: lower yields on dollar denominated assets.

But there is one crucial rate the Fed does not set.

Gold lease rates operate outside the Federal Reserve system. They are not policy tools. They are not adjusted at press conferences. They are not dependent on monetary stimulus.

Gold lease rates are determined by supply and demand within the physical gold market—specifically, by businesses that need gold to operate and will pay to lease it. That demand exists whether the Fed is cutting, hiking, or standing still on rates.

At Monetary Metals®, investors earn a fixed income by leasing their gold to vetted businesses in the precious metals industry, including jewelers, refiners, and mints.

The return is paid in gold, not dollars.

And importantly, those rates have remained stable, even as dollar yields begin to roll over.

While banks adjust savings rates downward and bond investors' brace for reinvestment risk, gold owners have the ability to lock in gold-denominated yield today.

This distinction matters.

Dollar-based income is ultimately controlled by the Fed. Gold income is not.

When you earn your income in ounces of gold, your return is insulated from monetary policy decisions that erode purchasing power over time.

You can increase the amount of metal you own, regardless of what happens to interest rates, inflation targets, or political pressure.

Gold does not have to sit idle in a vault. It can produce passive income for you. For investors who already own gold, this presents a timely opportunity.

As dollar yields compress and traditional fixed income becomes less productive, gold lease rates stand apart.

They are available today, fixed by contract, and paid in gold ounces--a form of money the Fed cannot print and cannot cut.

The one rate the Fed can’t cut may be the one worth paying attention to now.

For a straightforward explanation of how to earn a yield on gold, paid in gold, read the free report: Earn Passive Income in Gold.